USD/JPY in a Range Market, Quiet Trading Continues

Fundamental Analysis

- U.S. manufacturing index came in below market expectations, leading to dollar selling and marking the tenth consecutive month of contraction

- Despite the U.S. attack on Venezuela, markets remained calm, and expectations for higher stock prices continue

- USD/JPY edged slightly lower, but no major yen appreciation trend has emerged

- USD/JPY stuck at high levels

USD/JPY Stuck at High Levels

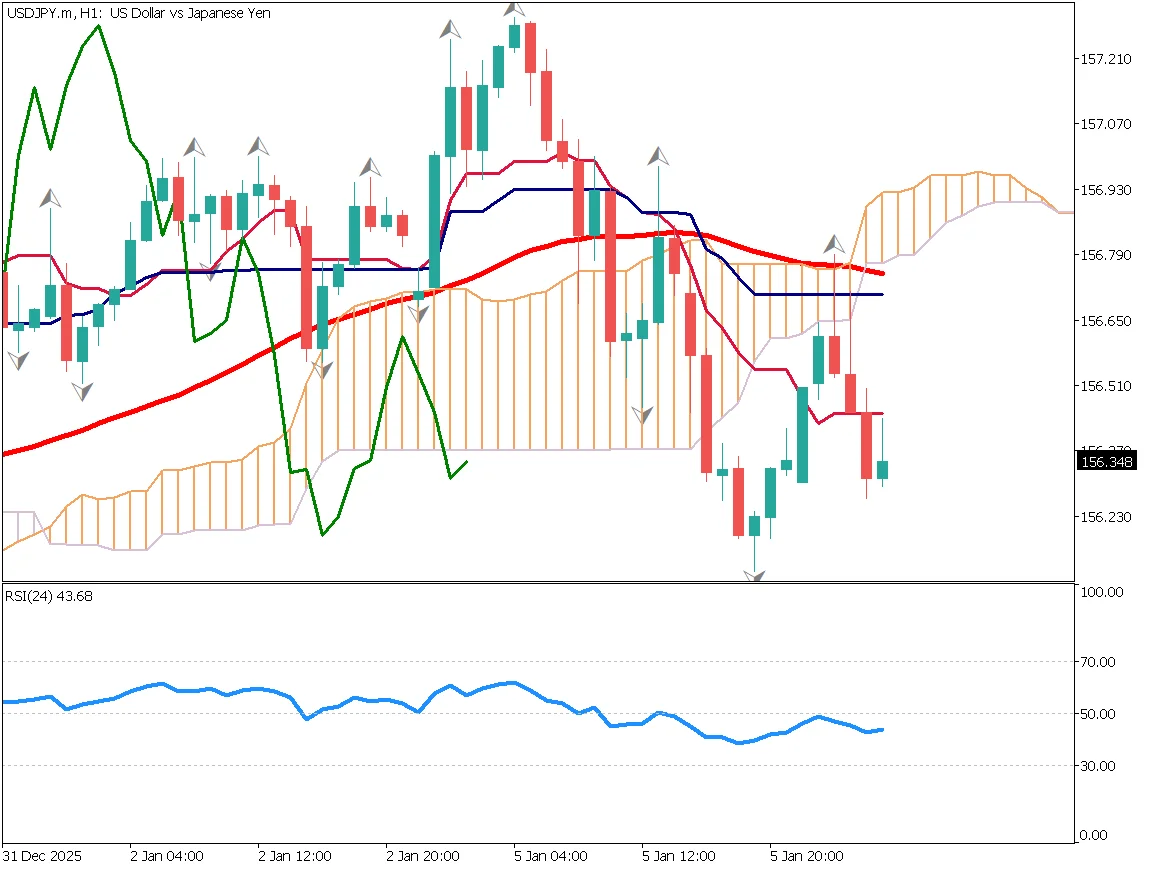

USD/JPY is forming a range around the 156 yen level. The 52-day moving average is acting as support, but it is very close to the candlesticks, highlighting heavy upside pressure. At high levels, bearish reversal signals such as a bearish engulfing pattern, the evening star formation, and a second bearish engulfing pattern have appeared.

Candlestick patterns indicate strong resistance above 157 yen.

Fibonacci retracement shows the 23.6% level acting as support. If the pair declines further, a break below the 52-day moving average and below 155 yen would be key. The Nikkei index has surged since the start of the year, supported in part by a weaker yen.

If USD/JPY breaks down, it could put downward pressure on the Nikkei index, requiring caution.

Baseline Acting as Resistance

The Ichimoku baseline is acting as resistance, increasing downward pressure. However, a major yen appreciation trend is unlikely, and the range market is expected to continue. Buying on dips around 156 yen may be considered.

With global conditions unstable, market direction remains difficult to predict. For now, it is necessary to watch whether dollar buying or dollar selling becomes dominant.

Today's Key Economic Indicator

| Event | Time |

|---|---|

| U.S. Services PMI | 23:45 |

Ready to trade?

Open live accountThis material is for informational purposes only and does not constitute investment advice. Trading leveraged products involves significant risk of loss. Past performance is not indicative of future results.

![[Special Edition] When Will the Bank of Japan's Next Rate Hike Come?](/_next/image/?url=%2Fimages%2Fmarket-analysis%2F20251031USDJPYDAY.webp&w=3840&q=75&dpl=dpl_DuroJaYkswUAC7zyZSzJuw8Qt8iH)