USD/JPY Falls Below the Conversion Line, Shaken by Geopolitical Risks and Domestic Politics

Fundamental Analysis

- Reports indicate that the ruling party plans to include a two-year consumption tax cut in its policy platform

- While consumer-related stocks moved higher against the broader trend, the bond market showed signs of instability

- Attention is focused on whether yen depreciation will accelerate, as USD/JPY currently remains in a cautious, wait-and-see phase

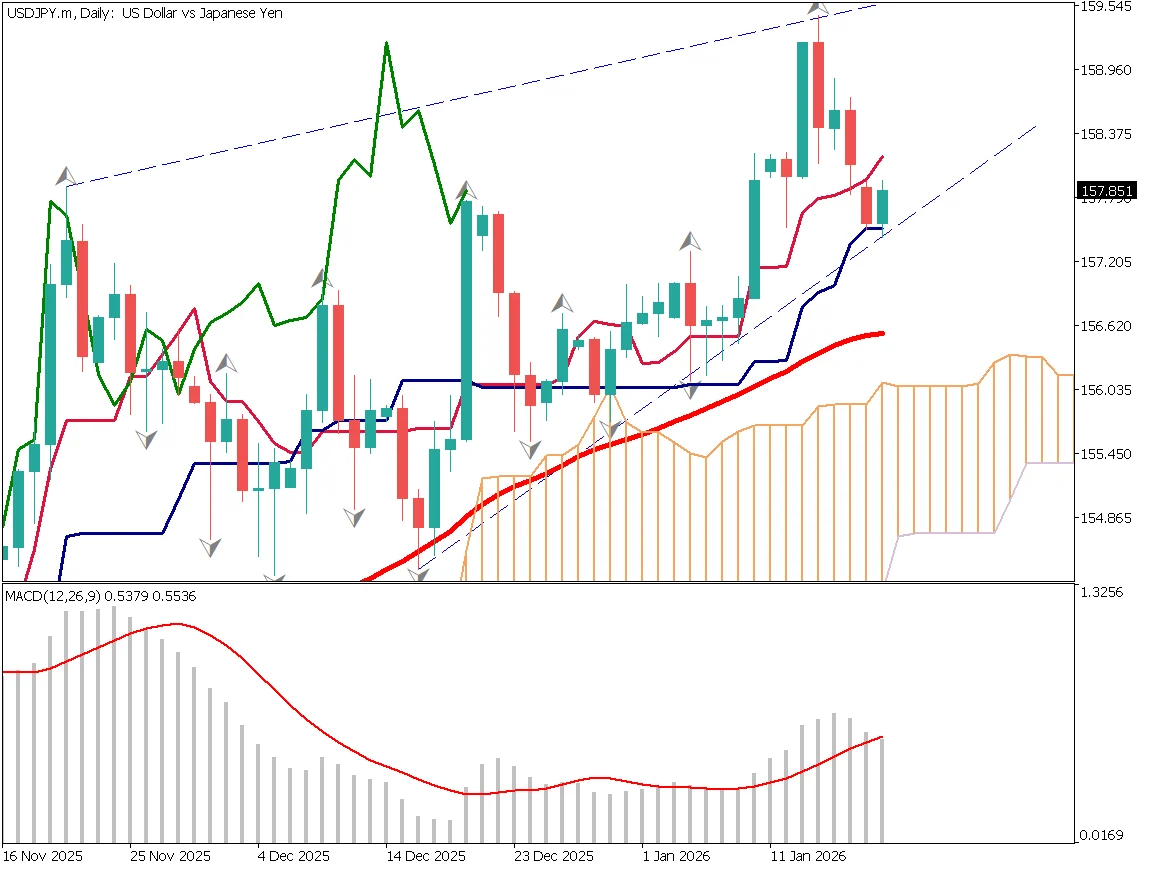

Uptrend Loses Momentum

USD/JPY's upward trend has paused, with the pair breaking below the Ichimoku conversion line. The base line is currently acting as support, but the chart is beginning to form a structure close to a rising wedge. If the descending trend line is broken, prices could fall toward around 156.60, where the 52-day moving average is located.

The MACD histogram is also approaching a break below the signal line, suggesting that downside pressure is gradually increasing.

Even a limited consumption tax cut could support stock prices and act as an economic stimulus. However, from a fiscal discipline perspective, increased government bond issuance would likely be required, making long-term interest rates prone to rise. Policy management will therefore become extremely challenging. As a result, upward pressure on USD/JPY may strengthen, increasing the likelihood of further gains.

