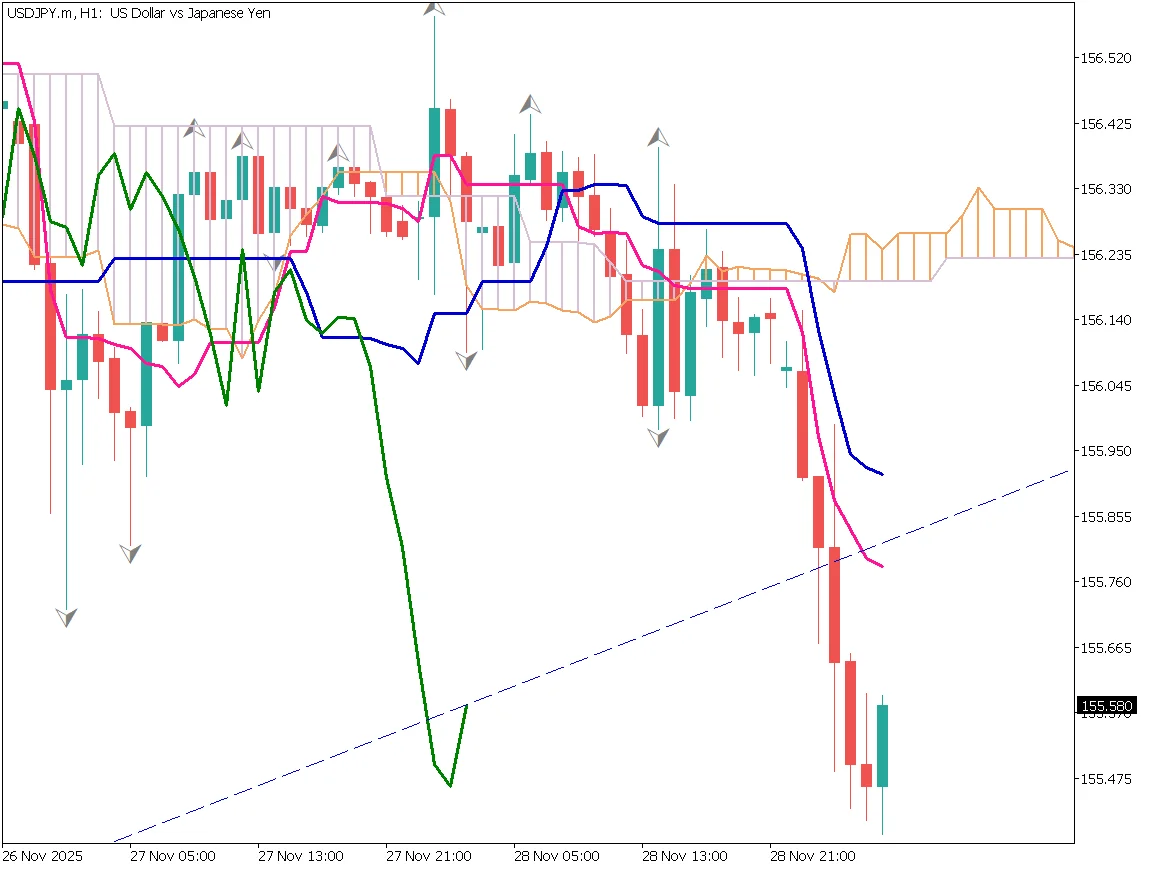

London Market — USD/JPY Falls as BOJ Governor Prepares for Rate Hike

Fundamental Analysis

- The Nikkei declined, pressured by real estate stocks, while bank stocks held firm

- USD/JPY fell toward the 155 level as expectations for a December rate hike grew

USD/JPY Daily Chart

The BOJ governor stated that the upcoming December policy meeting would include a "decision on whether to raise rates," effectively signaling the possibility of a hike. Government bond yields continue to rise, increasing upward pressure on interest rates.

The Nikkei dropped below 50,000, and USD/JPY slipped below the mid-155 range. Using Fibonacci retracement, the pair has fallen to the 23.6% level near 155.50. Growing rate-hike expectations may slow the ongoing uptrend in USD/JPY.

Whether the pair holds above the 26-day moving average will be important. The downtrend is not confirmed yet, but caution is needed.

USD/JPY Day Trading Strategy

USD/JPY fell below 156 and moved into the low-155 range. The BOJ governor's comments increased expectations for a December rate hike, looking much like preparation for tightening. A similar rise in expectations occurred last year at year-end.

Higher rates tend to weigh on stocks and can lead to a stronger yen. A one-way yen-weakening trend is unlikely for now. Additional comments from BOJ officials will be important. If the government pushes back against rate hikes, market volatility may rise.

For day trading, a wait-and-see stance is advised while watching whether the price can stay above the 26-day moving average.

Key Economic Indicators Today

| Event | Time |

|---|---|

| U.S. Manufacturing PMI | 23:45 |

Ready to trade?

Open live accountThis material is for informational purposes only and does not constitute investment advice. Trading leveraged products involves significant risk of loss. Past performance is not indicative of future results.

![[Special Edition] When Will the Bank of Japan's Next Rate Hike Come?](/_next/image/?url=%2Fimages%2Fmarket-analysis%2F20251031USDJPYDAY.webp&w=3840&q=75&dpl=dpl_DuroJaYkswUAC7zyZSzJuw8Qt8iH)