Bitcoin Nears 120000USD – How High Can It Go?【JULY14,2025】

Fundamental Analysis

- This week marks “Crypto Week” in the U.S. House of Representatives, where cryptocurrency-related legislation will be intensively discussed.

- Bitcoin has broken through the 110000USD resistance and is now approaching 120000USD.

BTCUSD Technical Analysis

As “Crypto Week” kicks off in the U.S. House, three major cryptocurrency bills are scheduled to be debated. Hopes are growing for the development of the crypto industry in the U.S., and Bitcoin has responded by hitting new all-time highs.

Bitcoin often trends along its 10-day Exponential Moving Average (10EMA), but currently it is trading slightly above it, indicating stronger upward pressure.

Bitcoin is forming a band walk between the +2σ and +3σ lines of the Bollinger Bands, signaling a strong upward trend.

To estimate how far this rally could go, it’s useful to consider the “N-wave” pattern and Fibonacci Expansion.

Bitcoin has broken upward from the 110000USD level, which corresponds to the 61.8% Fibonacci expansion.

On the weekly chart, this suggests a potential target around 132000USD.

On the daily chart, based on the “N-wave” theory, the projected target is approximately 136370USD.

Day Trading Strategy (1-Hour Chart)

From a long-term perspective, Bitcoin appears to be heading higher. Ideally, a buy-on-dip strategy should be considered.

However, due to Bitcoin’s high volatility, risk and position management are crucial.

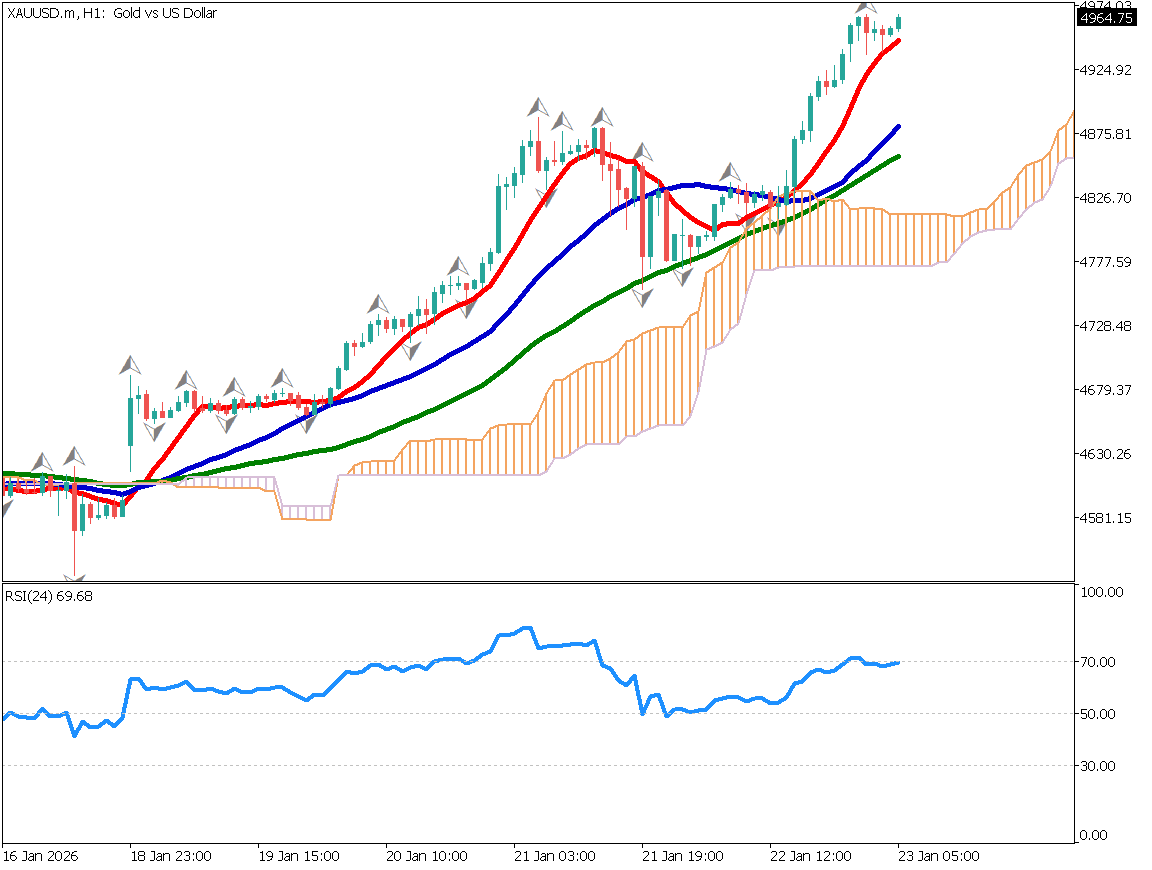

On the 1-hour chart, the RSI is hovering in overbought territory, indicating strong bullish momentum.

Still, with the round number of 120000USD just ahead, a short-term pullback would not be surprising.

The pivot point is located around 118890USD.

For short-term day trading, consider placing buy-limit orders near S1 at 118580USD and S2 at 118000USD to wait for potential entry opportunities.

BTCUSD Pivot Points

- R3: 120203USD

- R2: 119700USD

- R1: 119393USD

- Pivot: 118890USD

- S1: 118583USD

- S2: 118081USD

- S3: 117773USD

Key Economic Events Today

| Event/Indicator | Time(JPT) |

| Crypto Week | Ongoing throughout the week |