USD/JPY Stalls — Will Japan–China Diplomatic Tensions Matter?

Fundamental Analysis

- Diplomatic friction between Japan and China is drawing attention, but its impact on the currency market appears limited

- In the United States, the release of GDP data is expected to be postponed, leaving the market with insufficient information to assess the economic outlook

USD/JPY is Currently Stalling

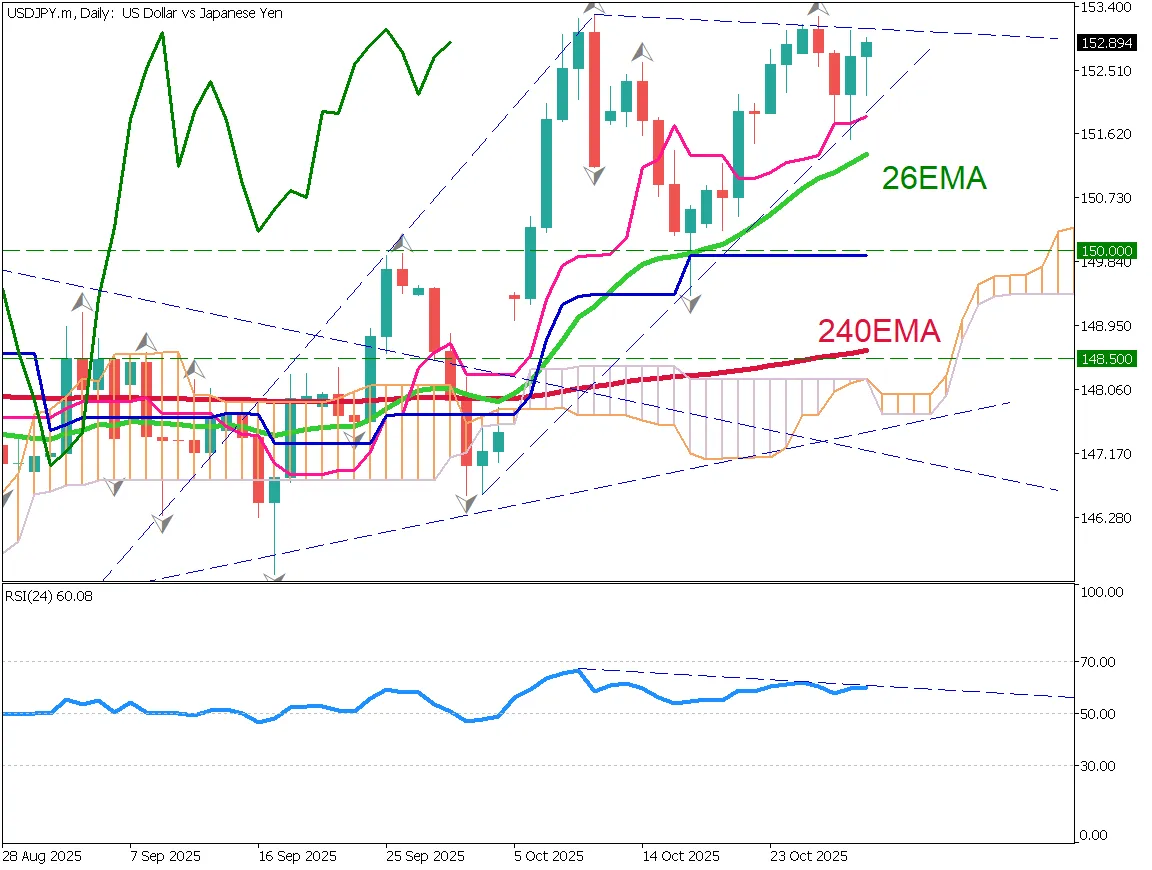

USD/JPY is currently struggling to break higher, although the overall trend still shows a gentle upward movement. Some Milton Markets users asked how far the yen may weaken, so this report explains the view from technical analysis.

In the current environment, Fibonacci expansion works well. The chart shows clear reactions at the 61.8% and 100% levels, with the latest rebound occurring near the 100% line. This suggests that these levels are being watched by the market.

The 161.8% projection corresponds to around 160.95 yen. Given that the 2024 high was 161.95, the target appears realistic. Whether authorities will intervene at these levels is uncertain, but intervention is generally triggered by rapid and one-sided moves. Since the current rise is gradual, intervention seems unlikely.

Attention should be paid to whether USD/JPY can remain above the 10EMA, and whether the 100% Fibonacci level continues to act as support.

