USD/JPY Declines as Reports Suggest the Government Will Allow a BOJ Rate Hike

Fundamental Analysis

- Expectations for a Bank of Japan rate hike have risen sharply after reports that the government will approve a December hike

- The market has started to price in this possibility

- USD/JPY has fallen below the baseline and dropped to the 155 yen level, increasing downward pressure

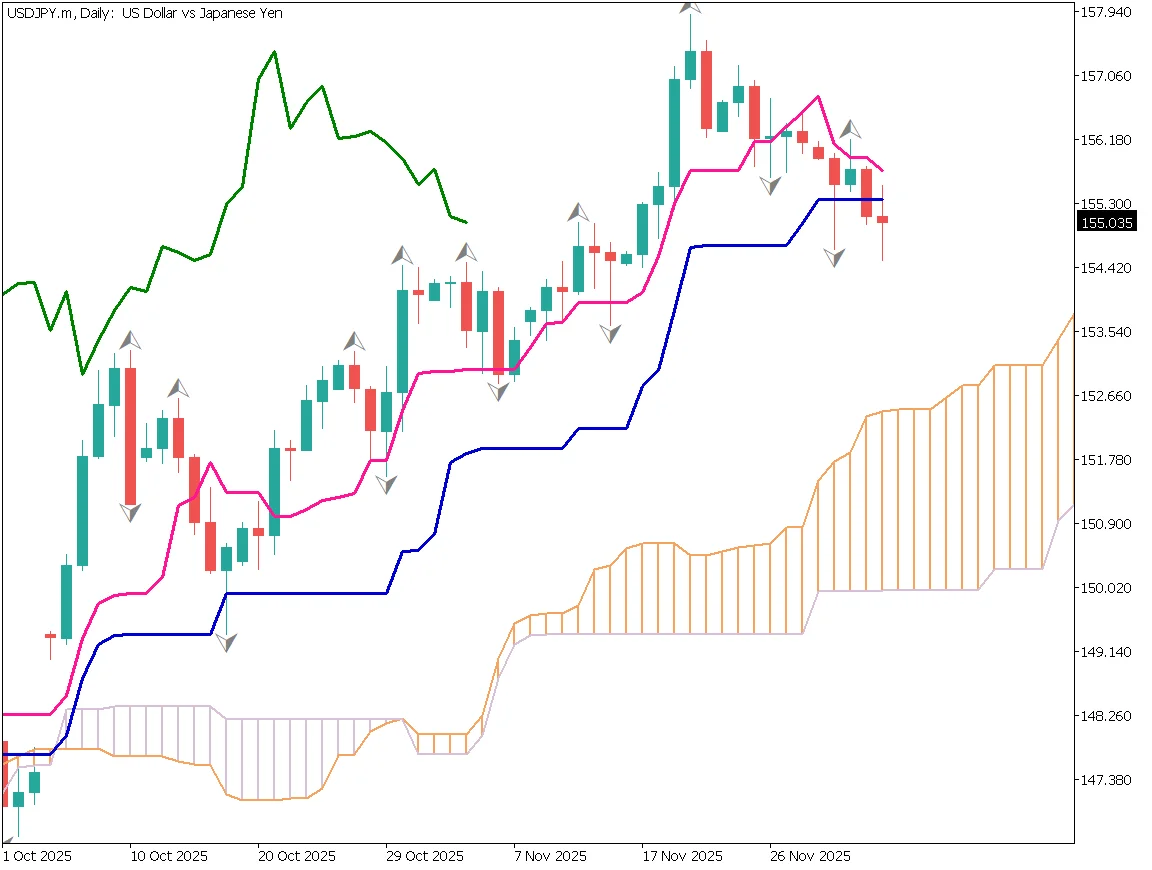

USD/JPY Daily Chart – Trading Strategy

USD/JPY has fallen below the baseline and dropped to the 155 yen level, increasing downward pressure. The Takai administration is reported to support a December hike, making it seem like an increasingly likely scenario. The BOJ likely wants to avoid a market shock, especially after the sharp stock decline following the July 2024 hike.

The mid-154 yen area is expected to act as a support zone.

