USD/JPY Faces Heavy Upside; New Fed Chair to Be Chosen Early Next Year

Fundamental Analysis

- Trump to Announce Next Fed Chair Soon

- Rate-cut expectations are increasing, leading to stronger dollar selling

- NEC Chairman Hassett is seen as a leading candidate for next Fed Chair

- Administration openly pressuring Fed to cut rates

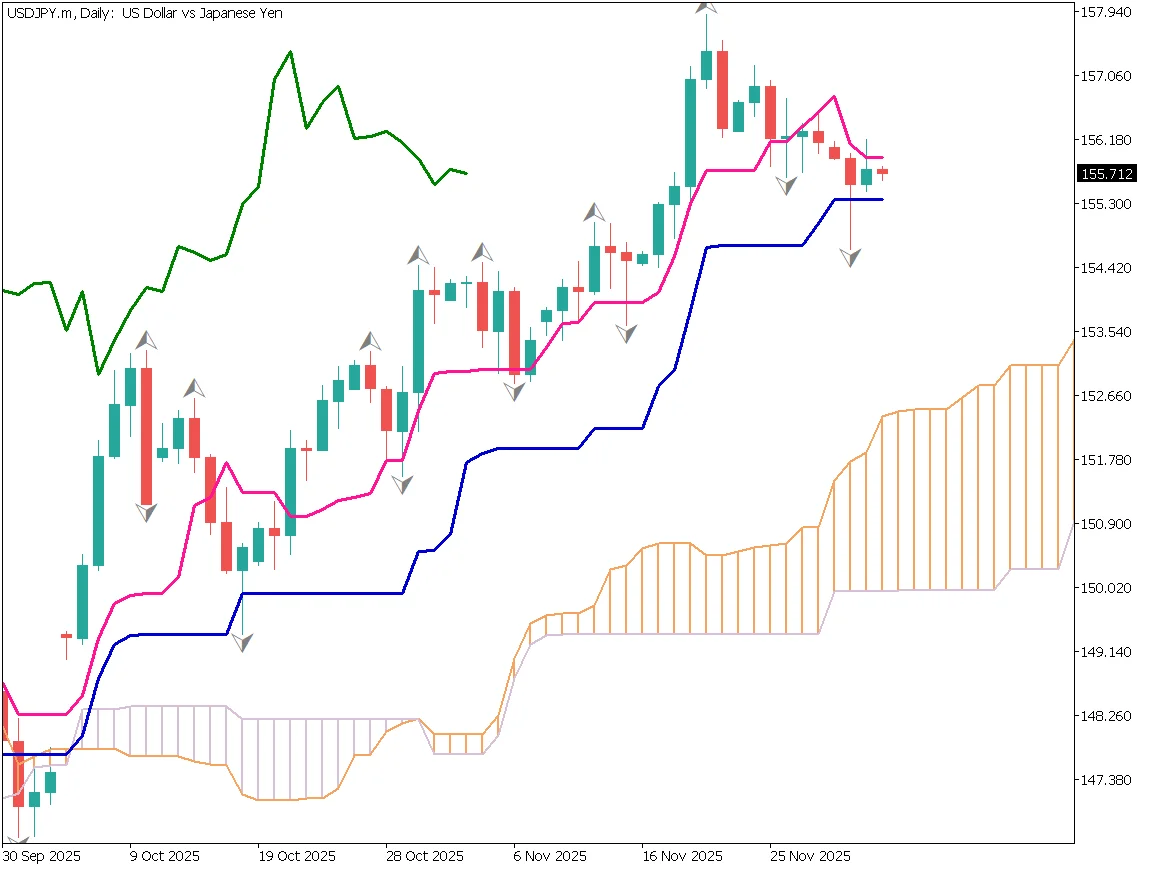

USD/JPY Daily Chart

President Trump plans to announce the next Federal Reserve Chair early next year. The administration is openly pressuring the Fed to cut rates, while Chair Powell remains cautious due to inflation risks. Because of this policy clash, markets expect the next chair to be someone who aligns with the administration's intentions. NEC Chairman Hassett is seen as a leading candidate.

Rate-cut expectations are increasing, leading to stronger dollar selling. USD/JPY is showing heavy topside, and if BOJ rate-hike expectations rise further, the pair may move toward yen appreciation. The BOJ also appears to be preparing the market for future hikes.

In the Ichimoku chart, the baseline is acting as support while the conversion line caps the upside. The 155-yen support zone remains strong, but if the scenario becomes "Fed cuts vs BOJ hikes," a trend shift to yen strength becomes possible.

