USD/JPY Rises Ahead of Tomorrow's Early-Morning FOMC

Fundamental Analysis

- A December rate hike by the Bank of Japan is now fully expected

- Even with a Fed rate cut and a BOJ rate hike priced in, the yen is not strengthening

Japan's Long-Term Interest Rate Close to 2%

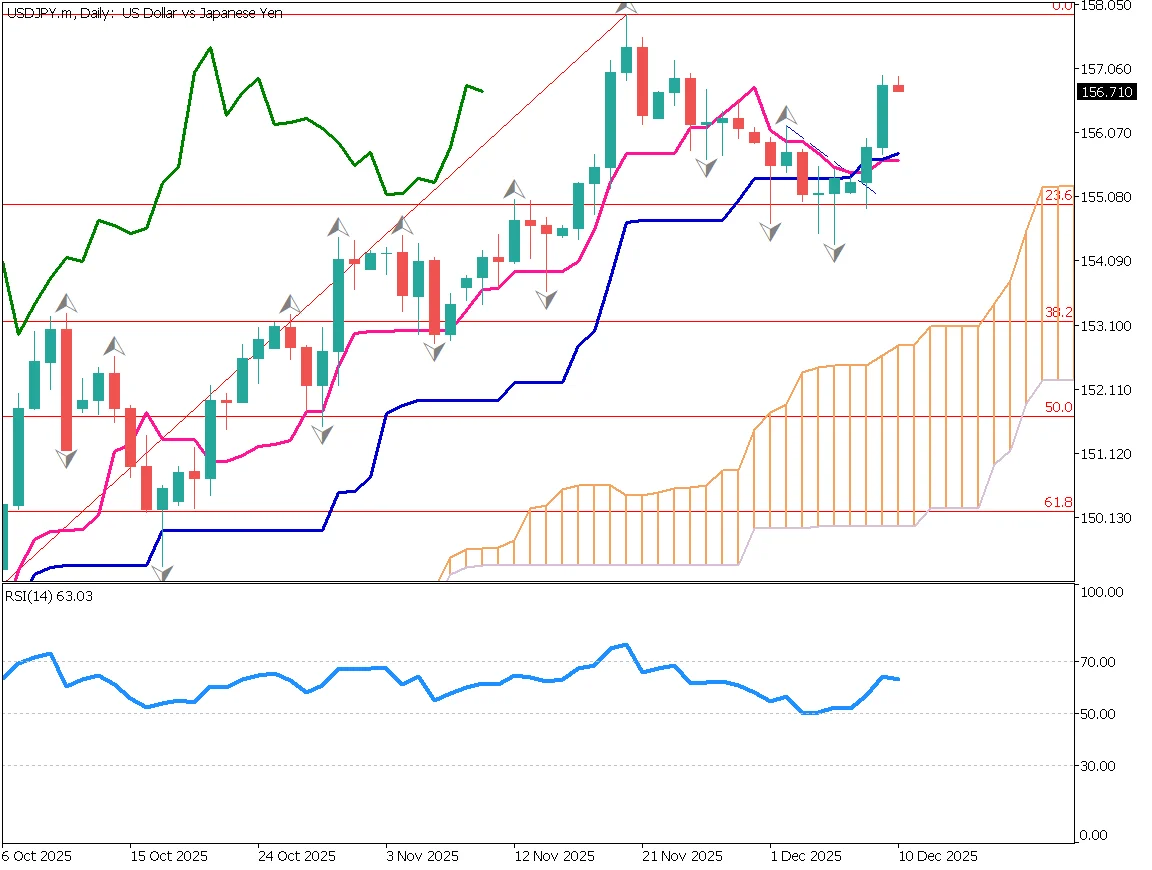

USD/JPY rebounded at the 23.6% Fibonacci level and regained its upward momentum. The pullback was shallower than expected. The baseline is rising, and the conversion line also looks ready to turn upward. The market is focused on whether the pair can break above 158.

Both the BOJ's December hike and the Fed's rate cut have been priced in. Normally, this would lead to yen appreciation, but the yen continues to weaken—likely due to declining confidence in Japan's fiscal situation. The 10-year Japanese government bond yield is approaching the 2% level.

Concerns about Japan's fiscal stability are becoming more prominent, supporting continued yen weakness. A 0.25% BOJ rate hike alone may not be enough to stop the trend.

Traders will be watching closely to see whether USD/JPY can set a new high.

