USD/JPY Forms a Range — What’s Next?

Fundamental Analysis

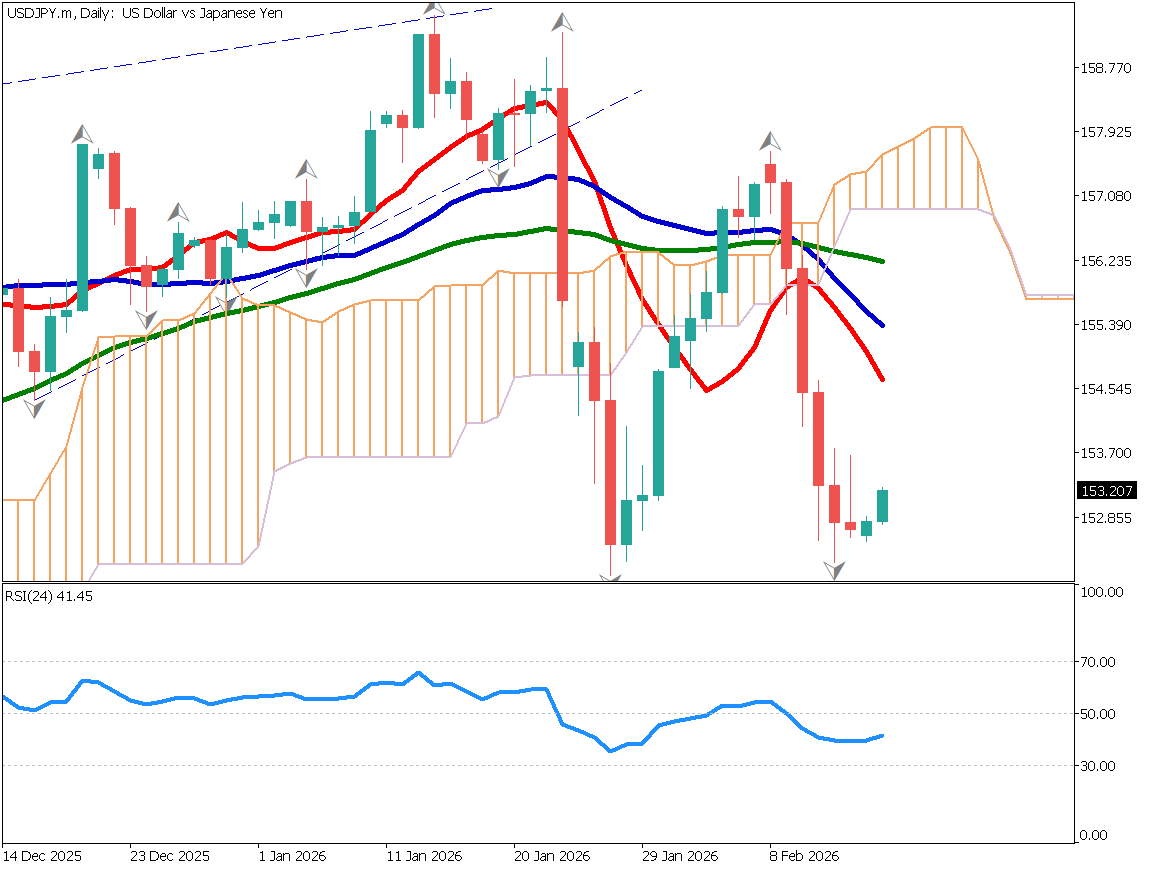

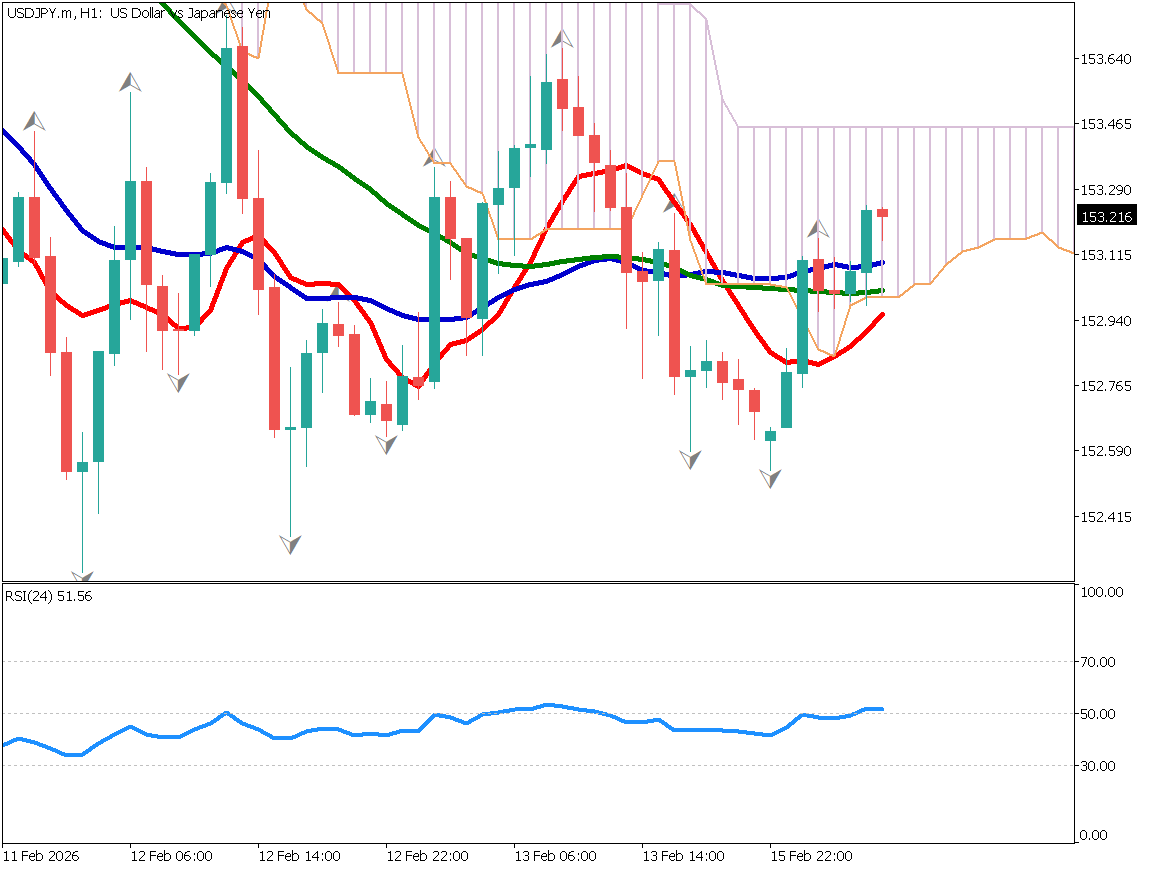

- USD/JPY is currently moving within a range around the 153 level, with no clear market direction. U.S. CPI has slowed, leading to lower long-term yields and increased dollar-selling pressure. Although a potential double bottom is forming on the daily chart, moving averages remain in a bearish perfect order, showing mixed signals. In the short term, a range between 152.50 and 153.50 is expected, making range trading strategies preferable.

Fundamental Analysis

The market is struggling to determine direction.

U.S. Consumer Price Index (CPI) declined, and long-term yields fell.

Will It Rebound from Solid Support?

USD/JPY appears to be forming a double bottom. However, moving averages are aligned in a bearish perfect order, and technical indicators are giving mixed signals.

On the daily chart, the pair has rebounded near the firm support level around 153. However, there is a possibility of rejection at the 10-day moving average. With U.S. CPI cooling, dollar-selling pressure has increased, suggesting that excessive yen weakness may be less likely.

Traders should watch whether the pair rejects at the 10-day moving average and makes a new low. Given the lack of a clear trend, utilizing range trading strategies on the 1-hour and 4-hour charts may be appropriate.

[USD/JPY – Daily Chart]

Strong Support, but Weak Rebound

On the 1-hour chart, USD/JPY is forming a range between 152.50 and 153.50, currently building energy for its next move. With no clear directional bias, focusing on range strategies is advisable. As this is no longer a one-sided yen-weakness market, trading difficulty has slightly increased.

As long as price remains inside the Ichimoku cloud, a range strategy may be appropriate: short-term selling in the upper 153 area and short-term buying in the lower 152 area.

[USD/JPY – 1-Hour Chart]

Today's Economic Indicators

None.

Ready to trade?

Open live accountThis material is for informational purposes only and does not constitute investment advice. Trading leveraged products involves significant risk of loss. Past performance is not indicative of future results.