[Special Edition] When Will the Bank of Japan's Next Rate Hike Come?

BOJ Governor's Press Conference Summary

- The Bank of Japan decided to keep its policy rate unchanged at around 0.5%.

- Governor Kazuo Ueda stated that the BOJ would closely watch wage negotiations in next spring's "Shuntō" before making any policy changes.

- Many financial institutions now expect the next rate hike to occur around January 2026, following last year's pattern.

- Among the nine Policy Board members, two members opposed the decision, arguing for a hike to around 0.75%, while five supported maintaining the status quo.

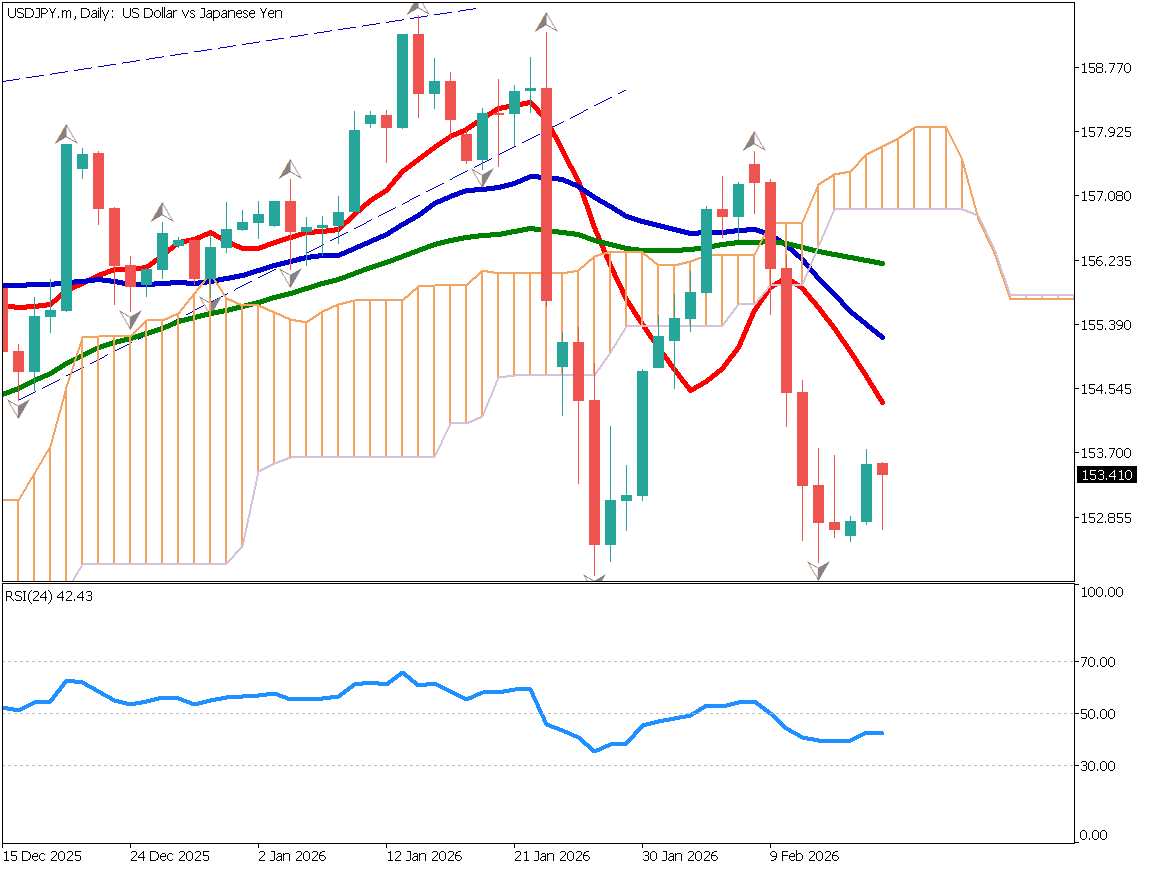

USD/JPY Daily Chart Analysis

Following the BOJ's decision to maintain its rate, the yen weakened as markets had partly priced in a possible rate hike this year. Ueda's emphasis on "Shuntō" suggested that any move would likely come after January, leaving investors feeling "left behind." This drove the yen sharply lower, pushing USD/JPY into the 154 range.

The pair has broken above recent highs, and attention now turns to whether the 153 range can act as new support. The conversion line (Tenkan-sen) is currently functioning as a support line, making it an attractive zone for buy-on-dip strategies.

Day Trading Plan

Day trading plan: Buy limit at around 153.30 yen, take profit at around 155.00 yen, stop loss below 153.00 yen. Traders should be cautious of weekend event risk when holding positions overnight.

Key Takeaway: "Shuntō"

Last week's FOMC and BOJ meetings caused major volatility across key currency pairs. The USD/JPY seems to have set its year-end direction — a continuation of the typical yen depreciation trend seen in previous years.

The BOJ maintained its current monetary easing stance, keeping the policy rate at 0.5%. Governor Ueda repeatedly mentioned "Shuntō" (spring wage talks), signaling that wage growth remains a crucial factor for future rate decisions. Thus, the timing of the next rate hike is likely to shift beyond 2025, possibly after the 2026 wage negotiations.

Meanwhile, Fed Chair Jerome Powell noted "divergent views among members," tempering expectations for a December rate cut. This boosted the dollar as markets reduced their dovish bets.

Overall, both the BOJ's delayed rate hike and the Fed's postponed rate cut point to a continuation of dollar strength and yen weakness toward year-end.

Today's Key Economic Indicators

| Indicator | Time (JST) |

|---|---|

| Eurozone CPI | 19:00 |

| Canada GDP | 21:30 |

| U.S. PCE (Personal Consumption Expenditure) | 21:30 |

Ready to trade?

Open live accountThis material is for informational purposes only and does not constitute investment advice. Trading leveraged products involves significant risk of loss. Past performance is not indicative of future results.