USD/JPY Faces Increasingly Heavy Tops

Fundamental Analysis

- The market is simultaneously pricing in a Bank of Japan rate hike and a Federal Reserve rate cut

- Whether these expectations will materialize depends on comments from key officials

USD/JPY Searching for Direction

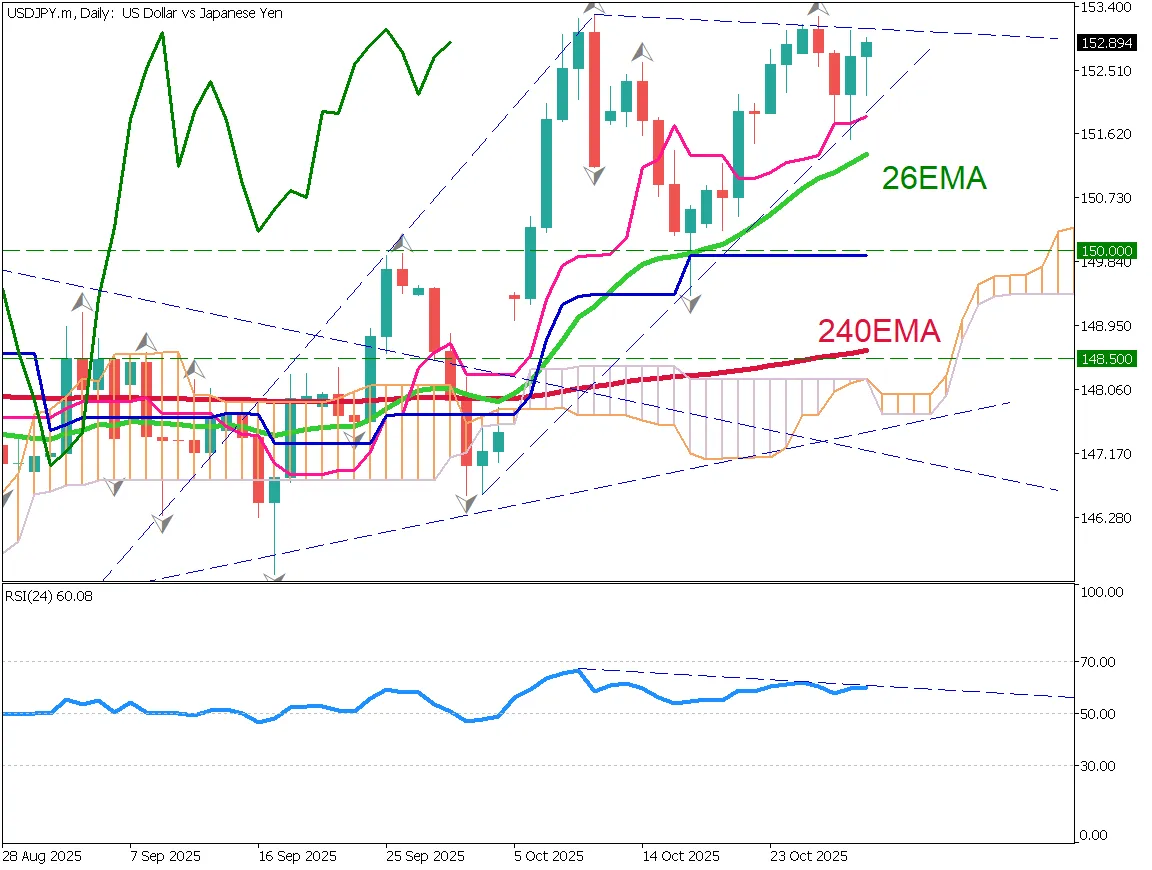

