USD/JPY Supported by Reopening Expectations – Trading Around 154

Fundamental Analysis

- Expectations for the end of the U.S. government shutdown have boosted global stock markets

- The USD/JPY remains range-bound, and traders are watching for a possible breakout

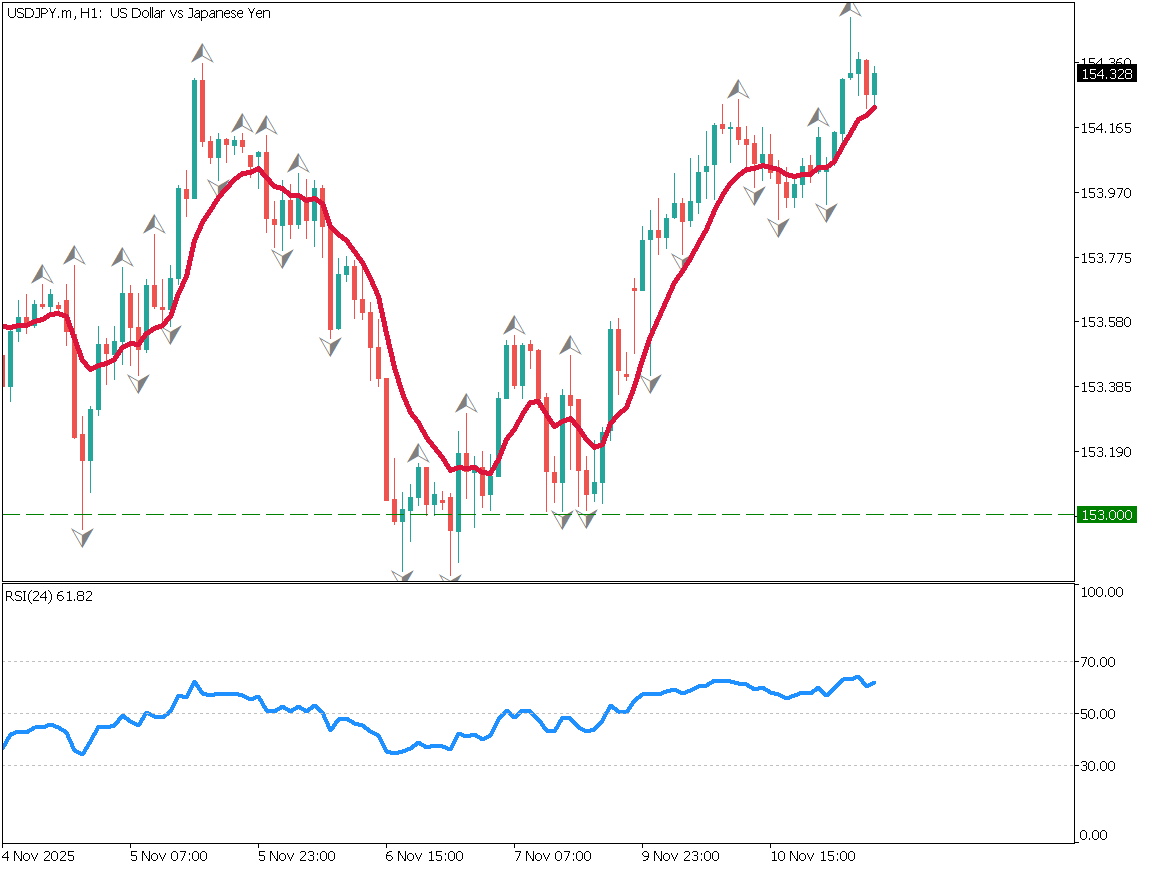

USD/JPY Daily Chart

The daily chart shows the conversion line acting as strong support. On a broader scale, the 61.8% Fibonacci retracement level also supports the pair, helping it turn upward.

Optimism over a potential U.S. government reopening has lifted global equities, with the London Stock Exchange reaching an all-time high. Improved investor sentiment is supporting USD/JPY gains.

The 52EMA is trending upward, indicating a strong bullish bias. The key focus is whether the pair can surpass its recent high.

USD/JPY Day Trading Strategy

The pair is moving within a range of 153.00–154.40, with heavy resistance above 154.50. As North American markets are closed today, major moves are unlikely. However, further progress on the government reopening could trigger stronger dollar buying.

If that happens, a breakout above 154.50 yen may occur. Traders may consider placing buy-limit orders around the 153.00 area.

Key Economic Events

Note: Some U.S. data releases may be delayed due to the government shutdown.

| Event | Time |

|---|---|

| U.S. and Canada Market Holiday | – |

Ready to trade?

Open live accountThis material is for informational purposes only and does not constitute investment advice. Trading leveraged products involves significant risk of loss. Past performance is not indicative of future results.

![[Special Edition] When Will the Bank of Japan's Next Rate Hike Come?](/_next/image/?url=%2Fimages%2Fmarket-analysis%2F20251031USDJPYDAY.webp&w=3840&q=75&dpl=dpl_DuroJaYkswUAC7zyZSzJuw8Qt8iH)