EU Agrees on 15% Tariffs — Is There More Upside for EUR/USD?

Fundamental Analysis

- President Trump Announces Agreement with EU on 15% Tariff Rate

- Expresses No Concern Over Ongoing Dollar Weakness

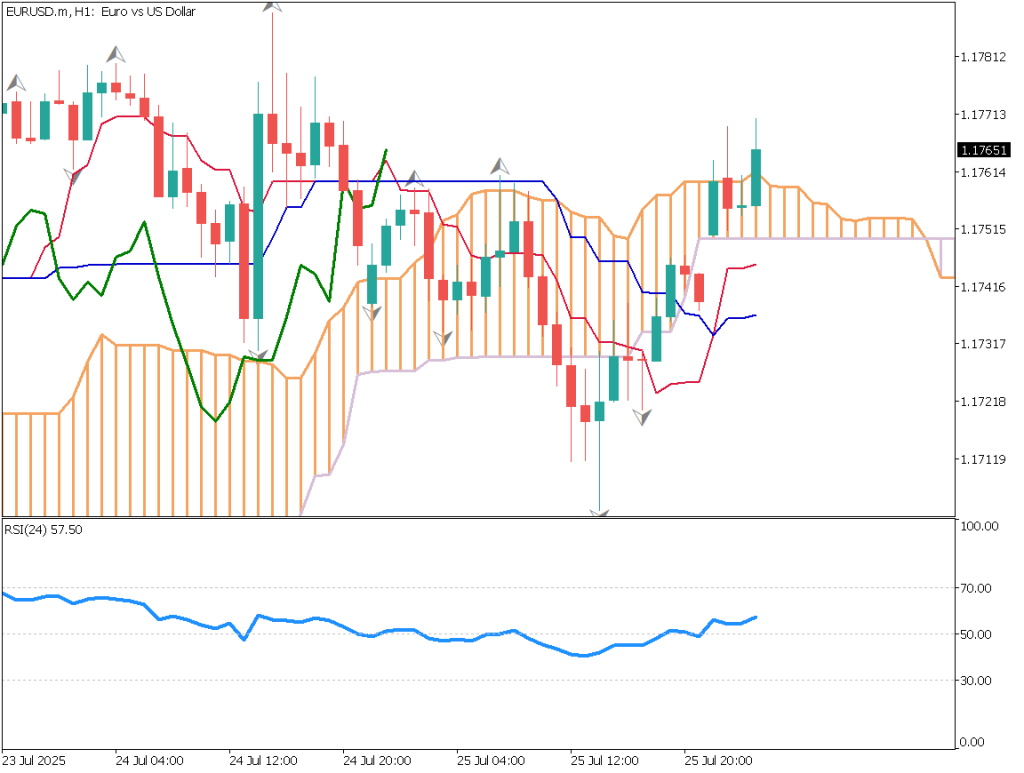

EUR/USD Technical Analysis

We analyze the EUR/USD daily chart. The trade negotiations between the U.S. and the EU have concluded, resulting in a 15% tariff agreement. Although the EU had previously signaled readiness for retaliatory measures, the conclusion of negotiations has eased concerns over a large-scale trade war, which appears to be supporting the euro.

The EUR/USD pair has once again moved above its upward trendline and the conversion line of the Ichimoku Cloud is about to cross above the base line. The next key levels to watch are around 1.1780 and 1.1830.

If the price breaks above the candlestick high where a fractal has formed, it could be seen as the beginning of an uptrend from a Dow Theory perspective.

Day Trading Strategy (1-Hour Chart)

It is important to observe how overseas traders will react tonight. The market’s response to the 15% tariff outcome will determine the direction. For short-term day trading, a counter-trend strategy could involve selling near 1.1780, aiming to catch a pullback. The 1.1830 level is also a strong resistance, marking a two-year high.

The RSI is at 57, indicating room for further upside, but the 1.18 area is expected to act as a significant resistance zone. From the London session onward today, consider placing a sell limit order around 1.1835.

Support and Resistance Levels

Key support and resistance levels to consider going forward:

- 1.1780 – Previous high zone

Market Sentiment

EUR/USD Buy: 29% Sell: 71%

Key Economic Events Today

| Event/Indicator | Time(JPT) |

| UK Retail Sales | 19:00 |

| U.S. Dallas Fed Manufacturing Activity Index | 23:30 |