USD/JPY: Is This a Pullback? Trading Around the Mid-155 Level

Fundamental Analysis

- Selling pressure on the U.S. dollar is growing as investors expect rate cuts under the incoming Chairman Hassett

- USD/JPY is trading in the mid-155 range and has dropped below the Ichimoku base line

- Markets are gradually pricing in a scenario of BOJ rate hikes and U.S. rate cuts

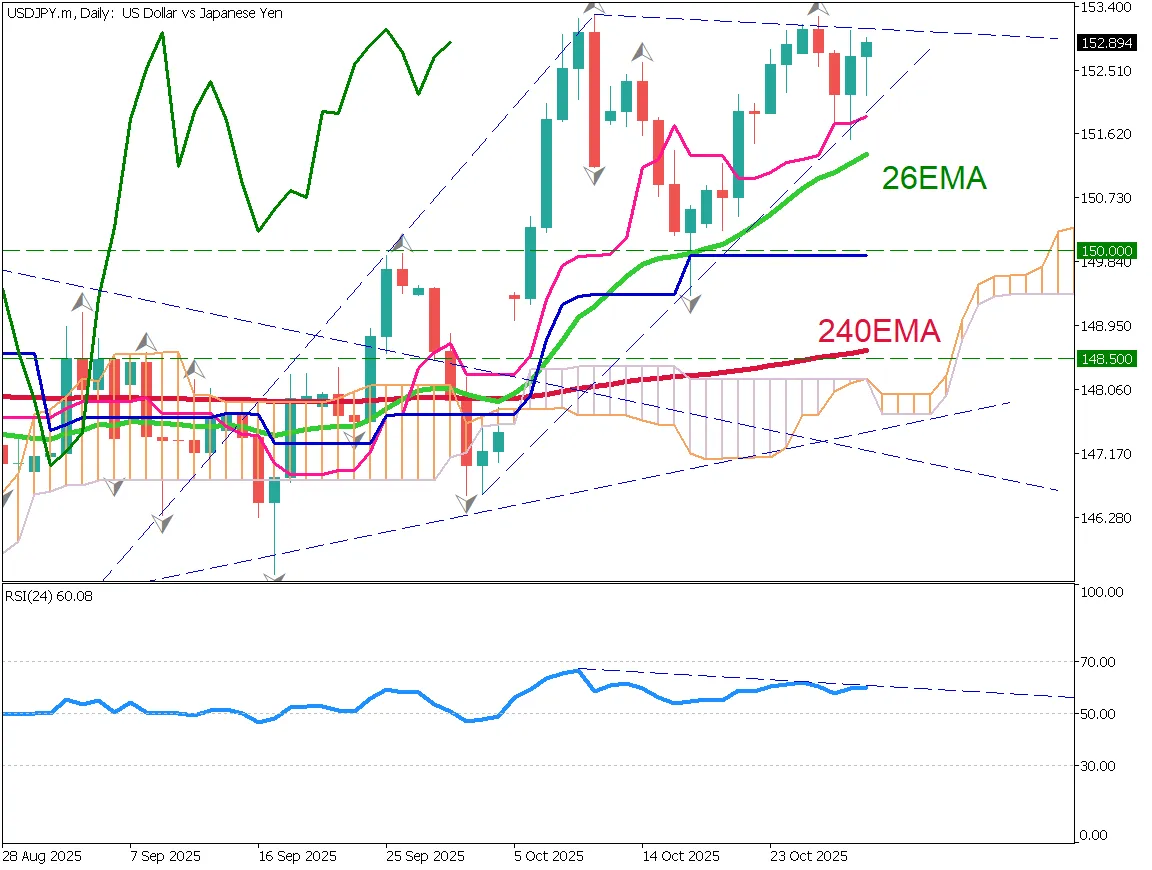

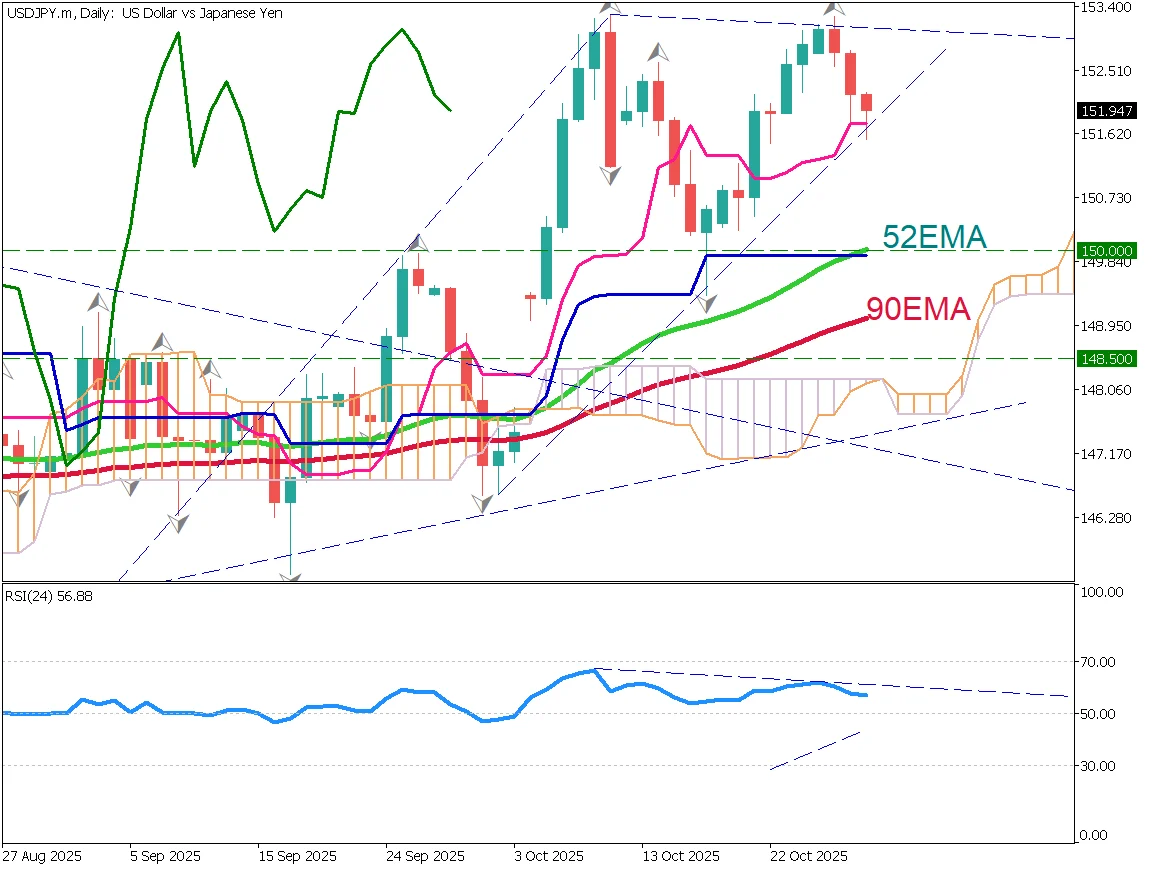

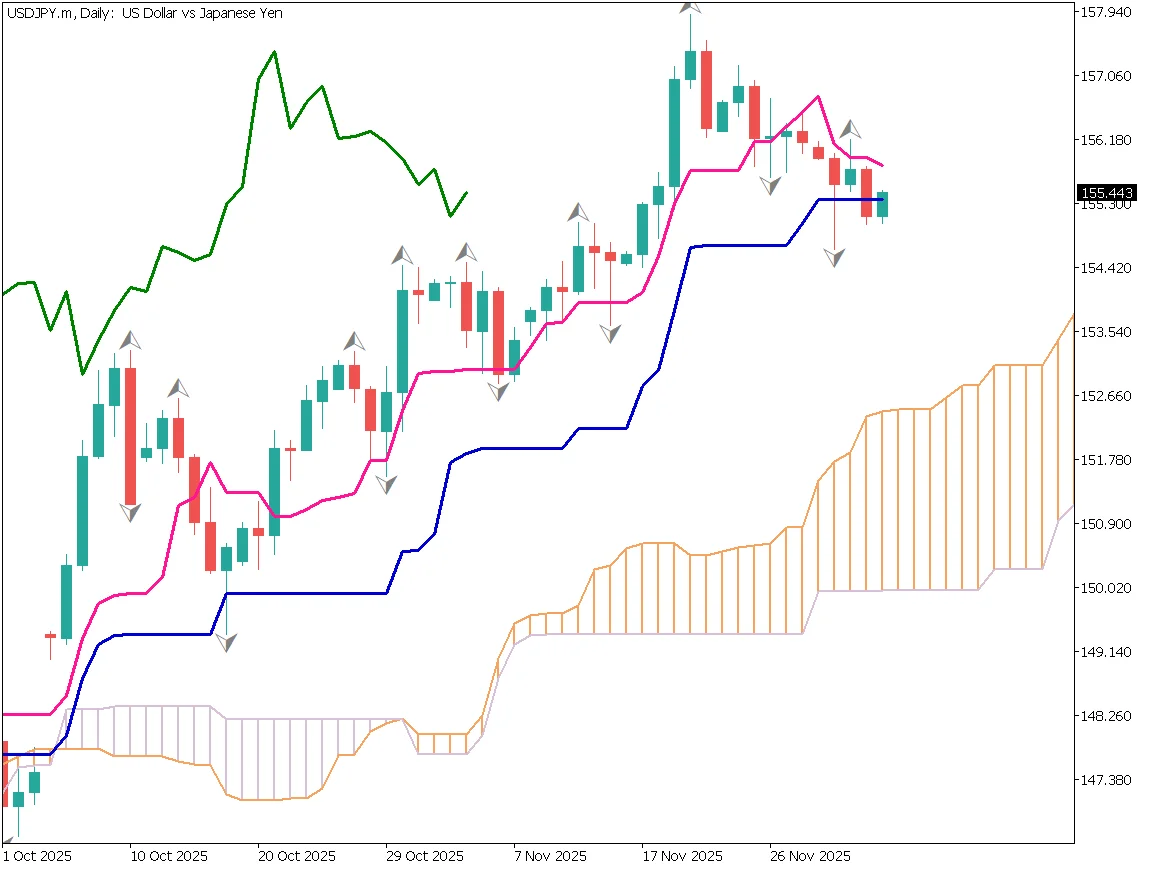

USD/JPY – Daily Chart

Selling pressure on the U.S. dollar is growing as investors expect rate cuts under the incoming Chairman Hassett. USD/JPY is trading in the mid-155 range and has dropped below the Ichimoku base line. If today's close remains below the base line, it will be the first time since late September, suggesting the pair may be entering a correction phase within the broader uptrend.

If the pair falls below the mid-154 level, it could be judged as the start of a downtrend. The 153 yen range is expected to act as very strong support. For now, the key focus is whether the Bank of Japan will raise rates at this month's meeting.