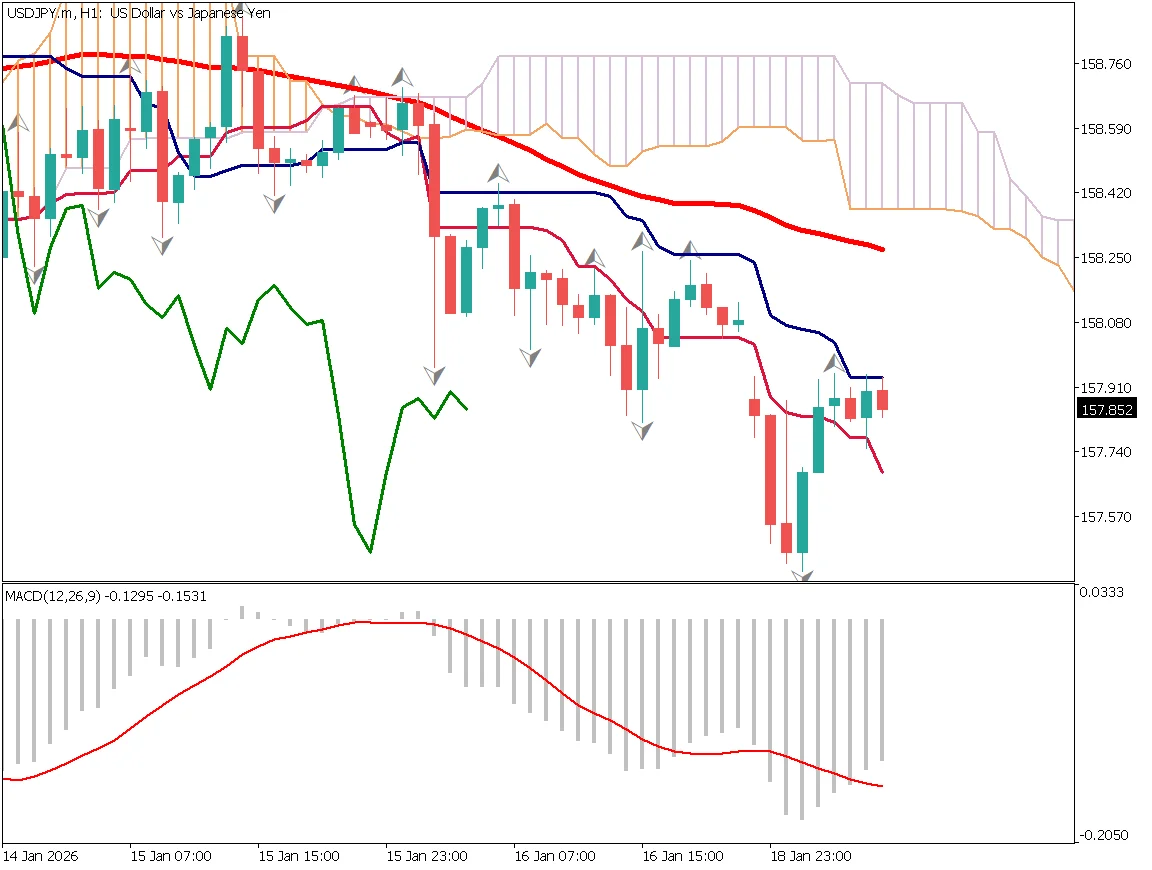

Rebound High Formation

The pair is forming a rebound high, with the base line now acting as resistance. Market participants are closely watching whether this level can be broken. Given the many conflicting factors, the market is struggling to determine its next direction. From a trend perspective, the situation appears similar to a buy-on-dips phase, but overall judgment remains difficult.

For now, a cautious stance and further observation are advised.

Today's Key Indicators and Events

| Economic Indicators | Time |

|---|---|

| U.S. Holiday | — |

Ready to trade?

Open live accountThis material is for informational purposes only and does not constitute investment advice. Trading leveraged products involves significant risk of loss. Past performance is not indicative of future results.

![[Special Edition] When Will the Bank of Japan's Next Rate Hike Come?](/_next/image/?url=%2Fimages%2Fmarket-analysis%2F20251031USDJPYDAY.webp&w=3840&q=75&dpl=dpl_7FDQsQkqrpcAqSED6PhxxDEbMMbP)