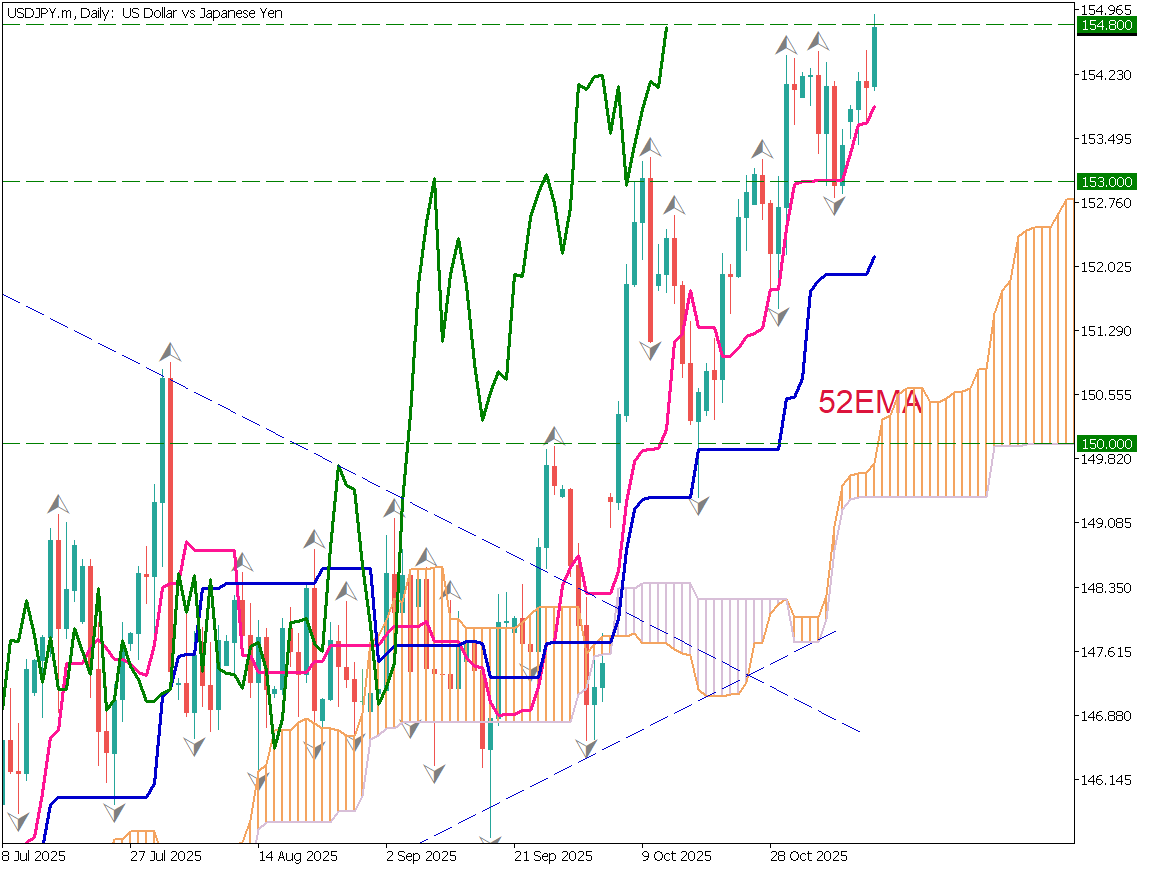

USD/JPY Targeting 155 Yen – Yen Weakness Trend Becomes Clear

Fundamental Analysis

- The market appears to have determined that Japan will not intervene, and the pair has broken through important resistance

- The yen weakness trend remains unchanged, testing how far it can rise

USD/JPY Approaching 155 Yen

USD/JPY is rising toward 155 yen. Despite verbal intervention-like comments from Japan's finance minister, the market has largely ignored them. Prime Minister Takashi commented that "we cannot declare an exit from deflation," restraining rate hikes. The Bank of Japan appears to be coordinating with the government behind the scenes, but may be forced to delay action.

Signs of a U.S. government reopening have triggered USD/JPY gains. Dollar buying has strengthened.

Supported by the conversion line, the pair is approaching 154.80 yen. A breakout above 155 yen seems only a matter of time. If U.S. economic data deteriorates significantly, a temporary decline may occur, but this could present a dip-buying opportunity.

As a side note, it is a fact that the Japanese yen has weakened internationally, and even compared to emerging market currencies, the yen has gradually weakened. We should prepare for further upward movement.

