[London Session] Ahead of U.S. Employment Report Tomorrow, USD/JPY Trends Mildly Lower

Fundamental Analysis

- Tomorrow's U.S. employment report will be released on a non-standard schedule, so caution is advised

- At the Bank of Japan policy meeting, a rate hike is largely priced in, yet USD/JPY continues to show a mildly bearish trend

Even with a BOJ Rate Hike, the Decline Remains Modest

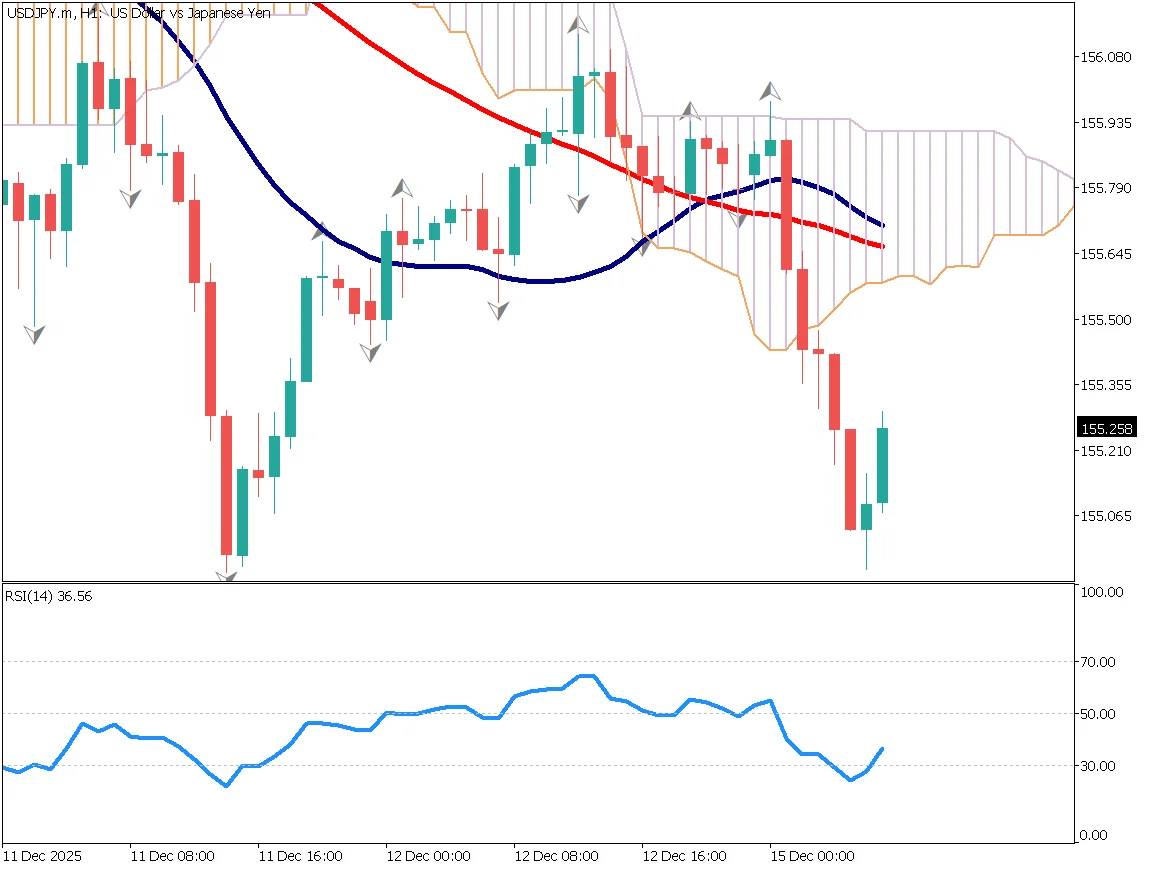

USD/JPY is trending slightly lower, having fallen below the 26-day moving average, confirming a gradual downtrend. Around the early 155 yen level, three fractals have appeared, suggesting strong support. However, two consecutive bearish engulfing patterns have emerged at high levels, indicating the potential for a corrective move.

RSI has also dropped below 50, reinforcing the bearish bias.

From a fundamental perspective, this week's BOJ policy meeting is expected to result in a rate hike. This move may already be fully priced in by the market. Compared with the previous hike, the yen appreciation trend is much weaker, resembling a mere adjustment rather than a clear trend. Attention should be paid to the market's reduced sensitivity to yen-positive factors.

If BOJ Governor Ueda clarifies the neutral interest rate level more explicitly, the yen could strengthen rapidly. In such a case, a sharp decline toward the 150 yen area cannot be ruled out, warranting caution.

Day Trading Strategy

A double bottom has formed, suggesting rebounds may continue as long as the lows are not broken. Near the Ichimoku cloud, selling on rallies is preferred. This week, there is also a possibility of verbal intervention against yen weakness from the BOJ governor, so long positions should be approached cautiously.

RSI has moved above 30. If it approaches the 50 level, selling on rallies may be considered.

Today's Key Economic Indicator

| Economic Indicator / Event | Time |

|---|---|

| New York Fed Manufacturing Index | 22:30 |

Ready to trade?

Open live accountThis material is for informational purposes only and does not constitute investment advice. Trading leveraged products involves significant risk of loss. Past performance is not indicative of future results.

![[Special Edition] When Will the Bank of Japan's Next Rate Hike Come?](/_next/image/?url=%2Fimages%2Fmarket-analysis%2F20251031USDJPYDAY.webp&w=3840&q=75&dpl=dpl_DuroJaYkswUAC7zyZSzJuw8Qt8iH)