U.S. Jobs Data Worsens! President Trump Fires Job Statistics Chief

Fundamental Analysis

- President Trump Dismisses Head of Job Statistics

- Fed Governor Intends to Resign, Creating Uncertainty Over Vacant Post

- U.S. Employment Data Worsens, Previous Figures Revised Down Sharply

USDJPY Technical Analysis

This is a daily chart analysis of USD/JPY.

Last week’s U.S. employment data deteriorated significantly, with previous months’ numbers also undergoing sharp downward revisions.

The report highlighted a steep drop in employment numbers due to tariff impacts and an economic slowdown. Furthermore, President Trump ordered the dismissal of the head of the Bureau of Labor Statistics.

While the market shows some anxiety, reactions remain muted.

Should Federal Reserve officials hint at future rate cuts this week, the dollar could weaken.

However, with the Bank of Japan still cautious on rate hikes, the overall tone favors USD/JPY strength.

An upward channel has formed, and the price is trading above 148 Yen.

If the pair breaks below the channel, a pullback toward the 146 Yen range is expected.

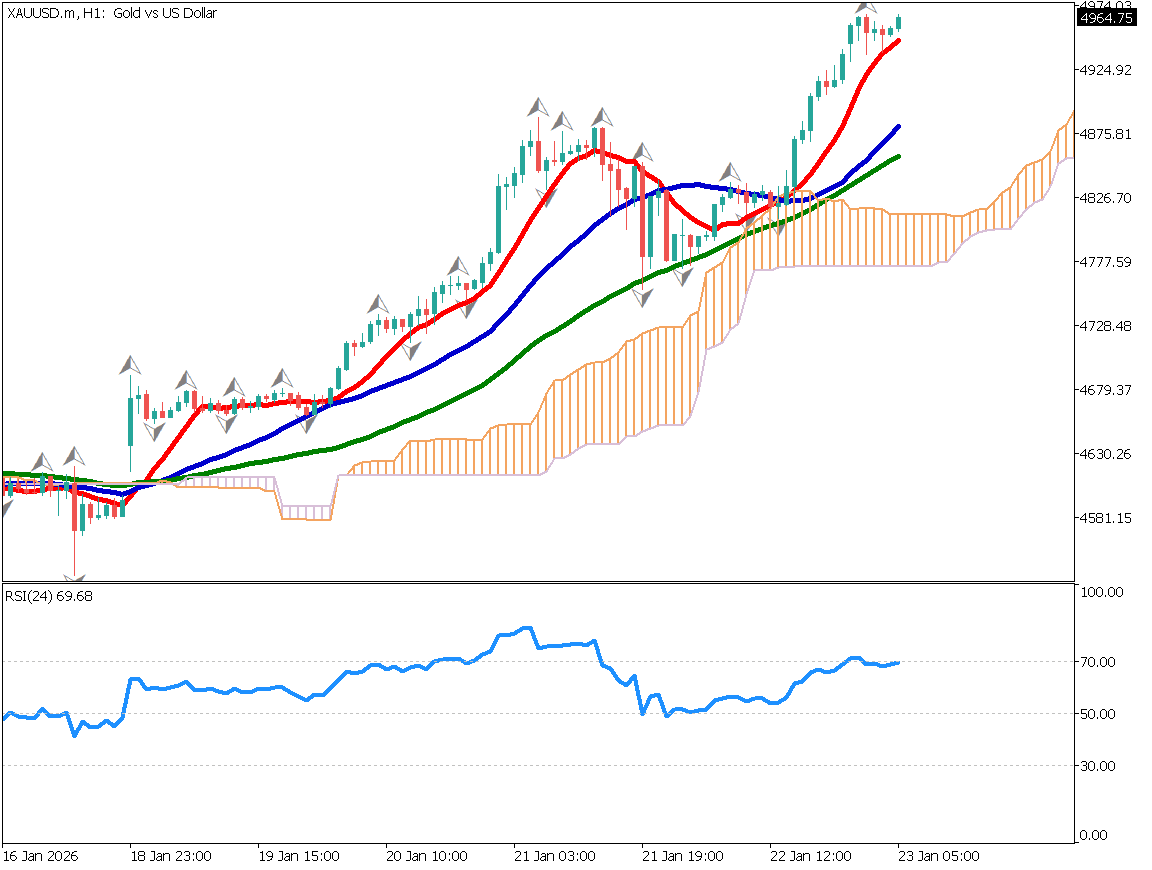

Day Trading Strategy (1-Hour Chart)

USD/JPY has experienced a sharp drop, which often leads to strong rebound movements.

The RSI has crossed above 30 from below, suggesting the potential for a rise toward the mid-148 Yen range.

With the London market closed, today’s main activity will come from New York traders.

How they interpret the weak U.S. employment data will be crucial.

A sell-on-rebound strategy is considered at 148.54 Yen.

Sell Limit Order: 148.54 Yen

Take-Profit: 147.50 Yen

Stop-Loss: 148.85 Yen

Key Economic Events Today

| Event/Indicator | Time(JPT) |

| U.K. & Canada Holiday | – |