【Year-End Special】Review of USD/JPY Movements in 2025

USD/JPY Movements in the Second Half of 2025

After facing yen appreciation pressure in May 2025, the USD/JPY pair reversed course from July onward, shifting into a rapid yen-weakening trend. This move was mainly driven by the Bank of Japan's dovish stance and expectations for aggressive fiscal policy under the Takaichi administration. In October, yen selling accelerated in what became known as the "Takaichi trade," pushing the pair into the 154 range by month-end.

USD/JPY in the First Half: Correction and Yen Strength (May)

In May 2025, USD/JPY remained on a downward trend. Concerns over expanding U.S. fiscal spending encouraged dollar selling. On May 19, Moody's downgraded the U.S. credit rating, further weakening the dollar amid ongoing tariff issues. The pair traded mainly in the low 143 range, with the possibility of breaking below 140 also discussed.

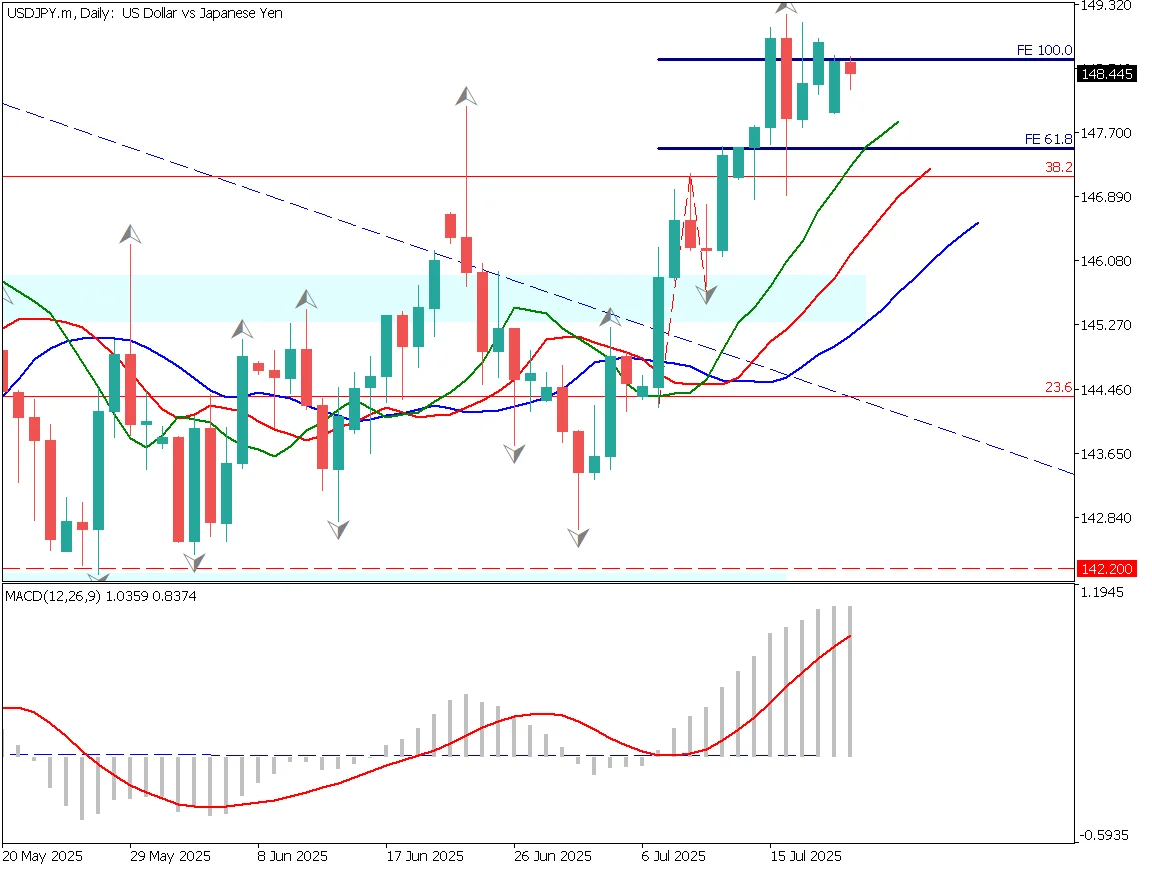

Yen Weakness Returns in Summer (July–Early August)

Entering summer, yen weakness accelerated again due to U.S. tariff policy, Japan's political situation, and the BOJ's dovish tone.

Reports of a 25% U.S. tariff on Japan and expectations that opposition parties advocating fiscal expansion would perform well in the Upper House election led to renewed yen selling. USD/JPY rose into the 147 range, with a break above 148 in focus. Strong U.S. CPI data and rising Japanese long-term yields added momentum, pushing the pair close to 150.

Early August

Cautious remarks from the BOJ governor further fueled yen selling, driving USD/JPY up to 150.92. However, downward revisions to U.S. employment data increased expectations for U.S. rate cuts, triggering dollar selling. Attention shifted to the 145 area, with the Ichimoku cloud lower boundary at 145.38 acting as a key support level.

