Gold Buy-on-Dip: Focus on Rebound Momentum

Fundamental Analysis

- Expectations for the end of the U.S. government shutdown have boosted market sentiment

- Weak U.S. employment data has encouraged dip-buying in gold

Gold Buy-on-Dip

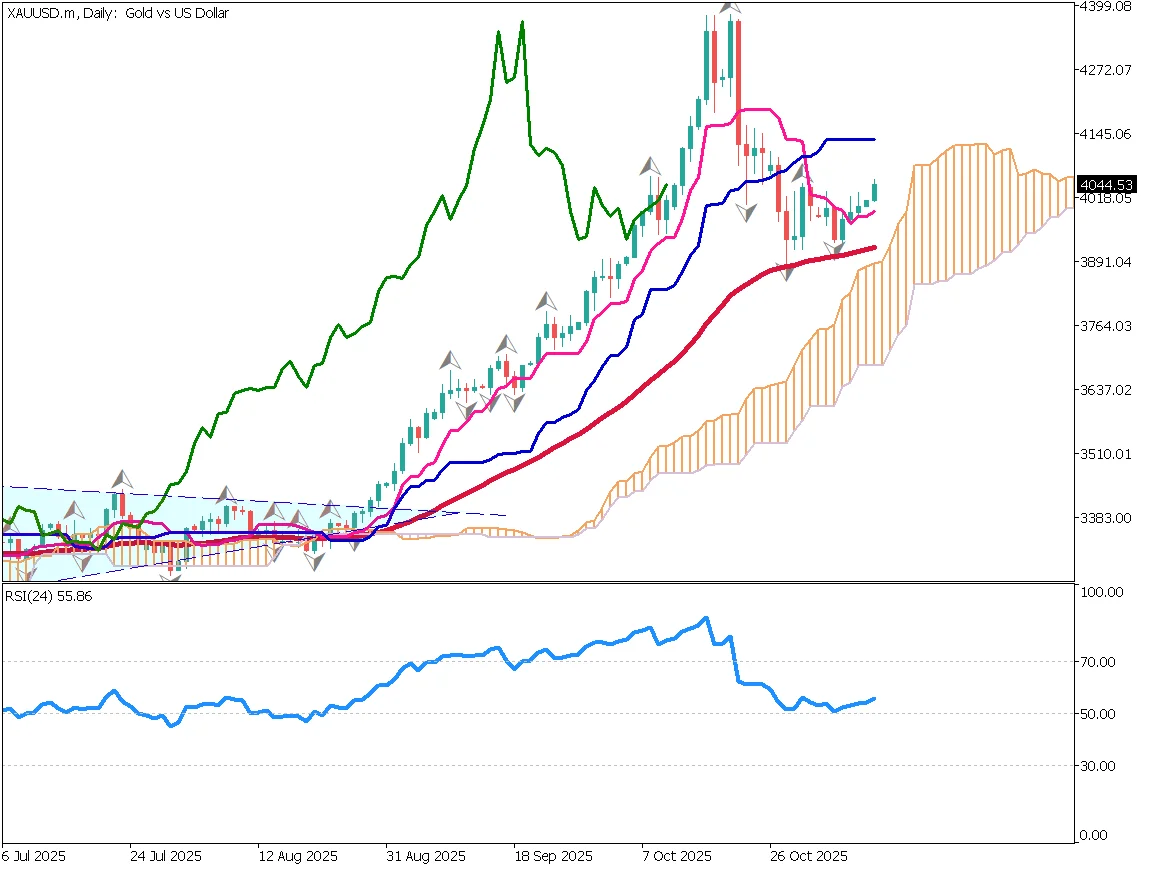

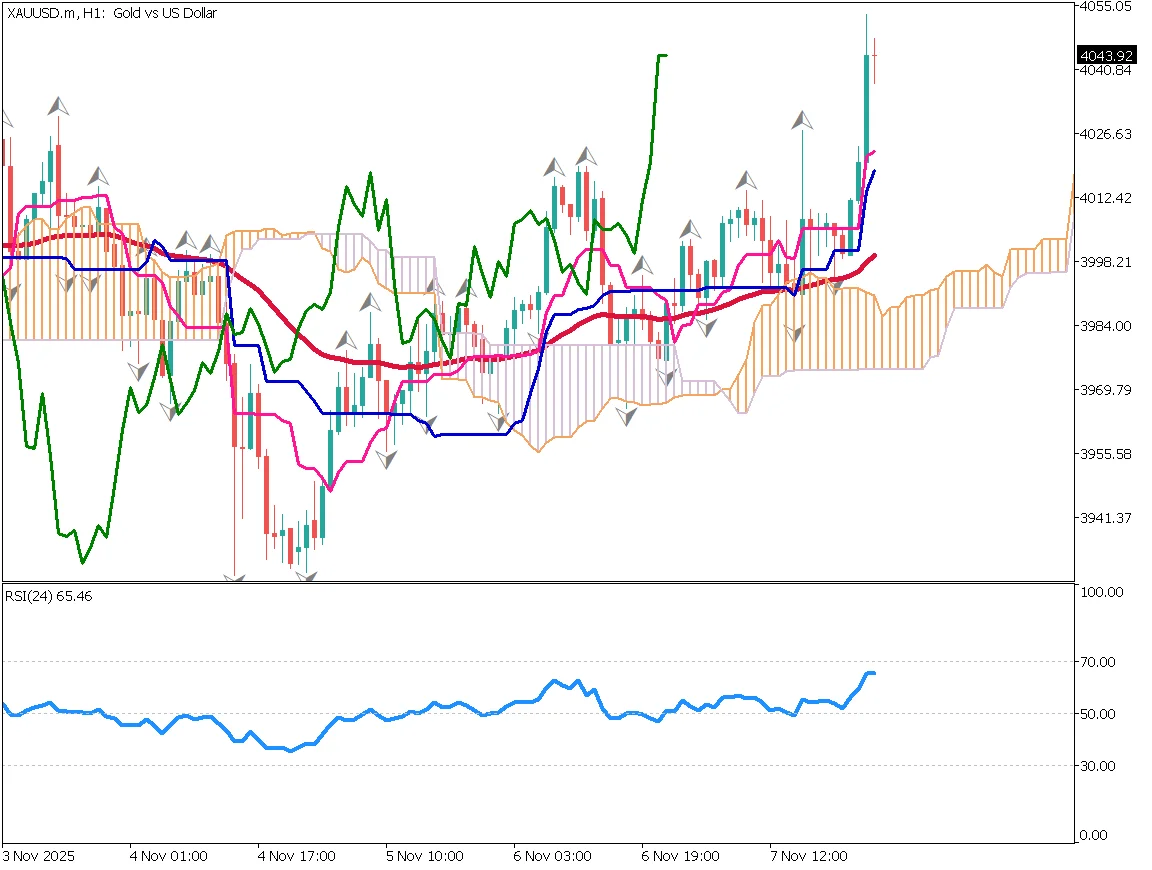

Gold rebounded from the 52EMA, trading around $4,040 after briefly dipping below $4,000. A weaker U.S. dollar and deteriorating fundamentals have prompted strong buying interest.

On the Ichimoku chart, the conversion line has been surpassed, and attention now turns to whether gold can break above the base line near $4,145. The lagging span overlapping the candlesticks also signals strengthening bullish momentum.

RSI has bounced at the 50 level, suggesting strong market appetite for dip-buying. The next target is the recent high near $4,380.

XAU/USD) daily chart showing buy-on-dip opportunity near $4,040 support level with Ichimoku indicators and RSI analysis (November 10, 2025)" />

XAU/USD) daily chart showing buy-on-dip opportunity near $4,040 support level with Ichimoku indicators and RSI analysis (November 10, 2025)" />