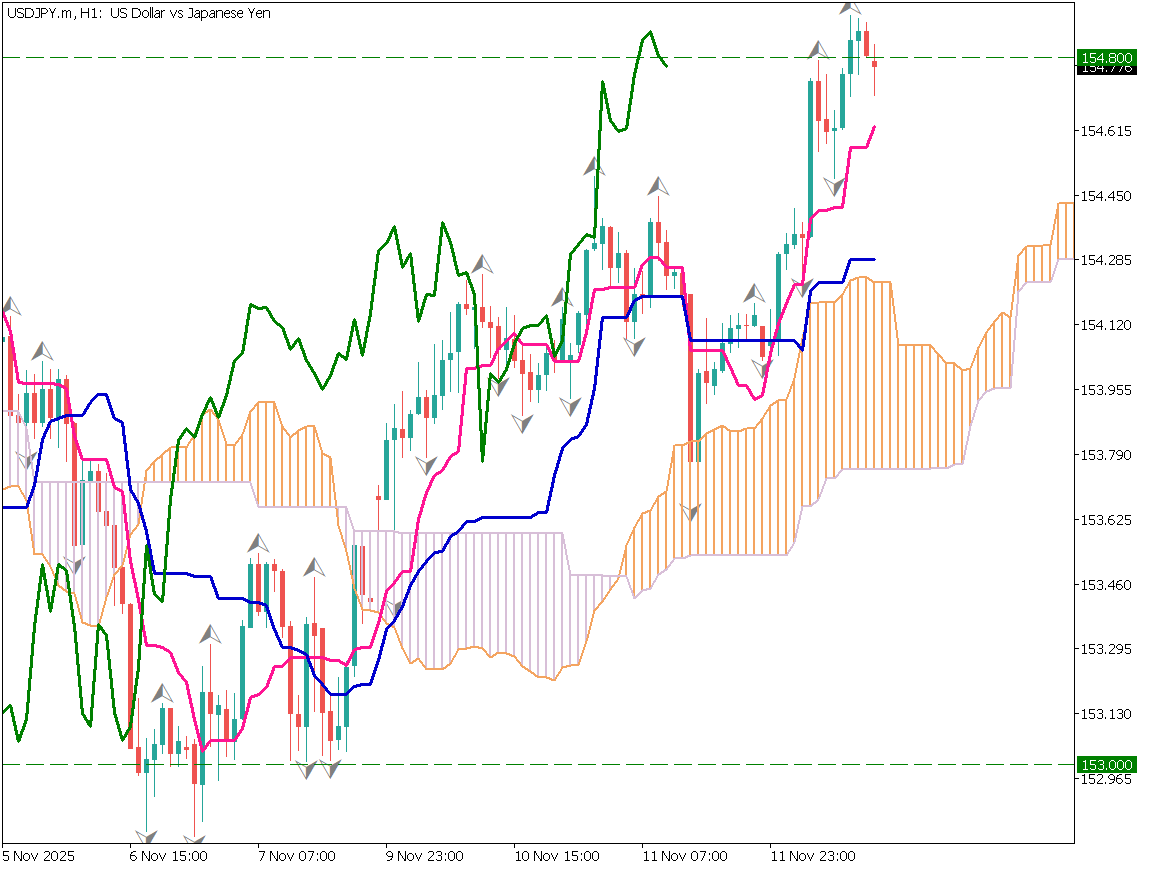

USD/JPY Day Trading Strategy

Looking at the 1-hour chart, the pair pulled back slightly after breaking above 154.80 yen. However, the upward trend remains unchanged. Japan is restraining rate hikes, and the current administration has shown a willingness to issue large amounts of government bonds. It is natural for a currency to depreciate when a country is expected to issue more bonds.

Maintain a thorough buy-on-dips strategy. On the 1-hour chart, consider adding to positions near the conversion line or base line. If the base line is broken, take a wait-and-see approach and set a stop loss.

Today's Key Indicators

※U.S. data releases may be delayed due to the government shutdown.

| Economic Indicator / Event | Time |

|---|---|

| Australia Employment Statistics | 9:30 |

| UK GDP | 16:00 |

| U.S. Consumer Price Index | 22:30 |

Ready to trade?

Open live accountThis material is for informational purposes only and does not constitute investment advice. Trading leveraged products involves significant risk of loss. Past performance is not indicative of future results.

![[Special Edition] When Will the Bank of Japan's Next Rate Hike Come?](/_next/image/?url=%2Fimages%2Fmarket-analysis%2F20251031USDJPYDAY.webp&w=3840&q=75&dpl=dpl_DuroJaYkswUAC7zyZSzJuw8Qt8iH)