USD/JPY Faces Resistance as BOJ Keeps Policy Unchanged

Fundamental Analysis

- The Bank of Japan decided to maintain its current policy settings.

- Markets are focusing on whether the Governor will mention a possible rate hike in his press conference.

- Meanwhile, although the U.S. has already begun rate cuts, opinions differ on a possible additional cut in December.

Monetary Policy Impact on FX

The BOJ's decision to keep the policy rate at 0.5% was widely expected. However, expectations for a rate hike in December have strengthened, especially after recent remarks from the U.S. Treasury Secretary that appeared to criticize Japan's slow response to monetary tightening and expressed concern about the strong U.S. dollar.

Treasury Secretary Bessent has repeatedly made comments interpreted as indirect criticism of BOJ policy, increasing pressure from the U.S. side for Japan to raise rates.

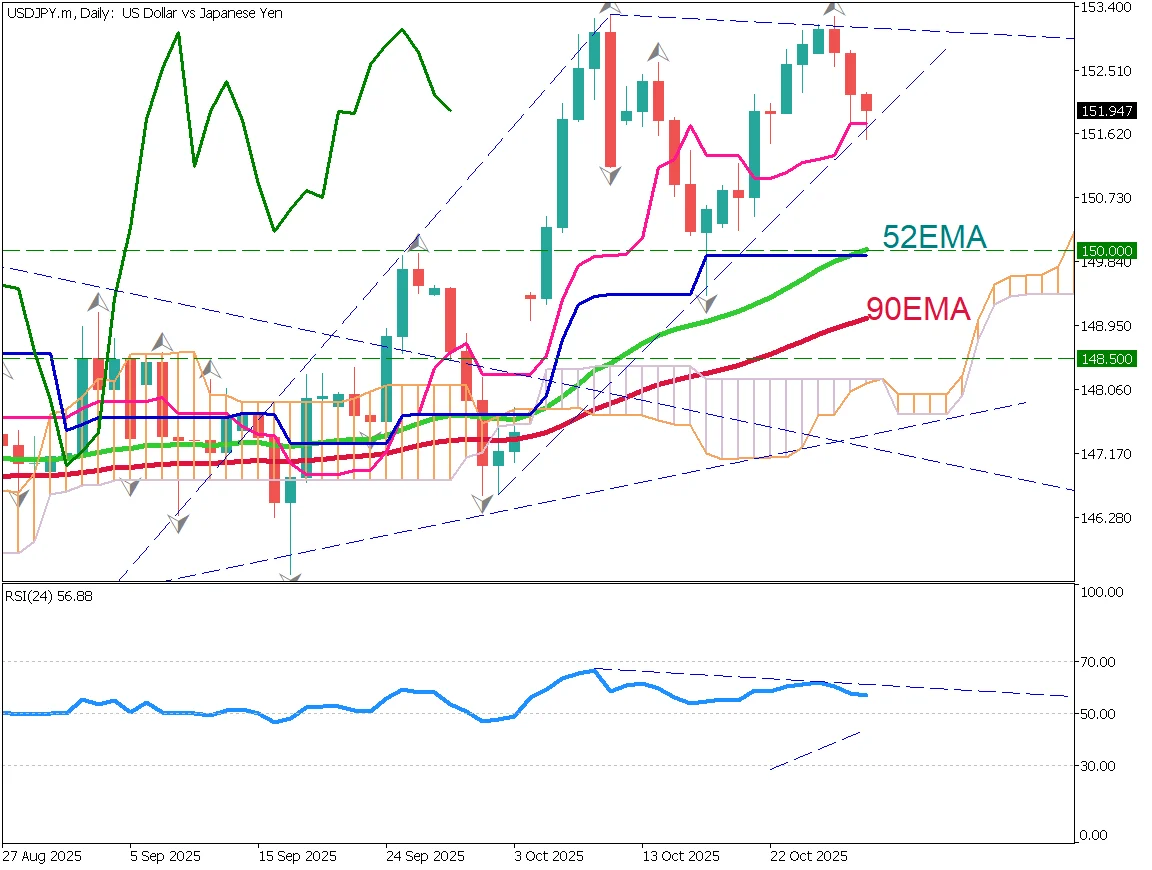

Following the BOJ announcement, USD/JPY surged sharply, rising close to the 153 level. The key focus now is whether it can break above 153.20.

[Pro Version] USD/JPY Day Trading Strategy

After the BOJ announcement, USD/JPY climbed near 153 but remains heavy at that level. The pair has formed an "N-shape" pattern, and the key question is whether it can break above its recent high. The RSI has risen to 57, targeting a potential breakout above 153.

It's difficult to predict before the Governor's press conference, but the event will likely stick to official talking points without any strong hawkish remarks. The BOJ will probably play it safe, though attention remains on whether it might hint at a December rate hike under U.S. pressure.

Upward momentum is expected to persist for the time being.

Key Events Today

Note: Some U.S. data releases may be postponed due to the government shutdown.

| Indicator | Time (JST) |

|---|---|

| BOJ Policy Rate Decision | Around Noon |

| BOJ Governor's Press Conference | 15:30 |

| U.S. GDP | 21:30 |

Ready to trade?

Open live accountThis material is for informational purposes only and does not constitute investment advice. Trading leveraged products involves significant risk of loss. Past performance is not indicative of future results.

![[Special Edition] When Will the Bank of Japan's Next Rate Hike Come?](/_next/image/?url=%2Fimages%2Fmarket-analysis%2F20251031USDJPYDAY.webp&w=3840&q=75&dpl=dpl_9ykzocQ3JggALwnGTkzEMuW9KCfi)