Dollar Selling on FOMC Rate Cut Expectations

We believe this is due to widespread dollar selling across the market. The dollar weakness is primarily driven by near-certain expectations of a rate cut at today and tomorrow's FOMC meeting.

Loading...

Daily insights from our Chief Market Analyst

624 analysis articles available

We believe this is due to widespread dollar selling across the market. The dollar weakness is primarily driven by near-certain expectations of a rate cut at today and tomorrow's FOMC meeting.

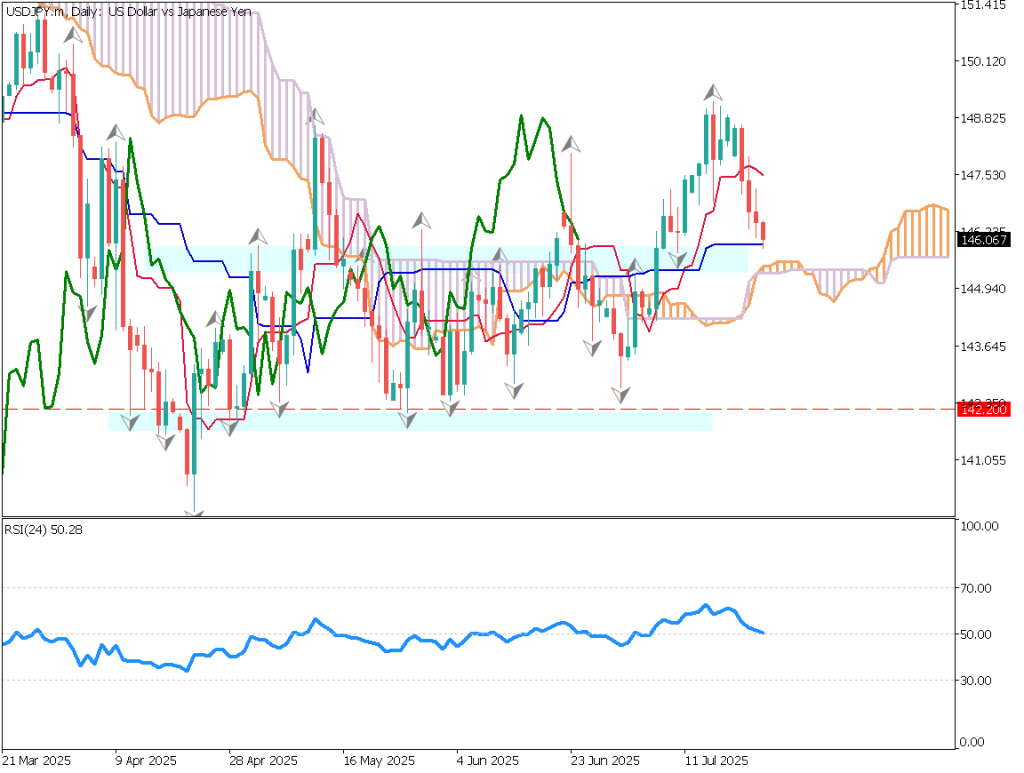

Analyzing the USD/JPY daily chart:The pair formed a large bearish candlestick during the U.S. jobs report, resulting in an engulfing pattern. The Ichimoku baseline acted as a resistance level. As expectations for U.S. rate cuts increased, U.S.

This is a daily chart analysis of USD/JPY.Last week’s U.S. employment data deteriorated significantly, with previous months’ numbers also undergoing sharp downward revisions.The report highlighted a steep drop in employment numbers due to tariff impacts and an economic slowdown.

Last night’s ADP employment report in the U.S. exceeded market expectations, showing solid results. This triggered dollar buying, with USD/JPY surging and EUR/USD plunging. The movement was further intensified by the FOMC’s decision to hold rates steady.

Analyzing the daily chart for USD/JPY: The pair rebounded at the Base Line and attempted to reach new highs. However, the decline in U.S. long-term yields triggered yen-buying pressure.Today, in addition to the ADP Employment Report, the FOMC meeting will be held in the early hours of tomorrow.