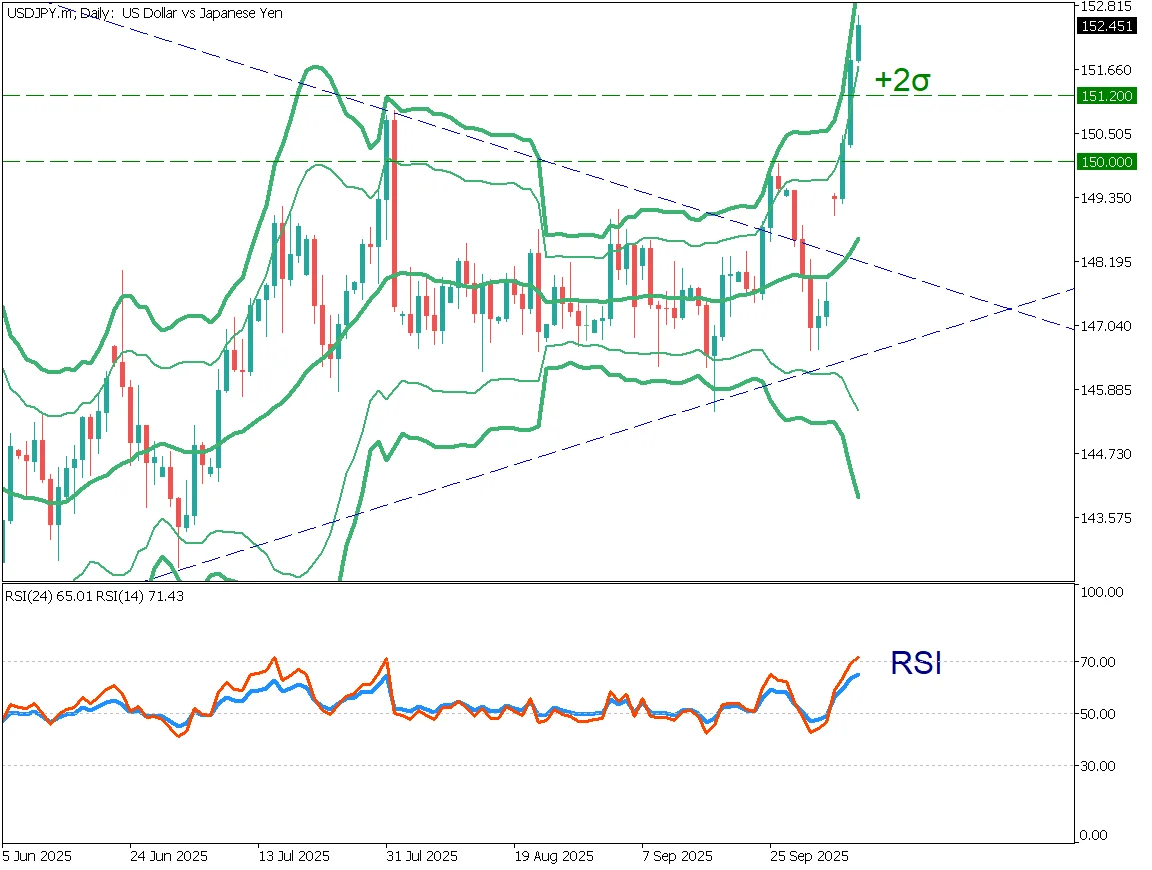

Policy Event Risk and Choppy Trading (Late August–September)

From late August through September, markets lacked clear direction as major central bank events approached. At the Jackson Hole symposium, comments from Fed Chair Powell raised expectations for a September rate cut. Meanwhile, FOMC minutes were viewed as relatively hawkish, keeping USD/JPY in a range with strong support around 146.50.

In September, speculation over a more hawkish BOJ stance and upcoming policy decisions by the BOJ, Fed, and Bank of England kept USD/JPY moving mainly in the low 147 range. Volatility was expected to expand as the market built energy.

"Takaichi Trade" and Political Uncertainty Drive Yen Weakness (October)

In October, Japan's political situation became a major driver of sharp yen depreciation. Expectations for aggressive fiscal policy following Takaichi's leadership victory, combined with speculation that the BOJ would delay further rate hikes, led to nearly a 5-yen move in just three days. USD/JPY surged into the mid-152 range.

Subsequent reports of political instability within the ruling coalition cooled the move, and the pair corrected to the 151 level. While short-term adjustments were expected, medium- to long-term projections continued to point toward a possible move into the 155 range.

Year-End Battle: BOJ Rate Hike vs. Fiscal Concerns (December)

Toward year-end, markets focused on the narrowing U.S.–Japan interest rate gap due to a BOJ hike and Fed easing. However, yen strength remained limited. On December 5, reports that the government would tolerate a BOJ rate hike pushed USD/JPY down to 155. Following a Fed rate cut on December 11, the pair slipped further into the mid-155 range.

Despite the BOJ raising its policy rate to 0.75% on December 19—the highest level in 30 years—USD/JPY reversed higher, briefly reaching the 156 range. This was attributed to a "buy the rumor, sell the fact" reaction and concerns over Japan's fiscal condition, often described as "bad yen weakness." Ahead of Christmas, thin liquidity capped gains near 158, but the broader yen-weakening trend was expected to continue amid rising long-term yields.

.webp)

USD/JPY Outlook for 2026

A detailed forecast for 2026 will be released in a New Year special report. From an anomaly perspective, 2026 corresponds to the "Hinoe-Uma" year, traditionally associated with corrective price movements, suggesting that market adjustments may become more prominent.

Ready to trade?

Open live accountThis material is for informational purposes only and does not constitute investment advice. Trading leveraged products involves significant risk of loss. Past performance is not indicative of future results.

![[Special Edition] When Will the Bank of Japan's Next Rate Hike Come?](/_next/image/?url=%2Fimages%2Fmarket-analysis%2F20251031USDJPYDAY.webp&w=3840&q=75&dpl=dpl_DuroJaYkswUAC7zyZSzJuw8Qt8iH)