USD/JPY Declines Amid Repeated Verbal Intervention

Fundamental Analysis

- Finance Minister Katayama stated that curbing excessive yen depreciation is necessary and that currency intervention is one possible option

Brake Applied Near 160

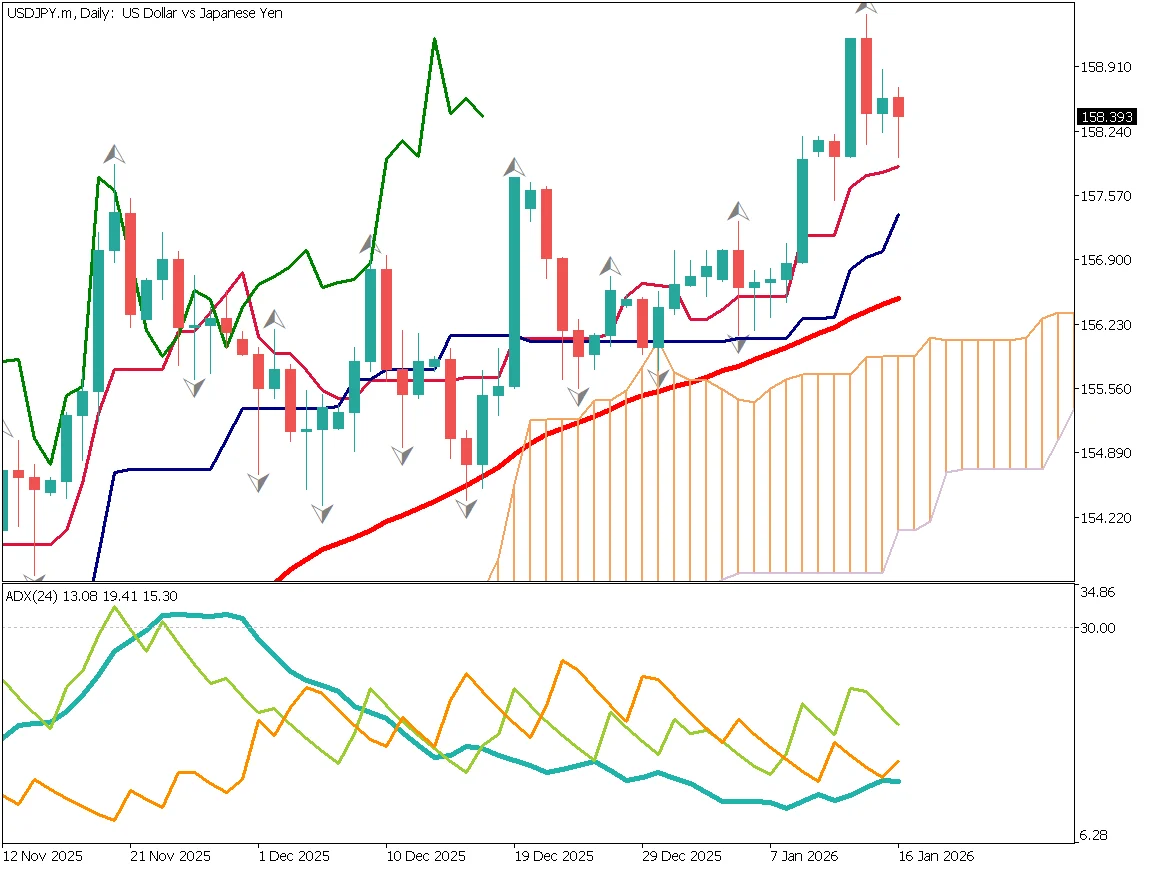

USD/JPY is trading around 158.40. The Ichimoku conversion line is functioning as a support level. Although the pair has updated recent highs, repeated verbal warnings from Finance Minister Katayama regarding yen weakness have reduced upward momentum. The ADX is hovering around 13, indicating a lack of trend strength.

With the psychological resistance at 160, market participants remain cautious about adding long positions. However, with the possibility of entering an election period, if confidence in a Takaichi-led administration strengthens, the yen's depreciation trend could resume. Should new catalysts emerge, a break above 160 may only be a matter of time.

Equities, USD/JPY, and precious metals have all risen excessively, showing signs of overheating. Markets without corrections are more vulnerable to sharp declines.

Going forward, attention will focus on whether the price breaks below the Ichimoku conversion line.

