USD/JPY Slightly Rebounds, Adjustment Ahead of Christmas Holidays

Fundamental Analysis

- The market is gradually entering Christmas holiday mode

- Position adjustments may intensify in the coming days

- A rate hike is widely expected at the Bank of Japan policy meeting

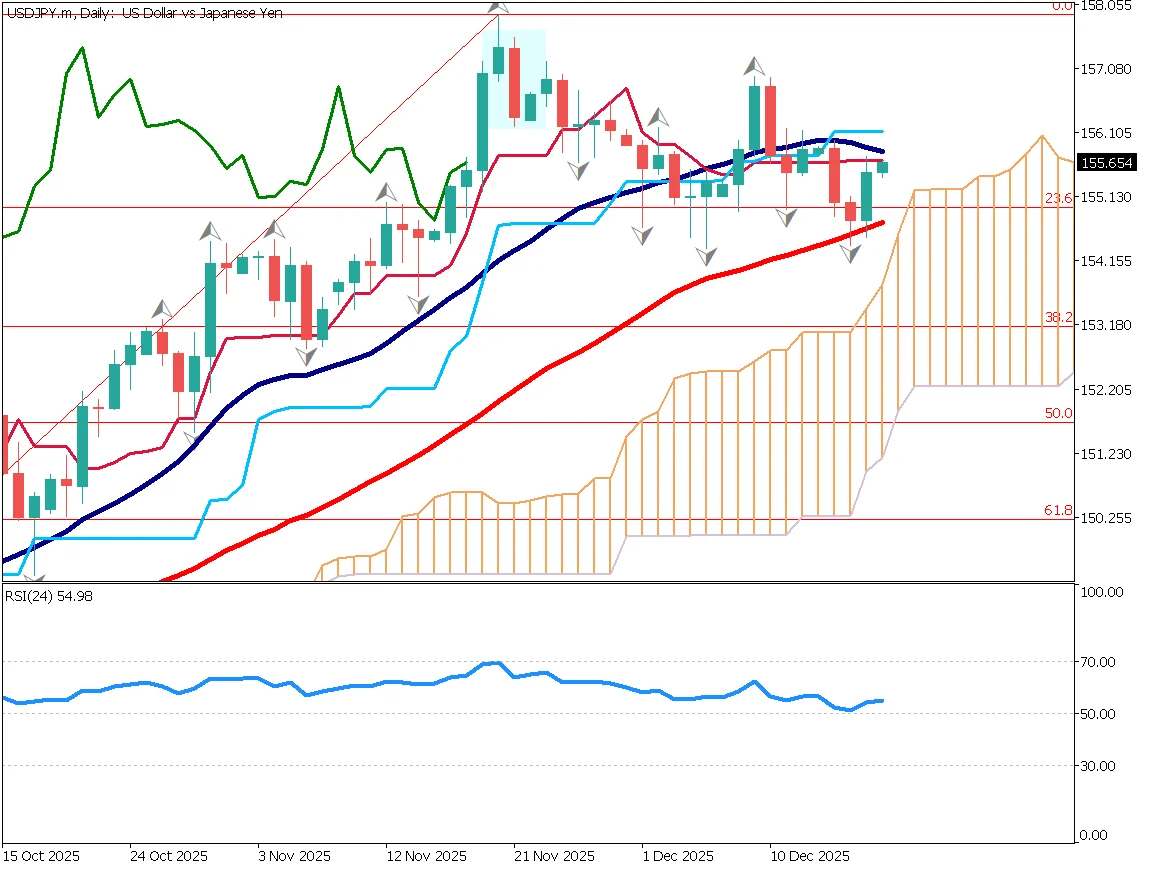

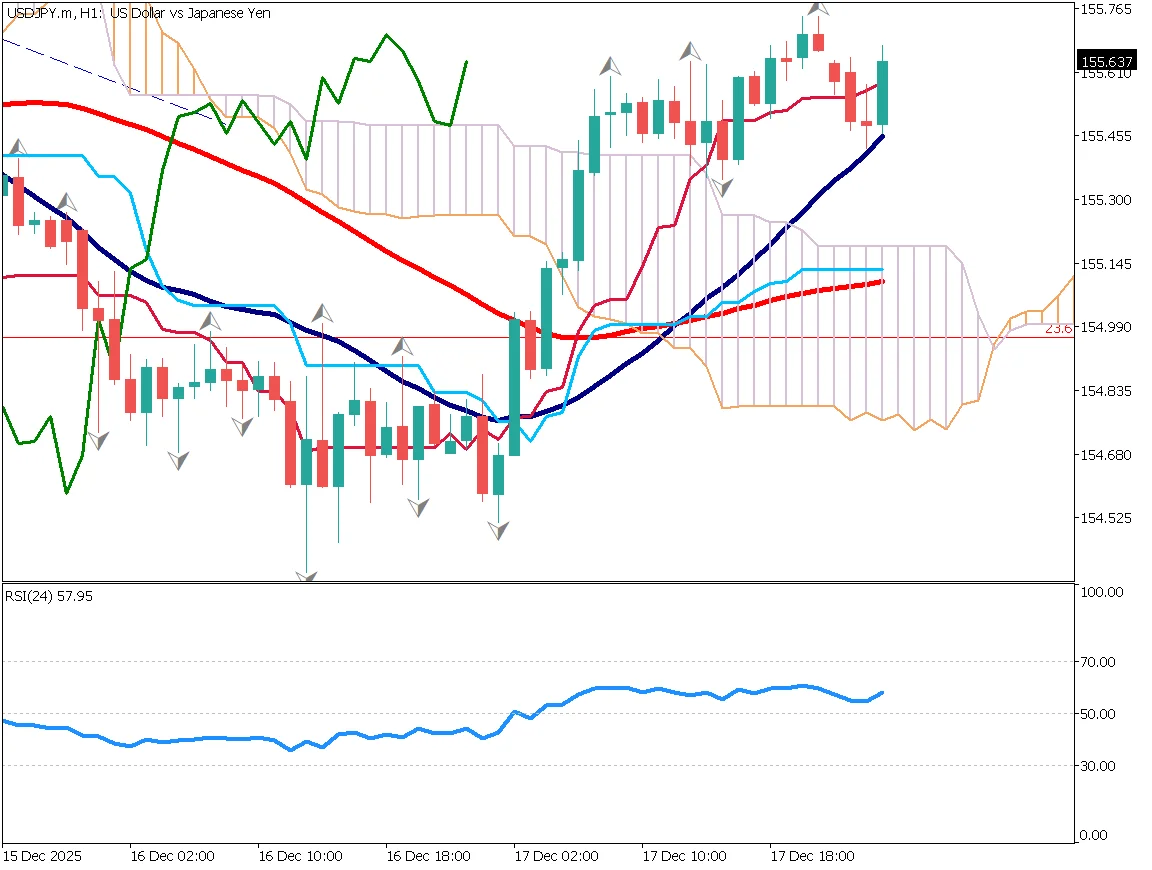

USD/JPY Rebounds?

USD/JPY rebounded at the 52-day moving average and is now approaching the 26-day moving average. The pair has moved back above the 23.6% Fibonacci level and is currently facing resistance at the conversion line. The 26-day moving average is also acting as resistance.

Today, the US Consumer Price Index will be released, followed by the Bank of Japan policy meeting tomorrow. For USD/JPY, tomorrow represents the final major event of the year.

While a rate hike is almost fully priced in, market attention is focused on whether BOJ Governor Ueda will comment on the "neutral rate," which indicates how far interest rates could rise. Previously, this level was considered to be around 1.0%, but if the terminal rate is suggested to be 1.5% or higher, the market may interpret this as a signal that rate hikes will continue.

This would be a strong catalyst for yen appreciation. Such a scenario could be particularly negative for equities outside the banking sector. Caution is warranted as the year-end approaches, given the risk of heightened volatility.

Day Trading Strategy

The 26-day moving average has crossed above the 52-day moving average, forming a golden cross, which technically suggests a bullish bias. However, considering tomorrow's major event, the current move is more likely a position adjustment.

USD/JPY is trading around the mid-155 level, but upside resistance is expected to remain strong. Traders should stay alert to potential reversal timing.

Today's Key Economic Events

| Economic Indicator / Event | Time |

|---|---|

| UK Policy Rate Decision | 21:00 |

| Eurozone Policy Rate Decision | 22:15 |

| US CPI | 22:30 |

| ECB President Press Conference | 22:45 |

Ready to trade?

Open live accountThis material is for informational purposes only and does not constitute investment advice. Trading leveraged products involves significant risk of loss. Past performance is not indicative of future results.

![[Special Edition] When Will the Bank of Japan's Next Rate Hike Come?](/_next/image/?url=%2Fimages%2Fmarket-analysis%2F20251031USDJPYDAY.webp&w=3840&q=75&dpl=dpl_DuroJaYkswUAC7zyZSzJuw8Qt8iH)