USD/JPY Weakens Despite Rate Hike, Market Awaits Governor Ueda's Press Conference

Fundamental Analysis

- The Bank of Japan decided to raise its policy rate to 0.75%, reaching the highest level in 30 years

- USD/JPY moved higher despite the rate hike, showing continued yen weakness

Rate Hike Yet Yen Weakness

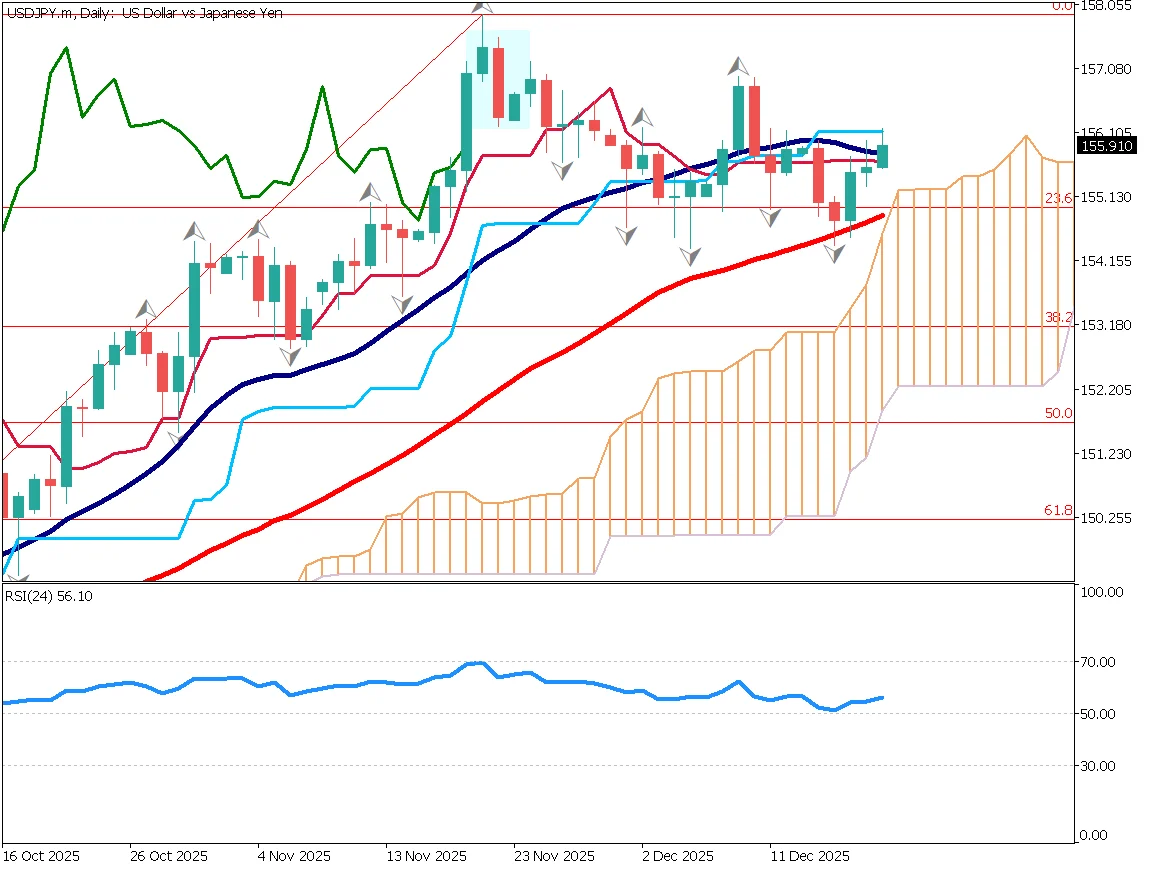

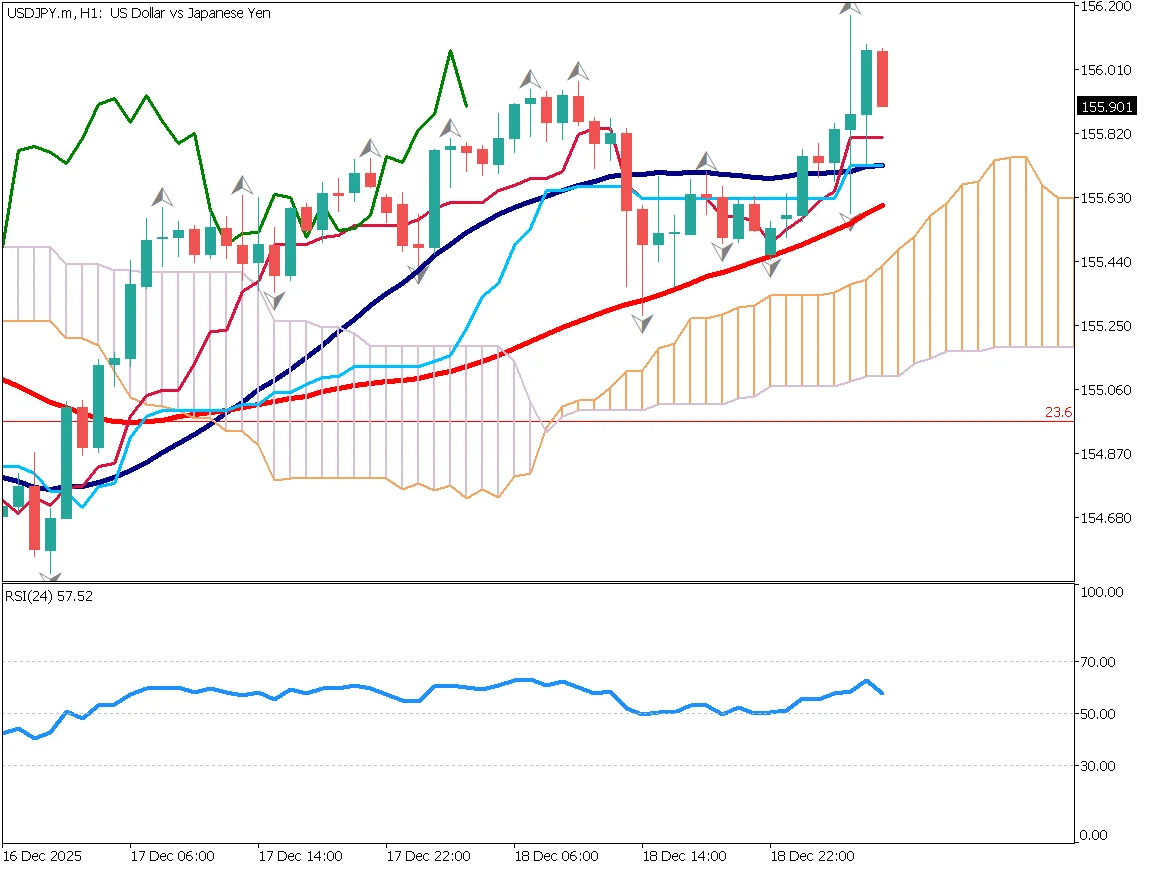

The Bank of Japan decided to raise its policy rate to 0.75%, reaching the highest level in 30 years. However, contrary to expectations, USD/JPY moved higher, showing continued yen weakness. The pair briefly rose to around 156.17.

This reaction suggests that the rate hike was fully priced in ahead of the announcement, leading to a sense of "event exhaustion." On the daily chart, the Kijun-sen is functioning as resistance, and the market lacks clear direction while awaiting the Bank of Japan Governor's press conference.

Attention will focus on whether Governor Ueda refers to the neutral interest rate and signals further tightening. Although additional rate hikes are expected, the market reaction so far has been limited.

Day Trading Strategy