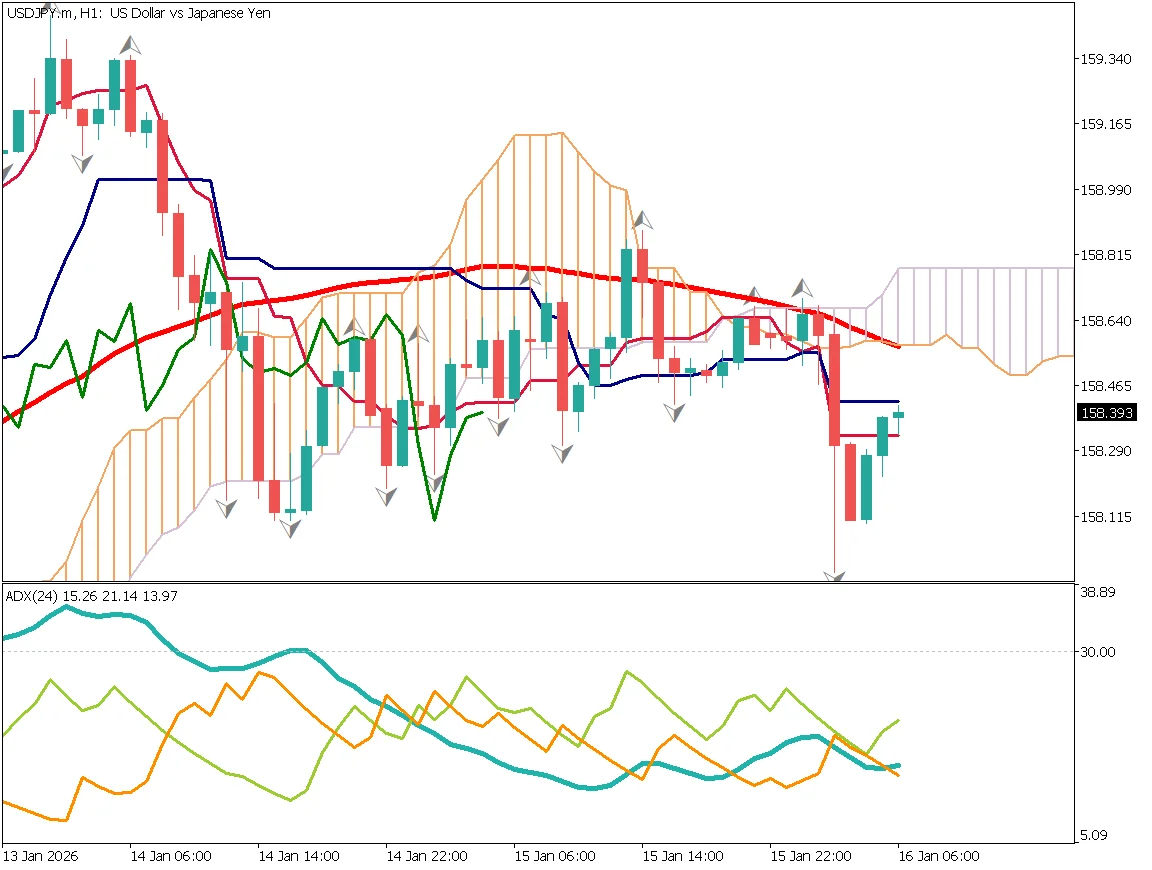

Moving Averages Showing a Sharp Curve

The 52-period moving average is sharply curving at elevated levels. Candlesticks are capped by the moving average and fail to break above it, forming a typical pattern signaling a potential trend reversal to the downside. At least in the short term, downside risk is increasing.

Unless the price clearly breaks above the moving average, selling on rebounds appears preferable. While expectations for currency intervention are uncertain, there is no need to force long positions.

If possible, it is better to stay on the sidelines.

Key Economic Indicators and Events Today

| Economic Indicator | Time |

|---|---|

| None | — |

Ready to trade?

Open live accountThis material is for informational purposes only and does not constitute investment advice. Trading leveraged products involves significant risk of loss. Past performance is not indicative of future results.

![[Special Edition] When Will the Bank of Japan's Next Rate Hike Come?](/_next/image/?url=%2Fimages%2Fmarket-analysis%2F20251031USDJPYDAY.webp&w=3840&q=75&dpl=dpl_7FDQsQkqrpcAqSED6PhxxDEbMMbP)