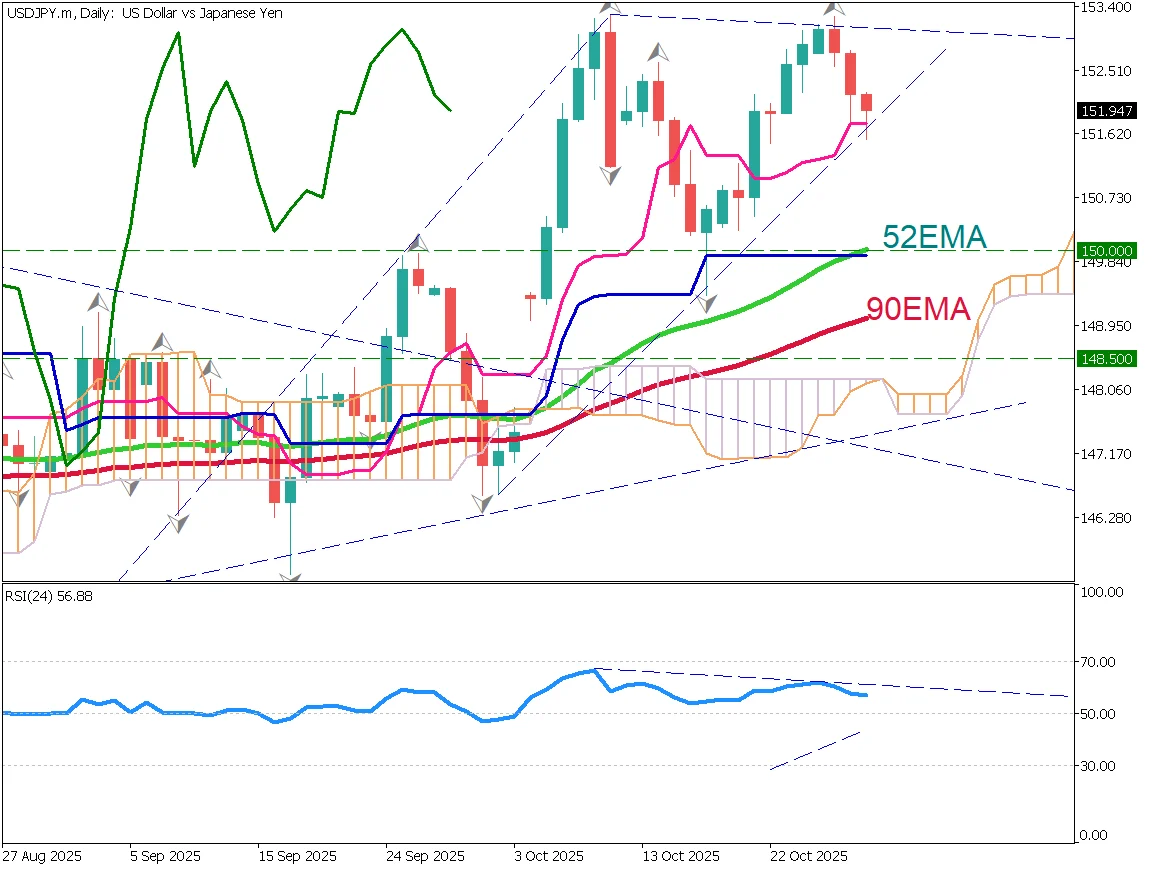

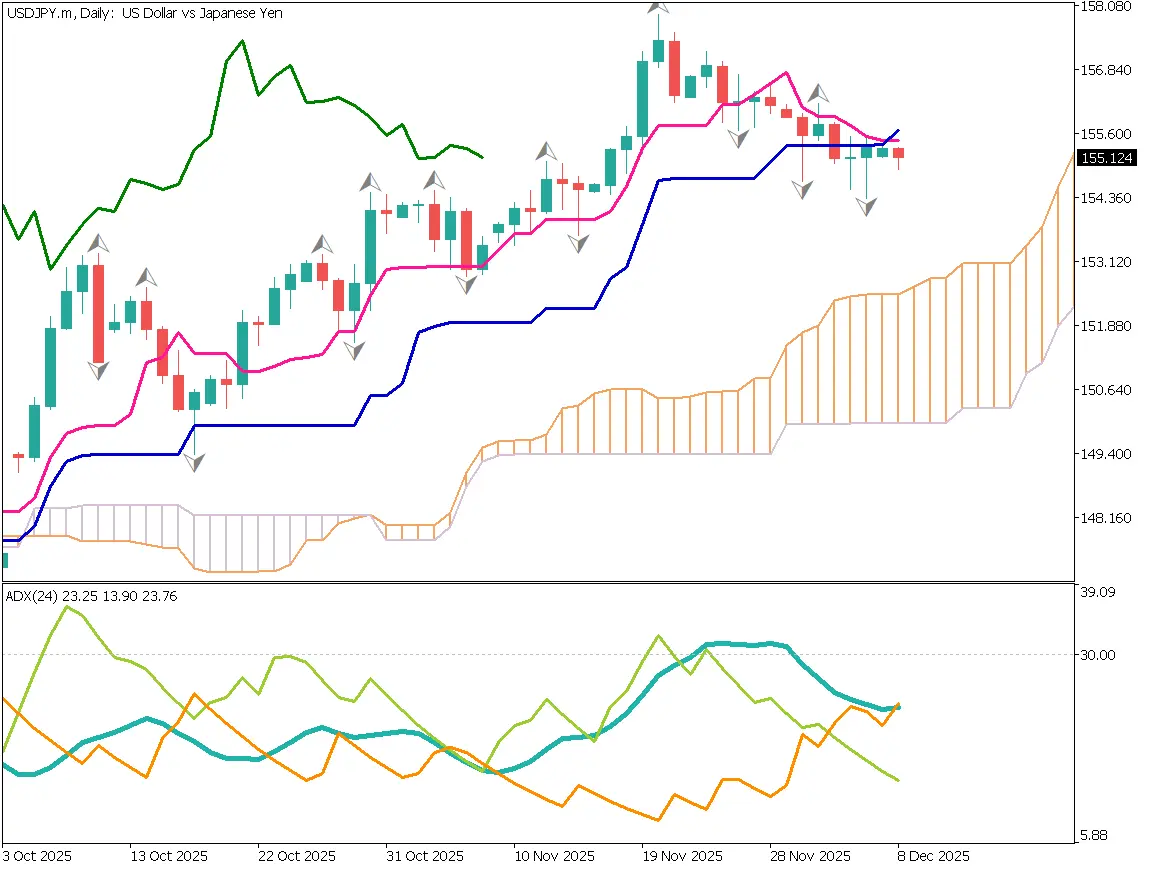

USD/JPY is gradually facing heavier tops, breaking below the baseline, with the conversion line now crossing under the baseline. Although downside moves remain limited, selling pressure is building, suggesting the pair is looking for a breakout opportunity.

