EUR/USD Reverses at High Levels! Strategy to Target Downtrend

Fundamental Analysis

- The FOMC decided to keep rates unchanged; a dissenting vote for the first time in 32 years

- USD/JPY surged as the BoJ also decided to maintain current rates

- EUR/USD is plunging as dollar buying gains strength

EURUSD Technical Analysis

Let’s analyze the daily chart of EUR/USD.

Last night’s ADP employment report in the U.S. exceeded market expectations, showing solid results. This triggered dollar buying, with USD/JPY surging and EUR/USD plunging. The movement was further intensified by the FOMC’s decision to hold rates steady.

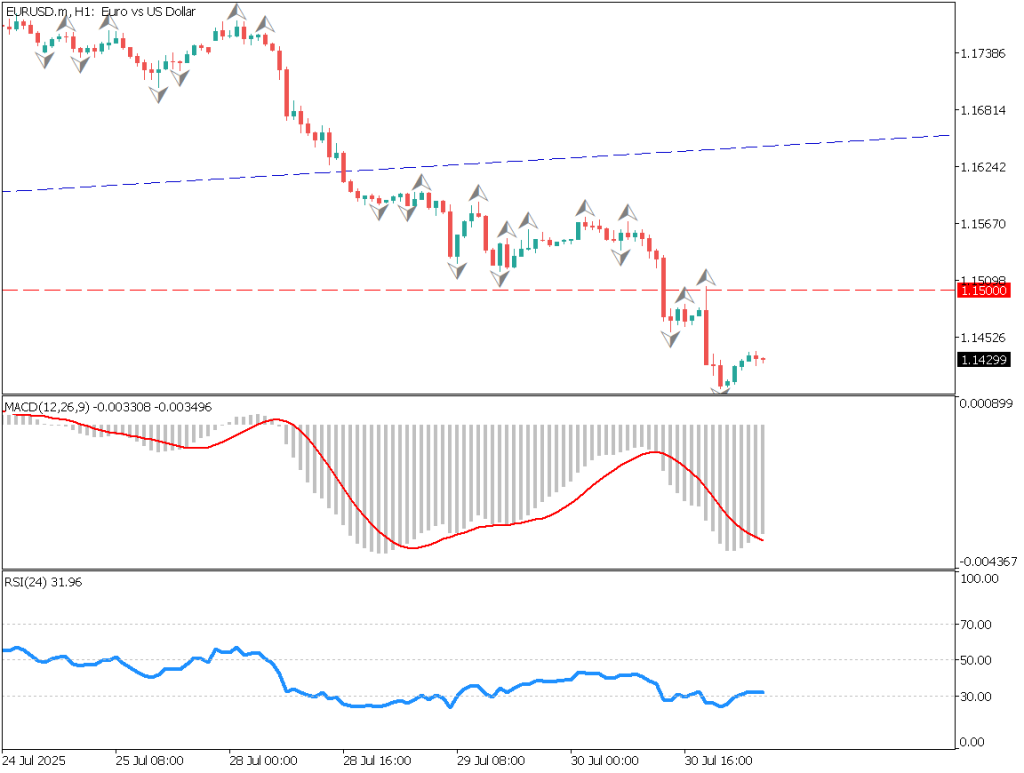

A rising wedge that had formed at high levels has broken downward—confirming a reversal wedge. Looking at the MACD, the histogram is below zero, indicating strengthening bearish momentum. RSI is below 50 and hovering around 40, showing a stable downward trend with potential for further declines.

EUR/USD tends to respect round numbers such as 1.1400, 1.1300, and 1.1200 as support levels. Additionally, the Fibonacci expansion’s 161.8% level at 1.1350 is likely to serve as a strong support line.

Day Trading Strategy (1-Hour Chart)

On the 1-hour chart, EUR/USD appears slightly oversold, and a rebound is likely. Although it fell to the low 1.14 range, it is expected to rebound toward the 1.15 level. RSI has also crossed above 30 from below, indicating signs of a reversal.

New tariffs are scheduled to take effect tomorrow, but the market likely already priced them in. Therefore, placing a sell limit order just below 1.15 may be a favorable strategy. 1.15 is a round number and also a recent high.Envision the following trading flow:

Sell limit at 1.1500

Stop-loss at 1.1525

Take profit at 1.1435

Key Economic Events Today

| Event/Indicator | Time(JPT) |

| Press Conference by BoJ Governor Ueda | 15:30 |

| Euro Area Consumer Price Index | 21:00 |

| Canada Gross Domestic Product (GDP) | 21:30 |

| U.S. Personal Consumption Expenditures (PCE) | 21:30 |

| U.S. Initial Jobless Claims | 21:30 |