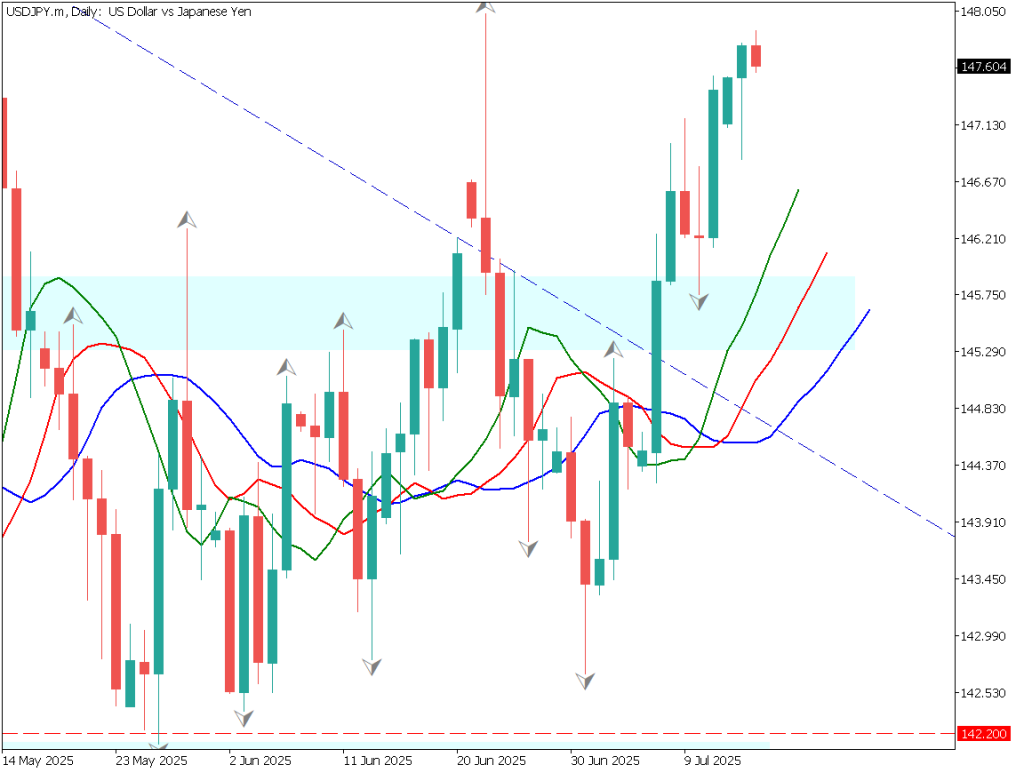

USD/JPY Rises to Upper 147 Yen Range, Senate Election Expectations May Be Influencing the Market【JULY15,2025】

USD/JPY Market Environment (Swing Trade Strategy)

Let’s begin with an overview of the USD/JPY market environment. Overall, the Alligator indicator shows its “mouth” wide open and facing upward. This suggests increasing bullish momentum and indicates that a trend may be forming.

Previously, the 145.75 yen area served as a strong resistance level, where ▲ appeared, signaling a potential pullback. However, this time ▼ has appeared, indicating a possible reversal and a shift toward a support zone. That said, we cannot conclusively say that the range has been broken. The key focus will be whether the price can break above the 148 yen level.

USD/JPY Day Trading Strategy

Let’s analyze the 1-hour chart to consider today’s day trading strategy.

When drawing an upward channel on the 1-hour chart, it is confirmed that the price is currently approaching the lower boundary of the channel. A contributing factor to the weaker yen is Japan’s upcoming House of Councillors election this weekend. Reports suggest that opposition parties calling for fiscal expansion are leading, prompting a major sell-off in long-term government bonds.

The sell-off of long-term JGBs suggests that the market is questioning Japan’s future fiscal outlook, leading to a weaker yen. Although the upward momentum has slightly weakened near the 148 yen mark, the overall outlook remains bullish.

