Will USD/JPY Reverse? 153 Yen as Key Support

Fundamental Analysis

- U.S. stocks tumbled sharply, with the Nasdaq falling below its 10-day moving average

- Japan's Nikkei index also dropped, suggesting signs of reversal across global markets

The Nikkei now shows warning signals

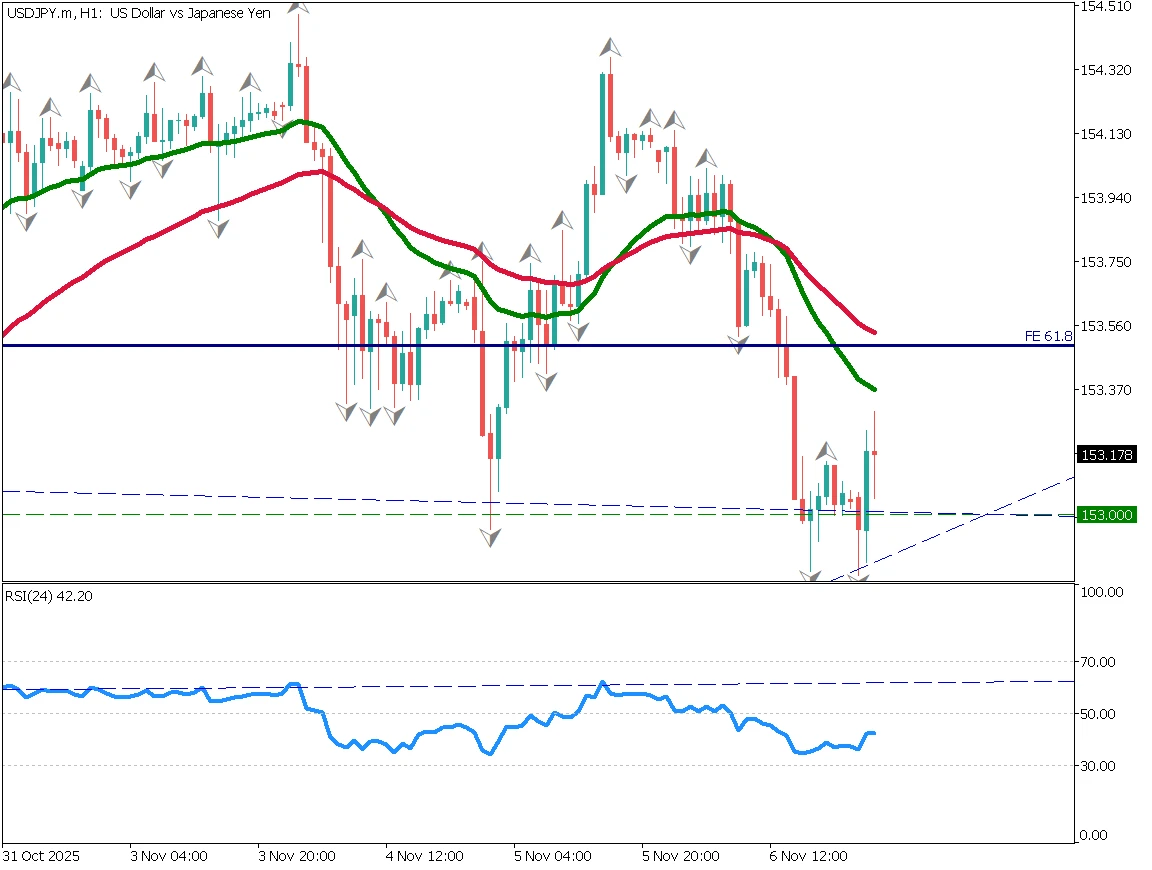

USD/JPY failed to break above 153.45, forming two fractals and turning downward. It also slipped below the 61.8% Fibonacci retracement, with 153.00 acting as a key support level.

Today would normally feature the U.S. employment report, but it is unlikely to be released due to the prolonged U.S. government shutdown. Meanwhile, U.S. stocks, cryptocurrencies, and global indices all saw sharp declines.

If 153.00 is broken, the next support lies near 152.35, where the 26EMA is positioned.

USD/JPY daily chart (Nov 7, 2025)" />

USD/JPY daily chart (Nov 7, 2025)" />

Day Trading Strategy

On the 1-hour chart, moving averages have formed a death cross, indicating stronger downward pressure. Although USD/JPY is rebounding from 153.00, a breakdown may be imminent.

With no major U.S. data expected, investors lack insight into real economic conditions. Concerns over overvalued equities are increasing, and short-term spikes are often followed by steep drops. The rally driven by AI-related stocks could prove to be a bubble, suggesting a deeper correction ahead.

Trading Idea: Consider short positions near the mid-153 range.

Key Economic Indicators

Note: U.S. data releases may be delayed due to the government shutdown.

| Indicator | Time (JST) |

|---|---|

| Canada Employment Data | 22:30 |

| U.S. Michigan Consumer Sentiment Index | 24:00 |

Ready to trade?

Open live accountThis material is for informational purposes only and does not constitute investment advice. Trading leveraged products involves significant risk of loss. Past performance is not indicative of future results.

![[Special Edition] When Will the Bank of Japan's Next Rate Hike Come?](/_next/image/?url=%2Fimages%2Fmarket-analysis%2F20251031USDJPYDAY.webp&w=3840&q=75&dpl=dpl_DuroJaYkswUAC7zyZSzJuw8Qt8iH)