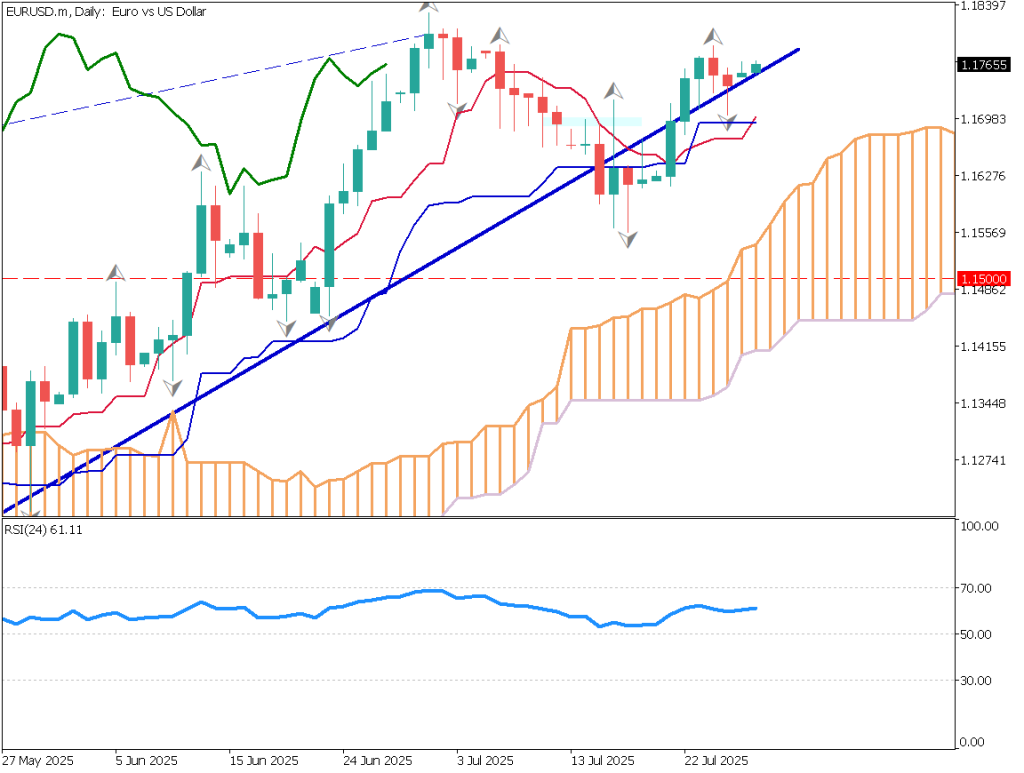

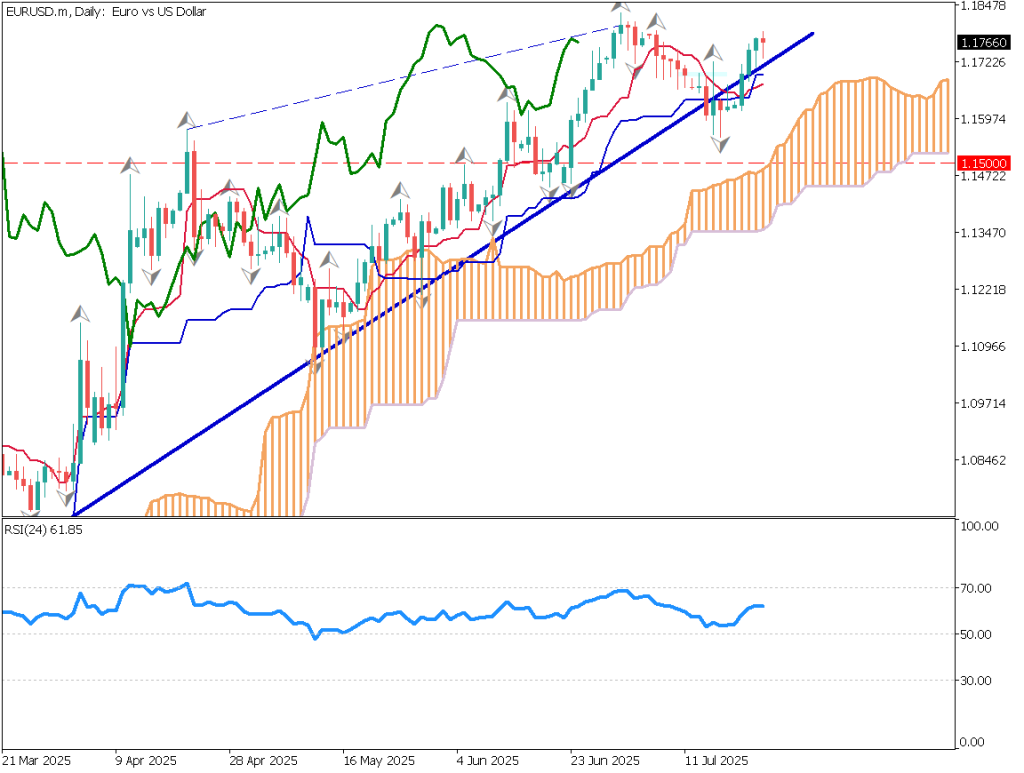

The EUR/USD pair has once again moved above its upward trendline and the conversion line of the Ichimoku Cloud is about to cross above the base line. The next key levels to watch are around 1.1780 and 1.1830.

