USD/JPY Faces Heavy Upside as BOJ Rate-Hike Expectations Rise

Fundamental Analysis

- Hawkish comments from several Bank of Japan officials have increased market expectations for a possible rate hike in December

- However, a major trend reversal in USD/JPY still appears unlikely at this stage

Hawkish Tone from BOJ Officials

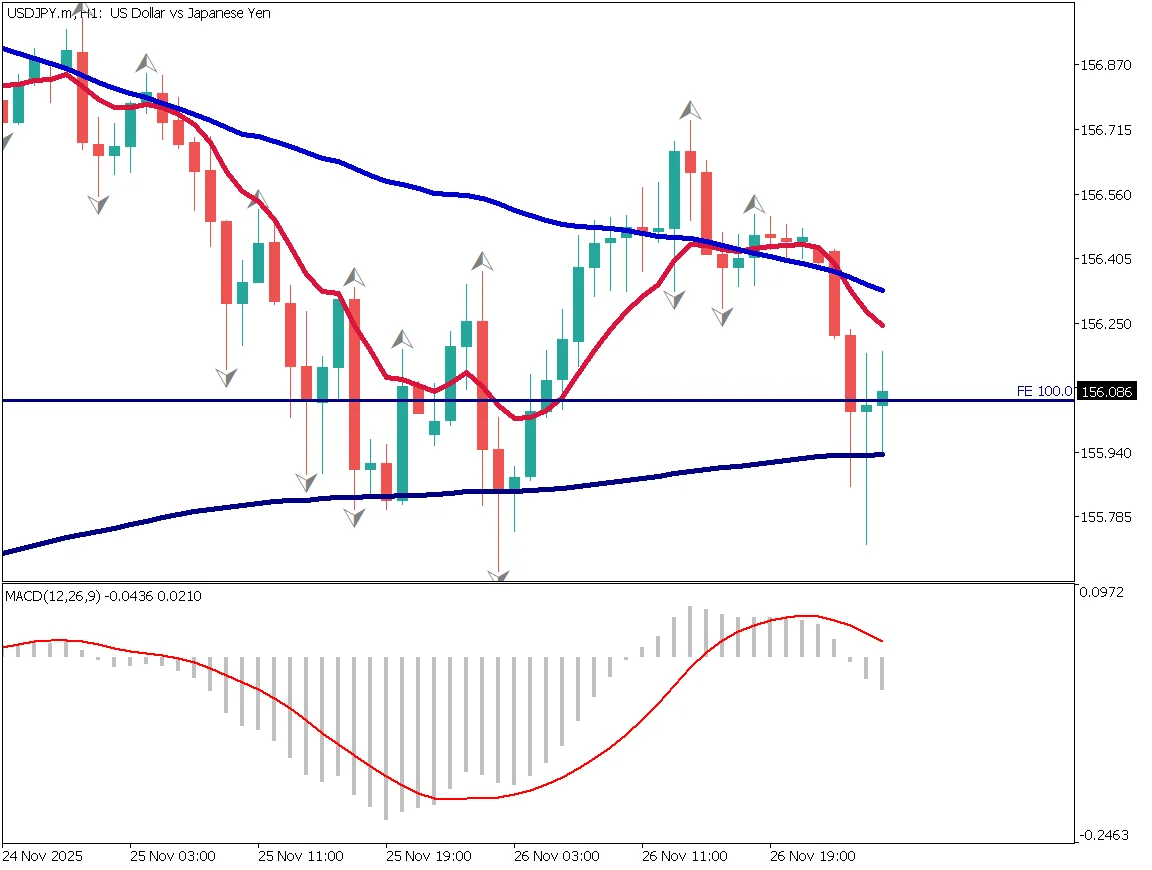

USD/JPY is trading in the low 156 range. The 10EMA and the 100% Fibonacci level form a strong support zone, helping the pair maintain a steady upward trend. Although the yen strengthened slightly after hawkish BOJ remarks, the reaction was limited.

If the BOJ does not raise rates in December, further yen depreciation is likely. The BOJ has raised rates in past year-end meetings, making the upcoming December policy meeting an important event. There is also speculation that the BOJ may delay action to monitor wage negotiations in next year's shuntō.

European traders continue to show a bias toward selling yen. Whether USD/JPY can rebound from the low 156 area will be key. A break below 156 could open the path toward the low-155 zone.

Intraday Trading Strategy

On the 1-hour chart, the 240EMA has provided strong support, with three rebounds occurring within a short period. However, the 157 yen level remains heavy, and short-term moving averages have crossed below mid-term averages, generating a sell signal under the Granville rules.

If USD/JPY breaks below the 240EMA, stop-loss orders may accelerate a drop toward the low-155 range.

For day traders, one approach is to enter a test sell once the pair clearly breaks below the 240EMA, then aim to buy back around the low-155 zone.

Today's Key Indicator

| Economic Indicators / Events | Time |

|---|---|

| ECB Meeting Minutes | 21:30 |

Ready to trade?

Open live accountThis material is for informational purposes only and does not constitute investment advice. Trading leveraged products involves significant risk of loss. Past performance is not indicative of future results.

![[Special Edition] When Will the Bank of Japan's Next Rate Hike Come?](/_next/image/?url=%2Fimages%2Fmarket-analysis%2F20251031USDJPYDAY.webp&w=3840&q=75&dpl=dpl_DuroJaYkswUAC7zyZSzJuw8Qt8iH)