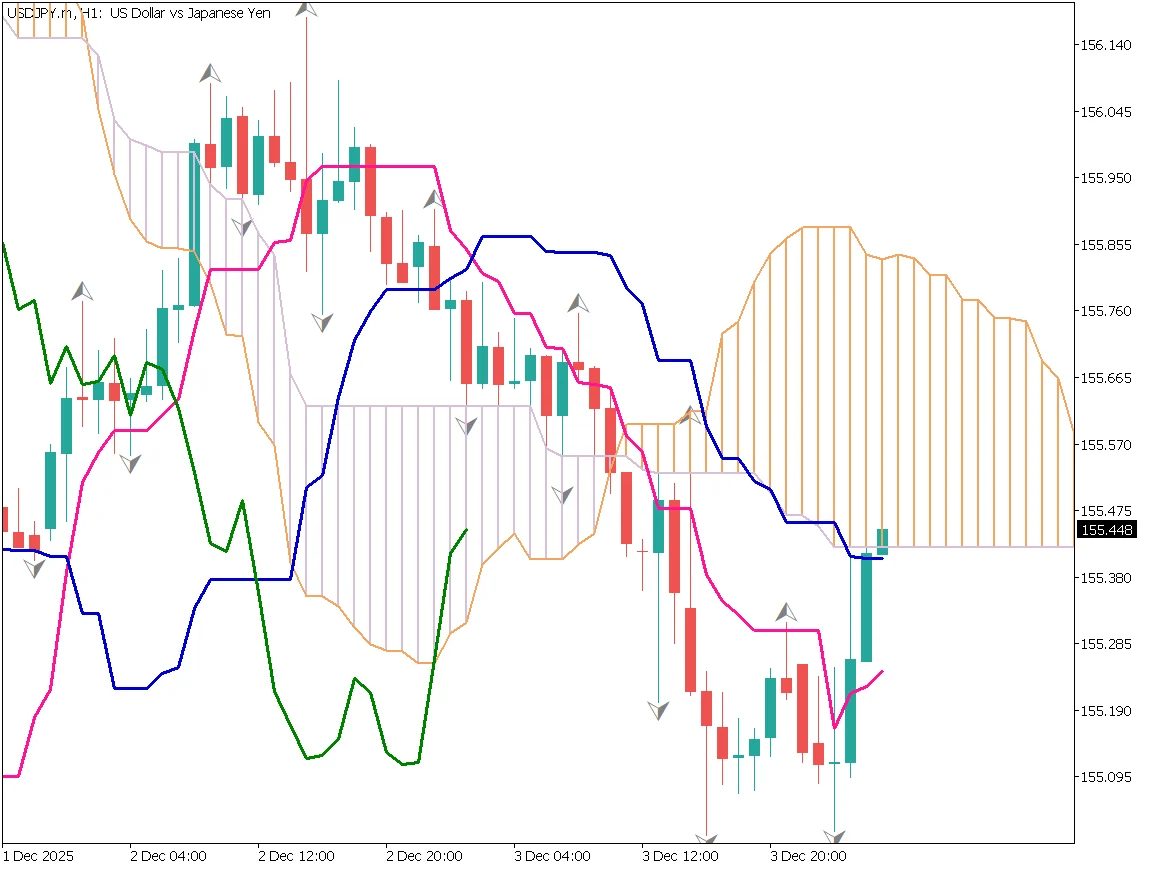

USD/JPY Day-Trading Strategy

USD/JPY has bounced twice around 155, forming a small double bottom. Although the price has temporarily moved above the base line, it is now entering the Ichimoku cloud. This makes buying entries risky. With Japan expected to hike rates and the U.S. expected to cut, fundamentals point toward yen buying and dollar selling.

However, Japan still faces structural issues, making it unlikely for the yen to strengthen sharply. For now, staying on the sidelines is a reasonable choice.

Today's Key Economic Events

| Indicator / Event | Time |

|---|---|

| U.K. Construction PMI (Nov) | 18:30 |

| Eurozone Retail Sales (Oct) | 19:00 |

| U.S. Initial Jobless Claims | 22:30 |

Ready to trade?

Open live accountThis material is for informational purposes only and does not constitute investment advice. Trading leveraged products involves significant risk of loss. Past performance is not indicative of future results.

![[Special Edition] When Will the Bank of Japan's Next Rate Hike Come?](/_next/image/?url=%2Fimages%2Fmarket-analysis%2F20251031USDJPYDAY.webp&w=3840&q=75&dpl=dpl_DuroJaYkswUAC7zyZSzJuw8Qt8iH)