Analyzing the daily EUR/USD chart: Although the pair remains in an uptrend, momentum appears to be weakening. Compared to the steeper trendline connecting the recent lows, the trendline connecting the highs is more gradual.

**The market appears to perceive Japan as having the upper hand in the recent US-Japan tariff negotiations. Japan successfully negotiated a reduction in auto tariffs, which is expected to revitalize its key automobile industry.

**In the latest Japan-U.S. tariff negotiations, Japan avoided the “25% tariff hike risk” and reached a relatively moderate agreement of 15% tariffs. The deal includes a 50% reduction in tariffs on automobiles and auto parts, and retention of tariffs on agricultural products.

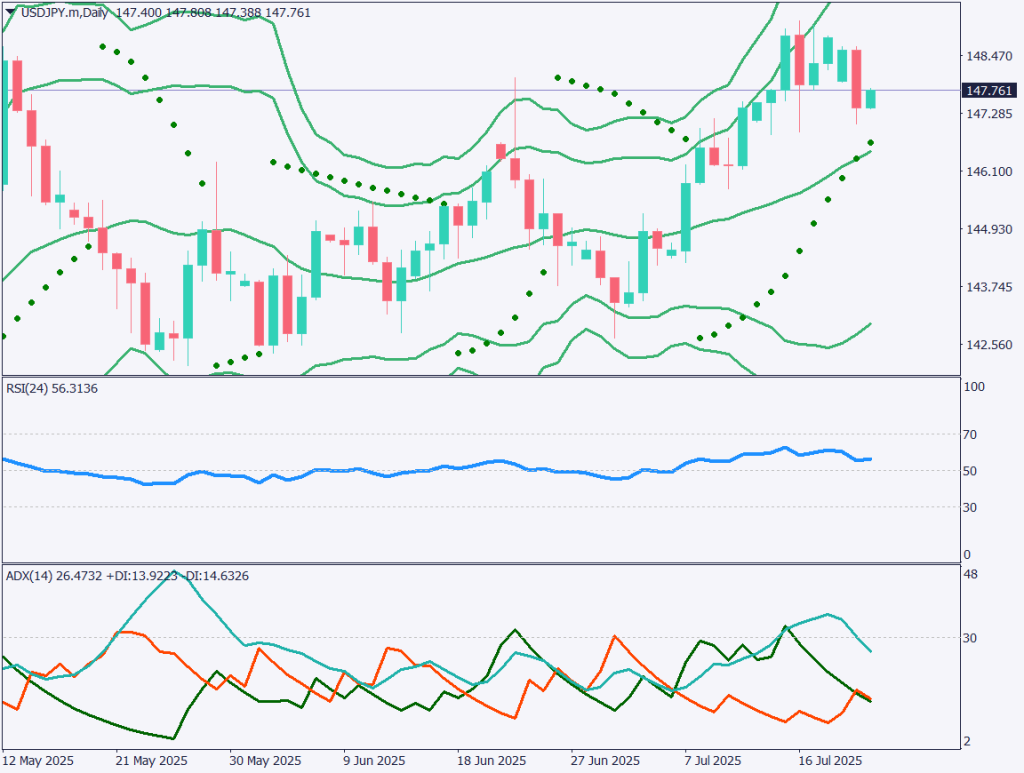

**An analysis of the daily USD/JPY chart shows the pair hovering around 147.76. Following the Upper House election, the yen has strengthened against the dollar.

![[Special Edition] Upper House Election Outcome Within Expectations, USD/JPY Remains Stable](/images/analysis/20250721-chart-1.jpg)

**With the Japanese Upper House election concluded, the market has passed a key event. Media had previously reported on the likely gains by the opposition, and the USD/JPY had already been pricing this in last week.

**Looking at the weekly chart, gold had been on a consistent uptrend since around October 2023, peaking near $3,500 before the momentum began to fade.******** The rally was intense, and there was little major correction on the weekly scale.