USD/JPY in a Range at Year-End, Yen Weakness in 2026?

Fundamental Analysis

- Even after the Bank of Japan's rate hike, a clear yen appreciation trend has not emerged

- Attention should be paid to possible corrections in equity and precious metals markets

- Rising geopolitical risks could trigger temporary yen strength

Year-End Range Market

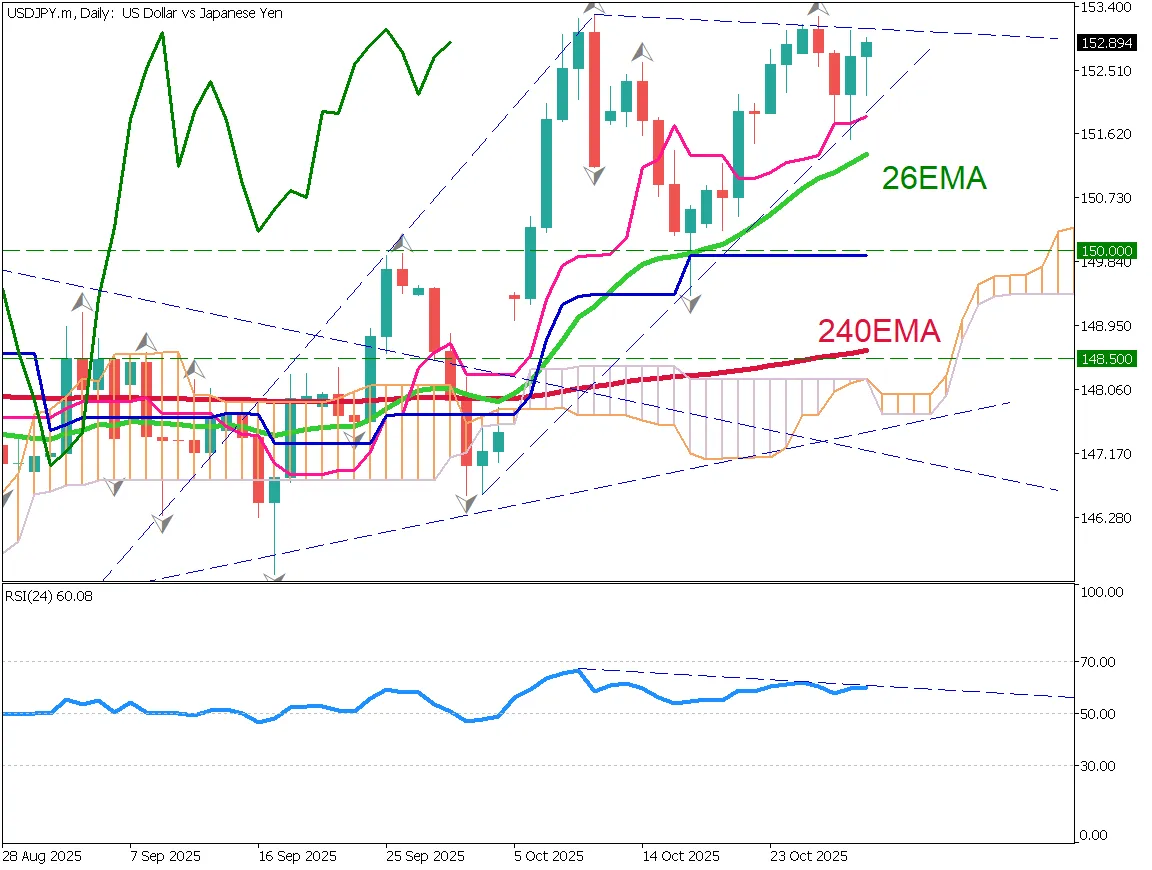

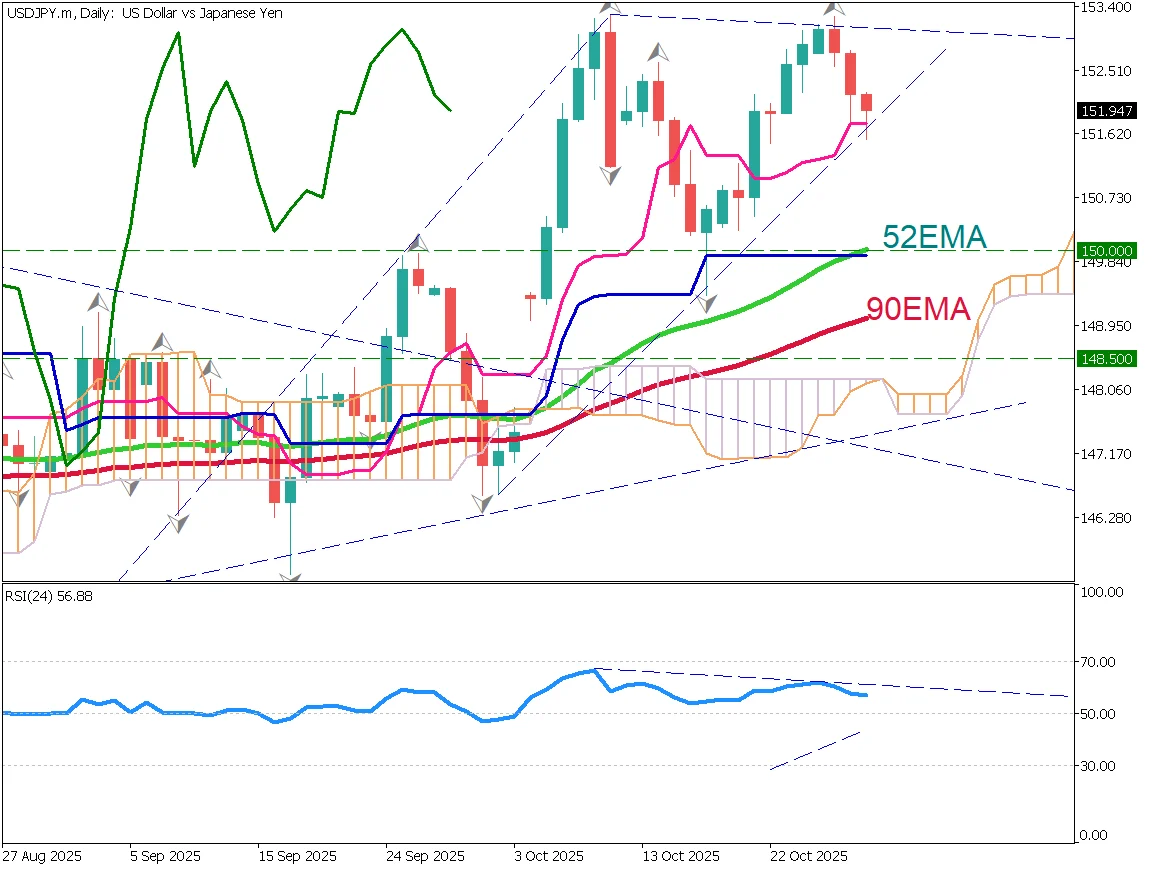

As year-end approaches, market liquidity has declined, and USD/JPY is forming a range between 155 and 158. With few new catalysts, this range is likely to persist into the new year. The 52-day moving average is acting as support, and whether it holds in early January will be an important point to watch.

Tomorrow marks the final trading day of the year for the Japanese stock market. Looking ahead to 2026, which corresponds to the "Fire Horse" year in the traditional calendar, some market participants warn of a possible correction following strong gains. Some financial professionals even expect a sharp decline during 2026.

Although USD/JPY did not shift into a yen appreciation trend after the rate hike, significant trends often form in January. Sudden moves at the start of the year are not uncommon, so caution is advised when carrying positions over the holidays.

Day Trading Strategy

With volatility declining, day trading conditions are difficult. Upside momentum feels heavy, yet neither a strong upside breakout nor a downside move is likely. The range market is expected to continue.

As spreads tend to widen, a "stay on the sidelines" approach may be the best strategy.

Today's Key Economic Events

| Event | Time |

|---|---|

| None | - |

Ready to trade?

Open live accountThis material is for informational purposes only and does not constitute investment advice. Trading leveraged products involves significant risk of loss. Past performance is not indicative of future results.

![[Special Edition] When Will the Bank of Japan's Next Rate Hike Come?](/_next/image/?url=%2Fimages%2Fmarket-analysis%2F20251031USDJPYDAY.webp&w=3840&q=75&dpl=dpl_DuroJaYkswUAC7zyZSzJuw8Qt8iH)