USD/JPY Day Trading Strategy

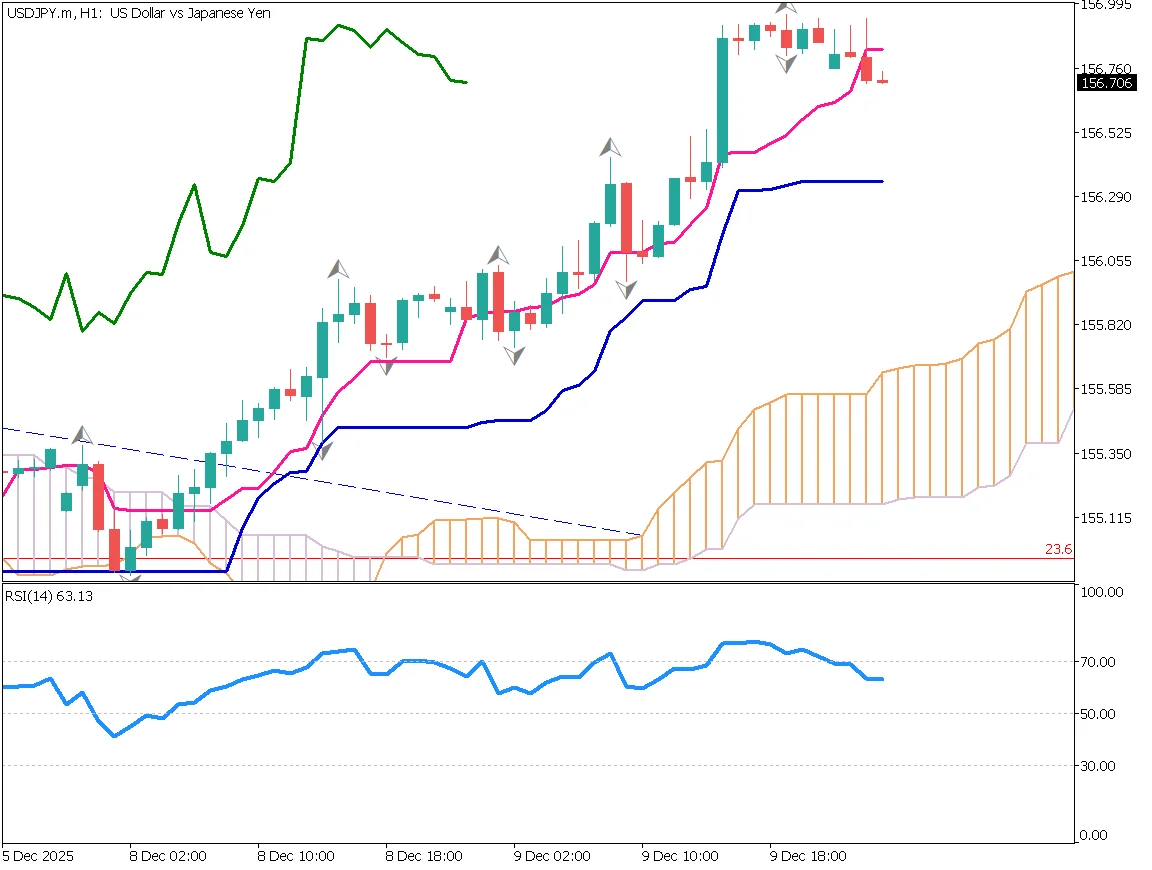

On the 1-hour chart, the pair maintains a stable uptrend. Price has dipped below the conversion line, and RSI has fallen below 70 from above, suggesting a possible short-term correction. A buy limit order around the baseline could be considered.

The broader trend still points toward yen weakness. Sudden sharp moves may occur when the FOMC results are released or when the BOJ announces its rate hike. However, overall, the movement is likely to remain a short-term adjustment.

Even so, proper risk management is essential, and positions should be reduced before major events.

Key Economic Events Today

| Event | Time |

|---|---|

| Bank of Canada Policy Rate Announcement | 23:45 |

| U.S. FOMC Policy Rate Announcement | 03:30 (next day) |

| Fed Chair Powell Press Conference | 04:30 (next day) |

Ready to trade?

Open live accountThis material is for informational purposes only and does not constitute investment advice. Trading leveraged products involves significant risk of loss. Past performance is not indicative of future results.

![[Special Edition] When Will the Bank of Japan's Next Rate Hike Come?](/_next/image/?url=%2Fimages%2Fmarket-analysis%2F20251031USDJPYDAY.webp&w=3840&q=75&dpl=dpl_DuroJaYkswUAC7zyZSzJuw8Qt8iH)