USD/JPY Day-Trading Strategy

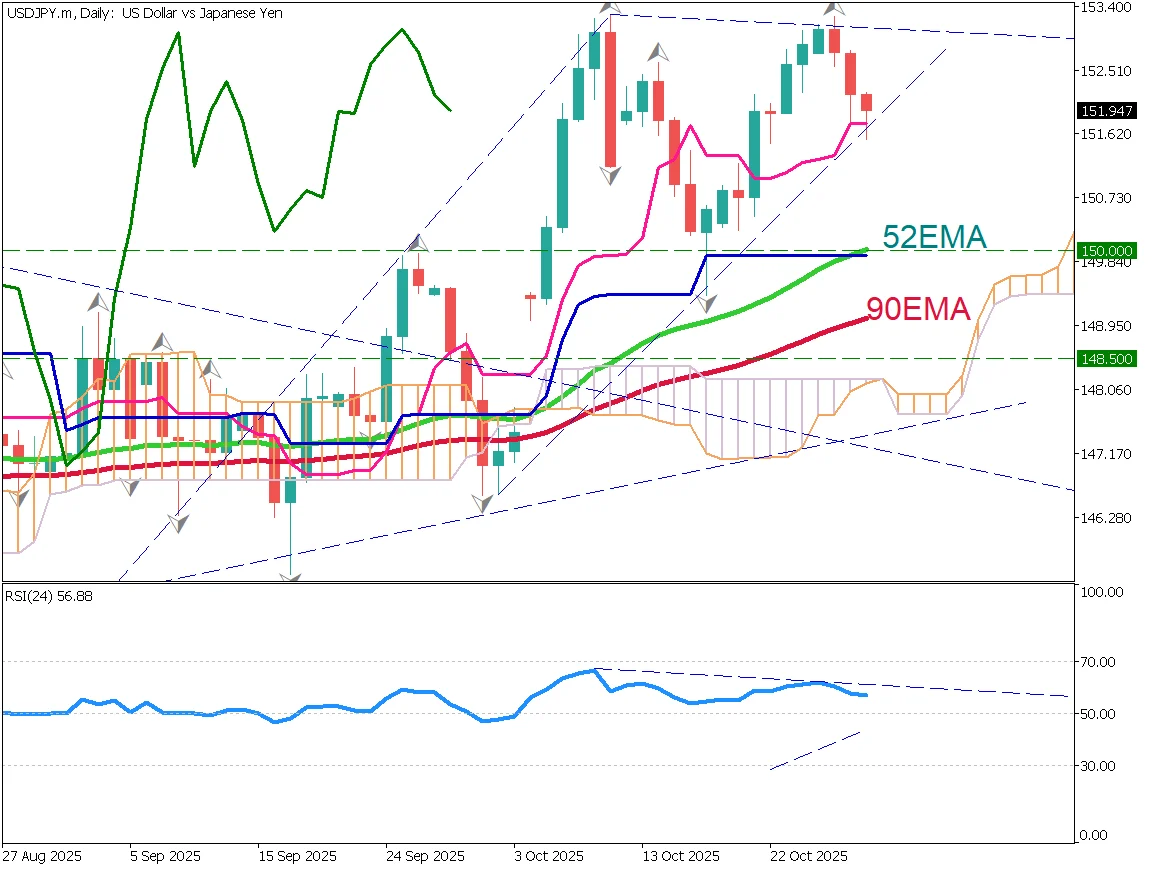

On the 1-hour chart, USD/JPY is drifting lower, likely due to a lack of fresh catalysts. The 52EMA is working as resistance. Since the daily trend is still upward, traders should wait for the 1-hour chart to regain upward momentum.

A buying opportunity may appear if the 10EMA crosses above the 52EMA, forming a golden cross. If price breaks below 156 yen and falls under the 240EMA, the market structure may be shifting, so caution is needed.

The basic approach remains buying on dips.

Today's Key Indicators

Note: U.S. economic data releases may be delayed due to the ongoing government shutdown.

| Indicator / Event | Time |

|---|---|

| U.S. Retail Sales | 22:30 |

| U.S. PPI | 22:30 |

| U.S. Consumer Confidence Index | 24:00 |

Ready to trade?

Open live accountThis material is for informational purposes only and does not constitute investment advice. Trading leveraged products involves significant risk of loss. Past performance is not indicative of future results.

![[Special Edition] When Will the Bank of Japan's Next Rate Hike Come?](/_next/image/?url=%2Fimages%2Fmarket-analysis%2F20251031USDJPYDAY.webp&w=3840&q=75&dpl=dpl_DuroJaYkswUAC7zyZSzJuw8Qt8iH)