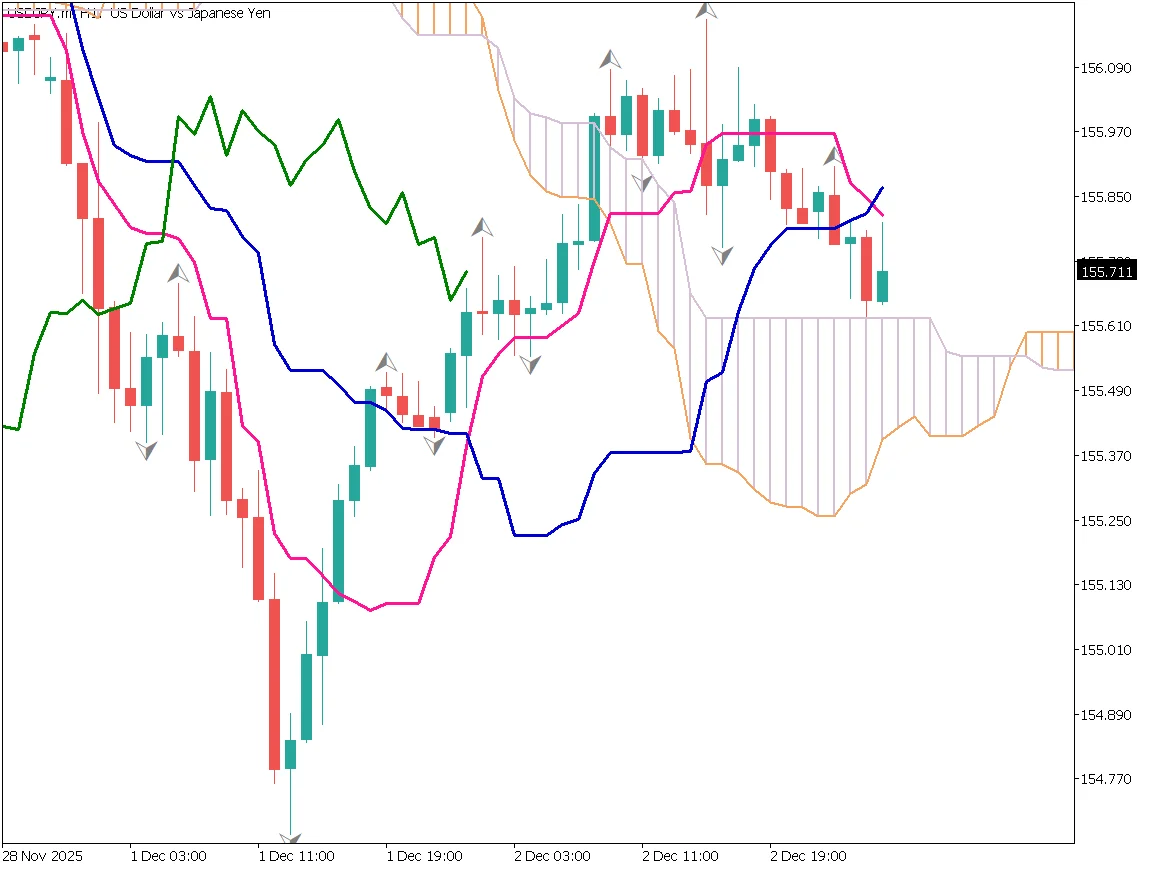

USD/JPY Day-Trade Strategy

Although upside is heavy, clear reasons for aggressive yen buying are limited, making direction hard to grasp. The pair dipped to the high-154s but rebounded to the 156-yen range. Another test is possible, but the Ichimoku cloud stands overhead, leaving the outlook uncertain.

Today's USD/JPY movement will depend largely on the U.S. ADP employment report. While the broader market is leaning toward dollar selling, yen selling due to Japan's fiscal concerns makes it difficult for USD/JPY to turn into a clear downtrend.

A possible short-term strategy is to sell short on rebounds and buy back around the low-155 range.

Today's Key Events

| Event | Time |

|---|---|

| U.S. ADP Employment Report | 22:15 |

| U.S. ISM Non-Manufacturing PMI | 24:00 |

Ready to trade?

Open live accountThis material is for informational purposes only and does not constitute investment advice. Trading leveraged products involves significant risk of loss. Past performance is not indicative of future results.

![[Special Edition] When Will the Bank of Japan's Next Rate Hike Come?](/_next/image/?url=%2Fimages%2Fmarket-analysis%2F20251031USDJPYDAY.webp&w=3840&q=75&dpl=dpl_DuroJaYkswUAC7zyZSzJuw8Qt8iH)