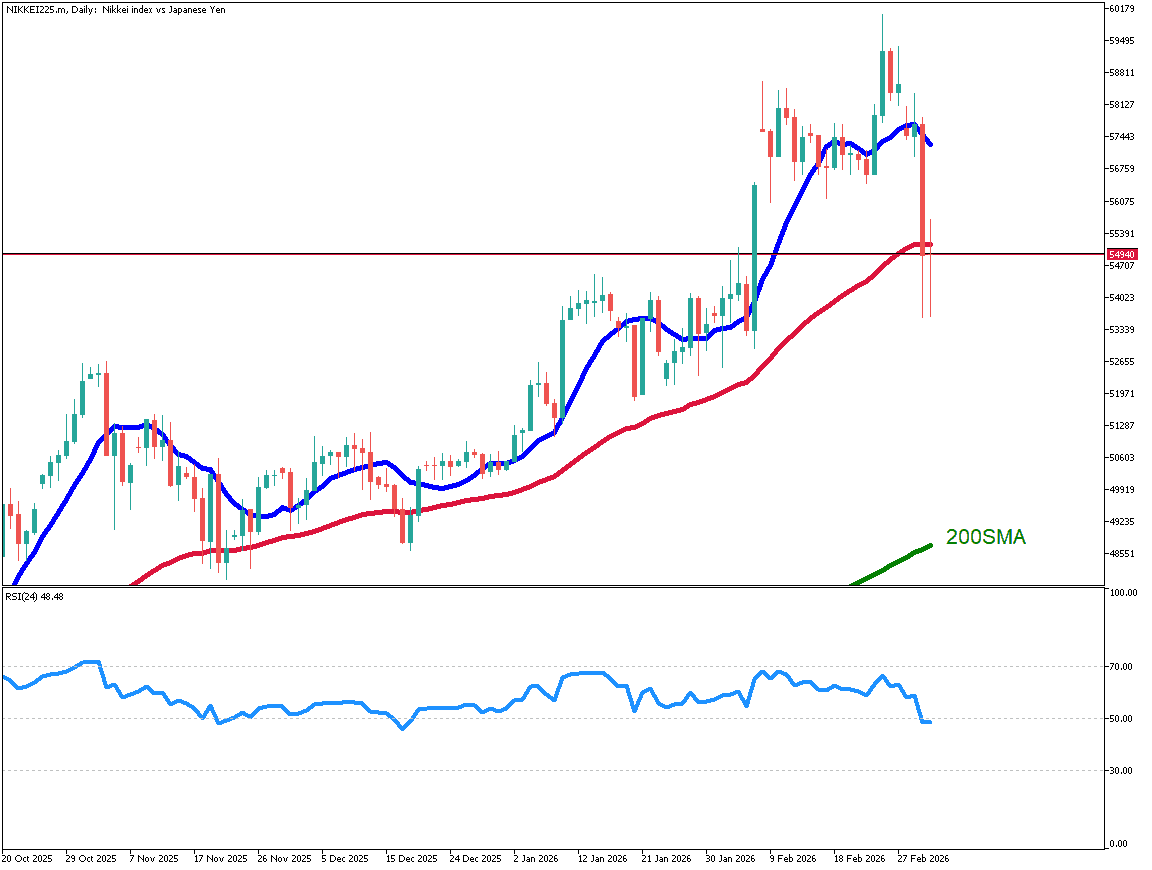

USD/JPY Forms Double Top, Downtrend Ahead?

Fundamental Analysis

- A Japan–U.S. summit was held under the slogan "Building a Golden Era for Japan and the U.S.," creating a friendly atmosphere.

- The FOMC meeting is scheduled for early tomorrow, and a rate cut by the Federal Reserve is already priced in.

Goldman Sachs Predicts 100 Yen?

According to Bloomberg, Goldman Sachs forecasts that if interest rates continue rising over the next decade, USD/JPY could return to around 100. Currently, the pair is trading in the low 151 range and appears to be forming a double top. The Ichimoku conversion line serves as support, along with the lower boundary of the rising channel.

While the pair remains above 151, the RSI is trending lower, indicating building selling pressure.

Although a rate cut is already priced in, the U.S. dollar may still face additional selling pressure following the FOMC meeting. If the conversion line is broken, a swift decline toward 150—where the 52EMA and the Ichimoku baseline lie—becomes possible.

Pro Strategy: Intraday Trading Outlook

On the 1-hour chart, multiple fractals have appeared in the 152 range, suggesting strong resistance. Although there is no sharp downtrend yet, selling pressure is gradually increasing.

The 52EMA has crossed below the 90EMA, forming a death cross, and the Ichimoku baseline is turning downward. Unless new bullish factors emerge, the pair is likely to drift lower gradually.

Markets are expected to react sensitively to Fed Chair Powell's comments after the FOMC meeting. Meanwhile, the prolonged U.S. government shutdown continues to cause significant disruption. Concerns about employment are rising, and if market balance collapses, stock prices could plunge sharply—caution is advised.

Today's Key Events

Note: Some U.S. indicators may be delayed due to the government shutdown.

| Time (JST) | Indicator |

|---|---|

| 22:45 | Canada Policy Rate Announcement |

| 03:00 | U.S. Federal Reserve Policy Rate Decision |

Ready to trade?

Open live accountThis material is for informational purposes only and does not constitute investment advice. Trading leveraged products involves significant risk of loss. Past performance is not indicative of future results.

![[Special Edition] When Will the Bank of Japan's Next Rate Hike Come?](/_next/image/?url=%2Fimages%2Fmarket-analysis%2F20251031USDJPYDAY.webp&w=3840&q=75&dpl=dpl_7FDQsQkqrpcAqSED6PhxxDEbMMbP)