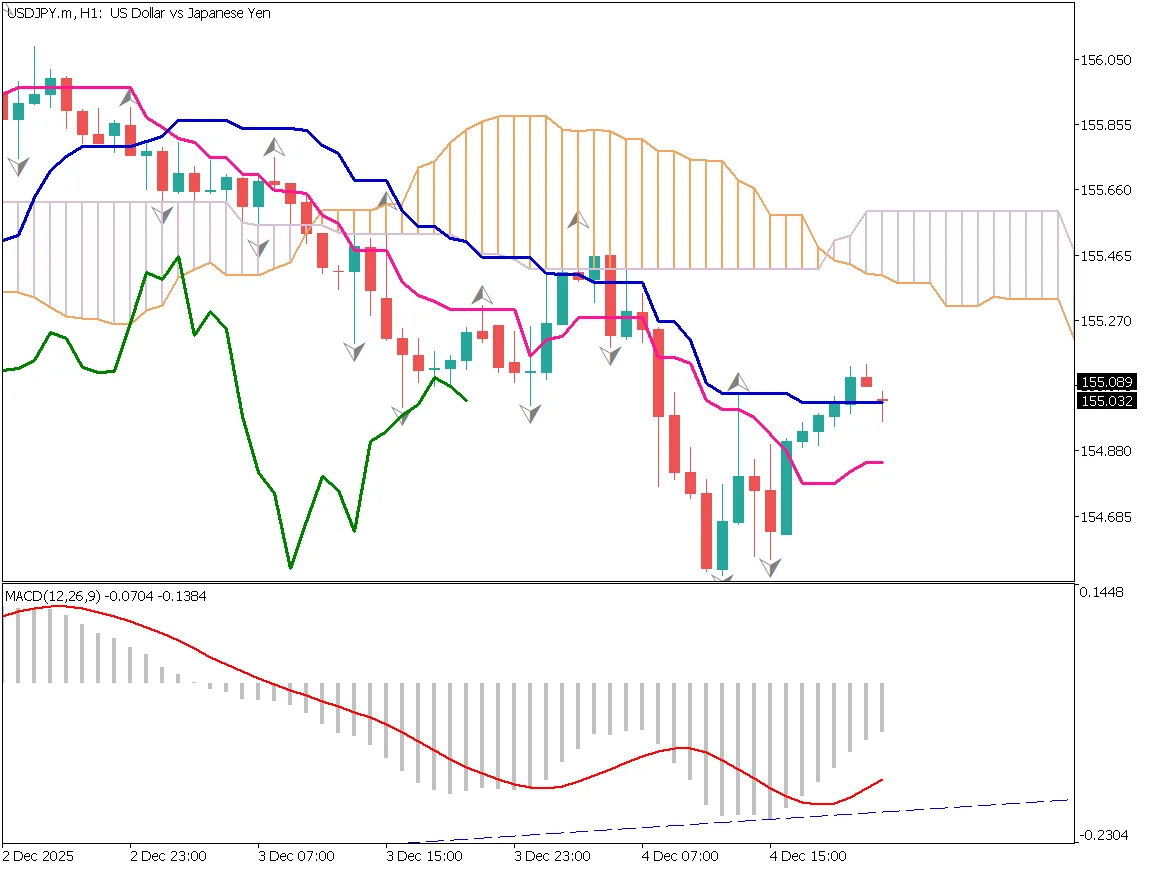

USD/JPY Day-Trading Strategy

USD/JPY briefly fell to the mid-154 yen level before recovering to the 155 yen range. However, with expectations of a BOJ rate hike and a potential Fed rate cut, yen-buying pressure may gradually increase. For now, a "sell on rallies" approach seems appropriate.

If USD/JPY rises back to the mid-155 yen level, it may offer a good opportunity to enter short positions. The overall trend is weakening, and further downside should be considered.

Key Economic Indicators Today

| Indicator | Time |

|---|---|

| Eurozone GDP (Q3) | 19:00 |

| Canada Employment Statistics (Nov) | 22:30 |

| US University of Michigan Consumer Sentiment | 24:00 |

| US Personal Income (Sep) | 24:00 |

| US Personal Consumption Expenditure (Sep PCE) | 24:00 |

Ready to trade?

Open live accountThis material is for informational purposes only and does not constitute investment advice. Trading leveraged products involves significant risk of loss. Past performance is not indicative of future results.

![[Special Edition] When Will the Bank of Japan's Next Rate Hike Come?](/_next/image/?url=%2Fimages%2Fmarket-analysis%2F20251031USDJPYDAY.webp&w=3840&q=75&dpl=dpl_DuroJaYkswUAC7zyZSzJuw8Qt8iH)