From a purely technical perspective, USD/JPY is biased toward yen weakness. Bond prices are falling, indicating rising yields, and the current move may reflect a "bad yen weakness" driven by concerns over Japan's fiscal situation. If yen depreciation is caused by declining confidence rather than monetary policy, rate hikes alone may not be sufficient to reverse the trend.

At this stage, speculation should be avoided. A short-term correction is possible, but global central banks are generally in a rate-cutting cycle. Due to persistent inflation risks, Europe and the UK may be nearing their final rate cuts.

For now, there is little indication of a strong yen appreciation. Market participants should wait for the governor's press conference before making a clear judgment.

Today's Key Economic Events

| Economic Indicator / Event | Time |

|---|---|

| Bank of Japan Governor's Press Conference | 15:30 |

| U.S. Existing Home Sales | 24:00 |

Ready to trade?

Open live accountThis material is for informational purposes only and does not constitute investment advice. Trading leveraged products involves significant risk of loss. Past performance is not indicative of future results.

![[Special Edition] When Will the Bank of Japan's Next Rate Hike Come?](/_next/image/?url=%2Fimages%2Fmarket-analysis%2F20251031USDJPYDAY.webp&w=3840&q=75&dpl=dpl_DuroJaYkswUAC7zyZSzJuw8Qt8iH)