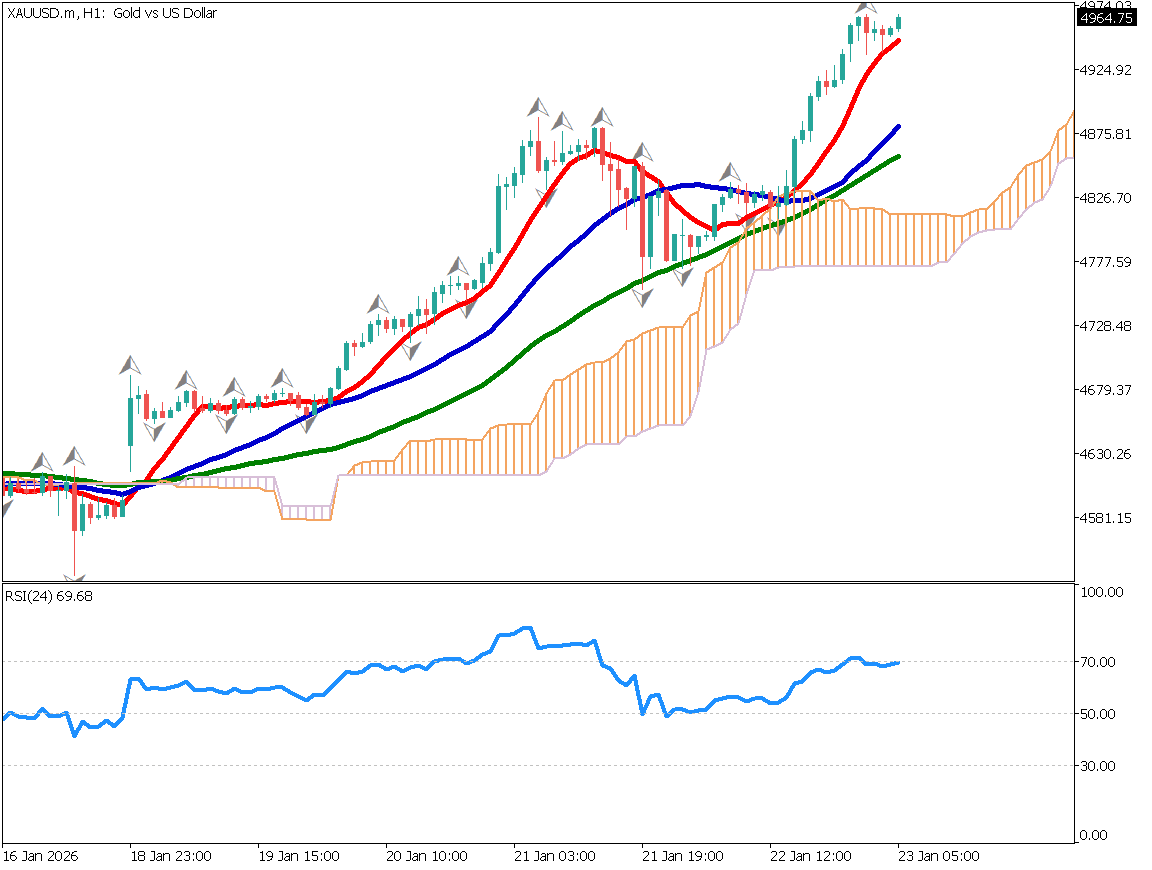

Gold Intraday Strategy

On the 1-hour chart, gold had been trading in a range centered around $4,000 before breaking above the upper limit to reach around $4,040. The University of Michigan Consumer Sentiment Index showed deterioration, highlighting concerns about a weakening U.S. economy.

The area below $4,000 remains solid support, and buying pressure has intensified. If investors perceive the U.S. slowdown as more serious, gold could continue rising.

Even if the government shutdown ends, its economic impact will be significant, and upcoming data are likely to show further weakness. Combined with dollar depreciation, gold may once again challenge record highs.

The basic strategy remains buy on dips.

Key Economic Events Today

Due to the U.S. government shutdown, data releases may be delayed.

| Economic Indicator / Event | Time |

|---|---|

| Bank of Japan Monetary Policy Meeting: Summary of Opinions | 8:50 AM |

Ready to trade?

Open live accountThis material is for informational purposes only and does not constitute investment advice. Trading leveraged products involves significant risk of loss. Past performance is not indicative of future results.