The ADX and -DI are rising, showing that bearish pressure is strengthening. It is unclear how far the pair will test lower levels, but at minimum, a moderate correction seems likely.

The 23.6% Fibonacci level is acting as support, but depending on rate expectations, a drop toward the 152-yen area warrants caution.

USD/JPY Day Trading Strategy

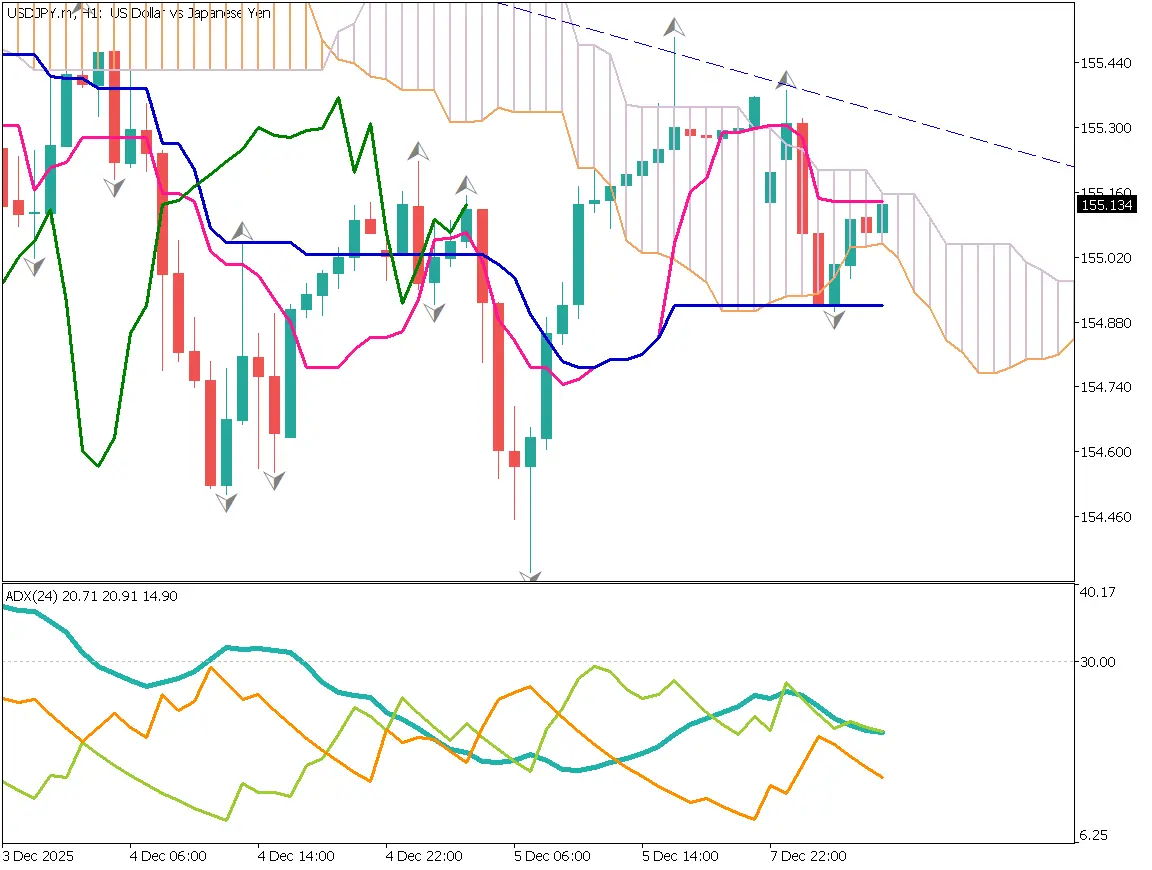

On the 1-hour chart, the baseline is providing clear support, and the pair is showing slight upward movement. The key point is whether it can break above the descending trendline. However, chasing long positions now carries higher risk.

It may be better to wait for a pullback and place sell-limit orders. If the pair rises to the upper 155-yen range, a sell-on-rally strategy could be appropriate.

Today's Key Economic Indicators

| Indicator | Time |

|---|---|

| Japan GDP | 8:50 |

| U.S. Factory Orders | 24:00 |

Ready to trade?

Open live accountThis material is for informational purposes only and does not constitute investment advice. Trading leveraged products involves significant risk of loss. Past performance is not indicative of future results.

![[Special Edition] When Will the Bank of Japan's Next Rate Hike Come?](/_next/image/?url=%2Fimages%2Fmarket-analysis%2F20251031USDJPYDAY.webp&w=3840&q=75&dpl=dpl_DuroJaYkswUAC7zyZSzJuw8Qt8iH)