USD/JPY Approaching 150 Yen – Exploring the Drivers of Yen Weakness【JULY16,2025】

USD/JPY Market Environment (Swing Trade Strategy)

Let’s take a look at today’s USD/JPY market environment.

Key points to note:

- US CPI data remains volatile, pushing back expectations of Fed rate cuts

- Japan’s 10-year bond yield hits a new high at 1.597%, approaching 1.6%

- USD/JPY chart shows a bottoming pattern

- USD/JPY has broken out upward, suggesting continued yen depreciation

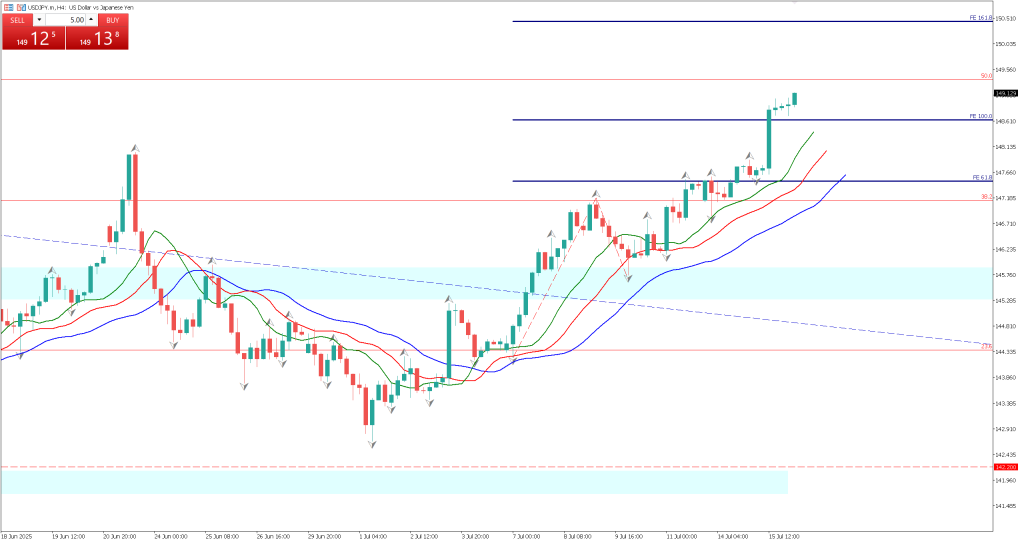

On the weekly chart, a pattern resembling a double bottom has formed, and the last two weeks have seen strong gains. The pair has broken through the 148-yen resistance zone and moved into the 149-yen range. The possibility of a temporary rise toward the 150-yen level can no longer be ruled out. Caution is warranted for further yen weakness.

From a weekly perspective, the target level may be around 132,000 dollars (approx.). Applying Fibonacci on the weekly chart indicates a resistance zone around 149.50 yen.

On the daily chart, envision a breakout from a triangle pattern. The downtrend line has been clearly broken, and the pair has also broken above the 148-yen resistance to hit new highs. The Alligator indicator is wide open, signaling a strong trend. A sharp rise toward 149.50 yen is expected.

However, a pullback may occur at 149.50 yen. This is a historically significant price zone where the pair has repeatedly stalled. As a weekly resistance level, a temporary reversal is likely.

USD/JPY Day Trading Strategy

Let’s formulate today’s day trading strategy using the 1-hour chart.

When forecasting how far a move might extend, the Fibonacci Expansion tool is particularly useful. Identifying key price zones with Fibonacci Retracement is also crucial.

USD/JPY is likely to focus on the 149.45–149.65 yen range. This zone aligns with weekly resistance and has historically triggered both pullbacks and rebounds. A sell limit around 149.45 yen could be a strategic move, with a target around 148.70 yen—equivalent to the 100% Fibonacci Expansion level.

If the price drops to the 148.70 yen range, consider placing a buy limit order. Ultimately, the upside target could reach as high as 150.42 yen.

With the House of Councillors election scheduled for this weekend, if pro-stimulus parties perform well, yen weakness could accelerate. It’s also worth monitoring Japan’s 10-year bond yield.

Fundamental Analysis

US CPI Overall Below Expectations, But Some Segments Rising Due to Tariff Pass-Through

Are Trump Tariffs Starting to Affect Prices?

Following yesterday’s US CPI release, expectations for an early Fed rate cut have diminished. As Chair Powell previously noted, signs of price pass-through from tariffs are beginning to emerge, leading to the highest price increases in years for some items. If inflation in the US remains unstable, the Fed may not be able to cut rates anytime soon.

Given expectations of rate stability, we anticipate further dollar strength in the USD/JPY pair.

Key Economic Events Today

| Event/Indicator | Time(JPT) |

| UK Consumer Price Index (CPI) | 15:00 |

| US Producer Price Index (PPI) | 21:30 |