Day Trading Plan

- Buy on dips

- Buy limit order at 147.58 yen

- Buy limit order at 147.58 yen

- Take-profit target around 148 yen

- Stop loss if price drops below 147.45 yen

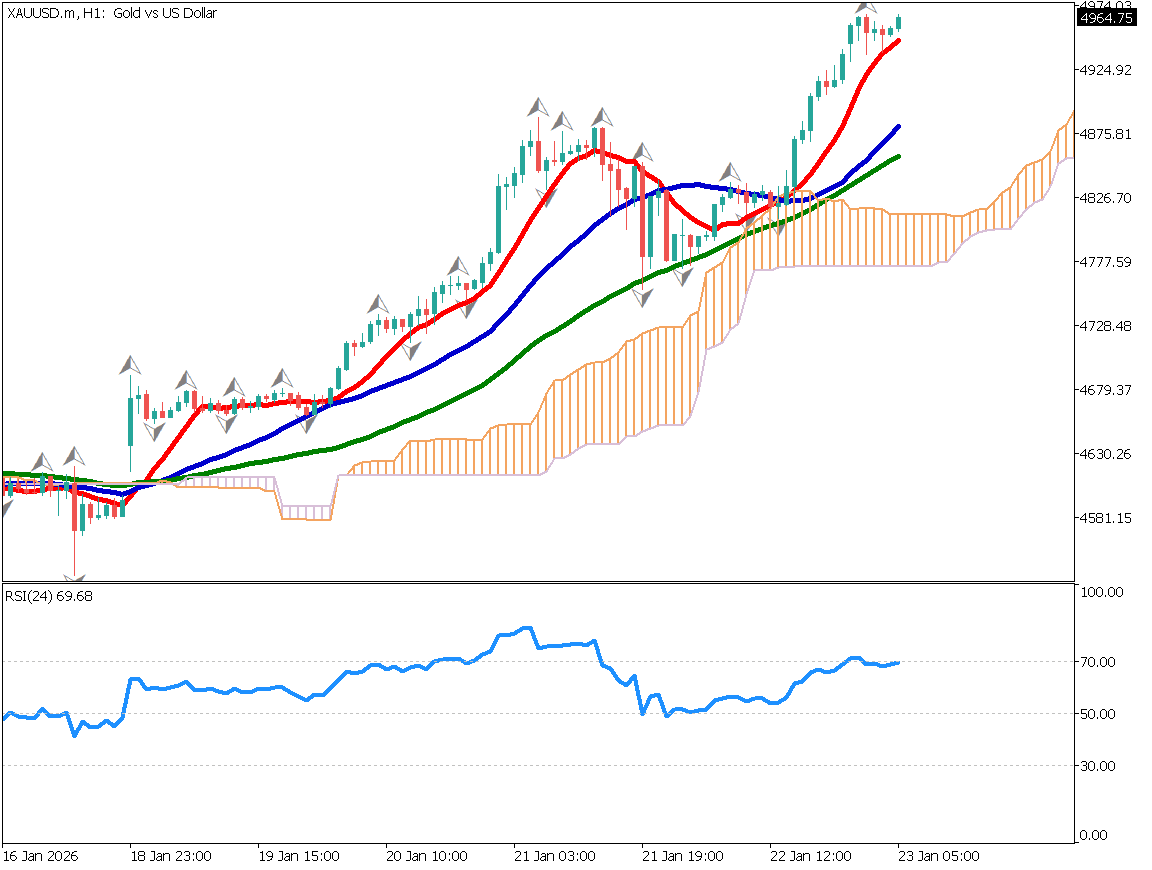

BTCUSD Pivot Points

| Pivot Price | Price |

| R3 | 147.81 |

| R2 | 147.76 |

| R1 | 147.72 |

| Pivot Point | 147.67 |

| S1 | 147.63 |

| S2 | 147.58 |

| S3 | 147.54 |

Must-Know Key Fundamental

Reports of opposition parties favoring fiscal expansion leading the race are causing Japanese long-term government bonds to be sold off.

Concerns about fiscal deterioration are pressuring the yen. Markets are focused on the outcome of the House of Councillors election.

Key Economic Events Today

| Event/Indicator | Time(JPT) |

| Crypto Week | Ongoing throughout the week |