USD/JPY Continues to Decline as Markets Brace for U.S. Jobs Data

Fundamental Analysis

- Markets are closely watching the U.S. employment report

- Whether the data is too strong or too weak, sharp market moves are possible

- Ideally, the market is looking for a moderate slowdown

Will U.S. Employment Data Show Moderate Slowdown?

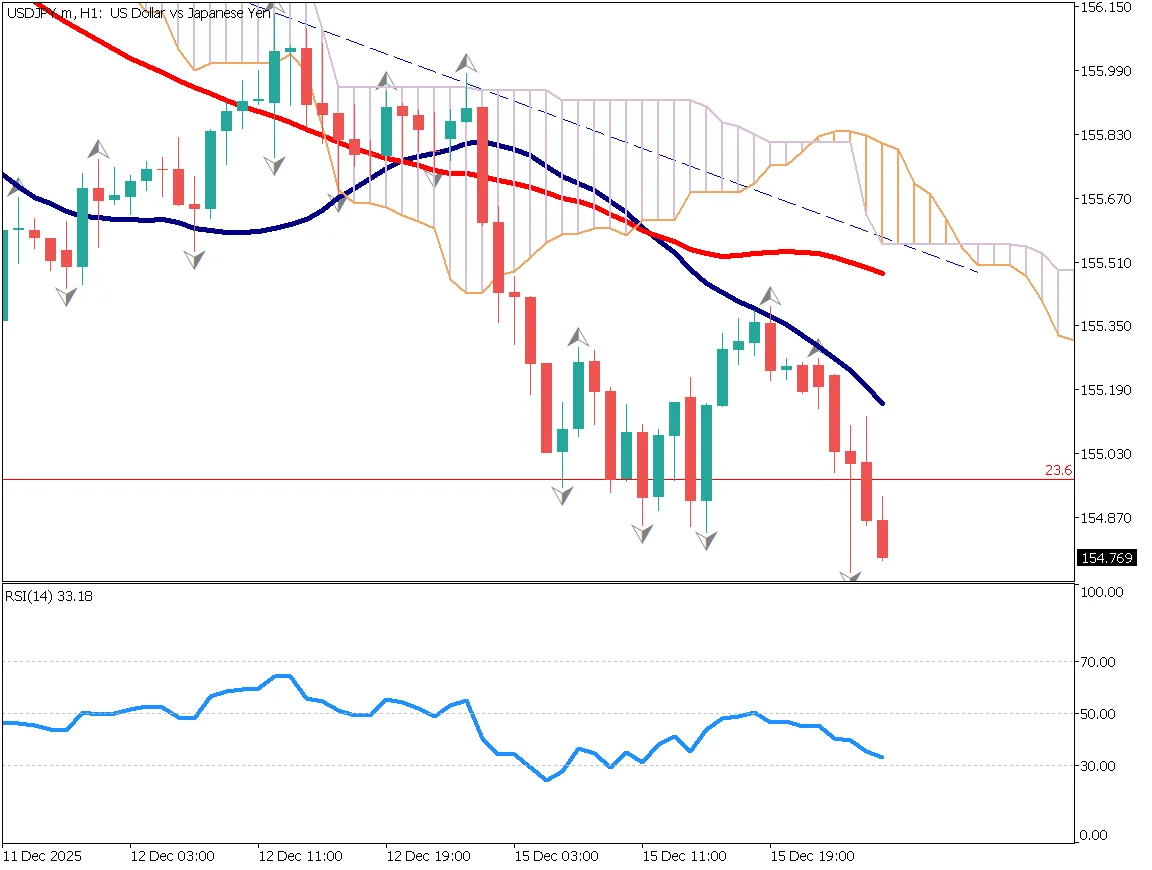

Expectations of a Bank of Japan rate hike are firm, which is likely to put a brake on the yen's depreciation. USD/JPY has broken below the 26-day moving average and is approaching the 52-day moving average. Lower highs are clearly forming, and attention is focused on whether the price will break below the 52-day line.

The pair has also fallen below the 23.6% Fibonacci retracement level, which had been acting as a key support. This opens the way toward the 38.2% level. A thick Ichimoku cloud lies ahead, making today's U.S. employment data a key test.

RSI has fallen below 50, indicating that the bearish trend is strengthening.

From a fundamental perspective, if the U.S. employment data is strong, expectations for rate cuts may fade, leading to lower stock prices and renewed dollar selling. If the data is weaker than expected, concerns about an economic slowdown could also trigger stock declines and dollar selling.

The key question is whether the data will be seen as a "moderate slowdown" by the market.

Volatility is likely to rise not only in USD/JPY but also in the gold market, requiring close caution.

Day Trading Strategy

Based on Dow Theory, the recent low has been broken, confirming a downtrend. This suggests that the decline may continue. As noted in the previous daily report, RSI has failed at the 50 level and is falling again.

RSI 50 is a critical level. Although RSI is currently around 33, this is not a situation suitable for counter-trend buying. As long as the 26-day moving average acts as resistance, a bearish bias should be maintained. A decline toward the 150 level is possible.

Key Economic Events Today

| Economic Indicator / Event | Time |

|---|---|

| U.S. Employment Report | 22:30 |

| U.S. PMI | 23:45 |

Ready to trade?

Open live accountThis material is for informational purposes only and does not constitute investment advice. Trading leveraged products involves significant risk of loss. Past performance is not indicative of future results.

![[Special Edition] When Will the Bank of Japan's Next Rate Hike Come?](/_next/image/?url=%2Fimages%2Fmarket-analysis%2F20251031USDJPYDAY.webp&w=3840&q=75&dpl=dpl_DuroJaYkswUAC7zyZSzJuw8Qt8iH)