USD/JPY Shows Slight Upward Bias, Awaiting U.S. Employment Report

Fundamental Analysis

- ADP employment data came in below expectations, USD/JPY shows slight upward bias

- Market awaiting U.S. employment report, can it break above 158?

- 52-day moving average acts as support

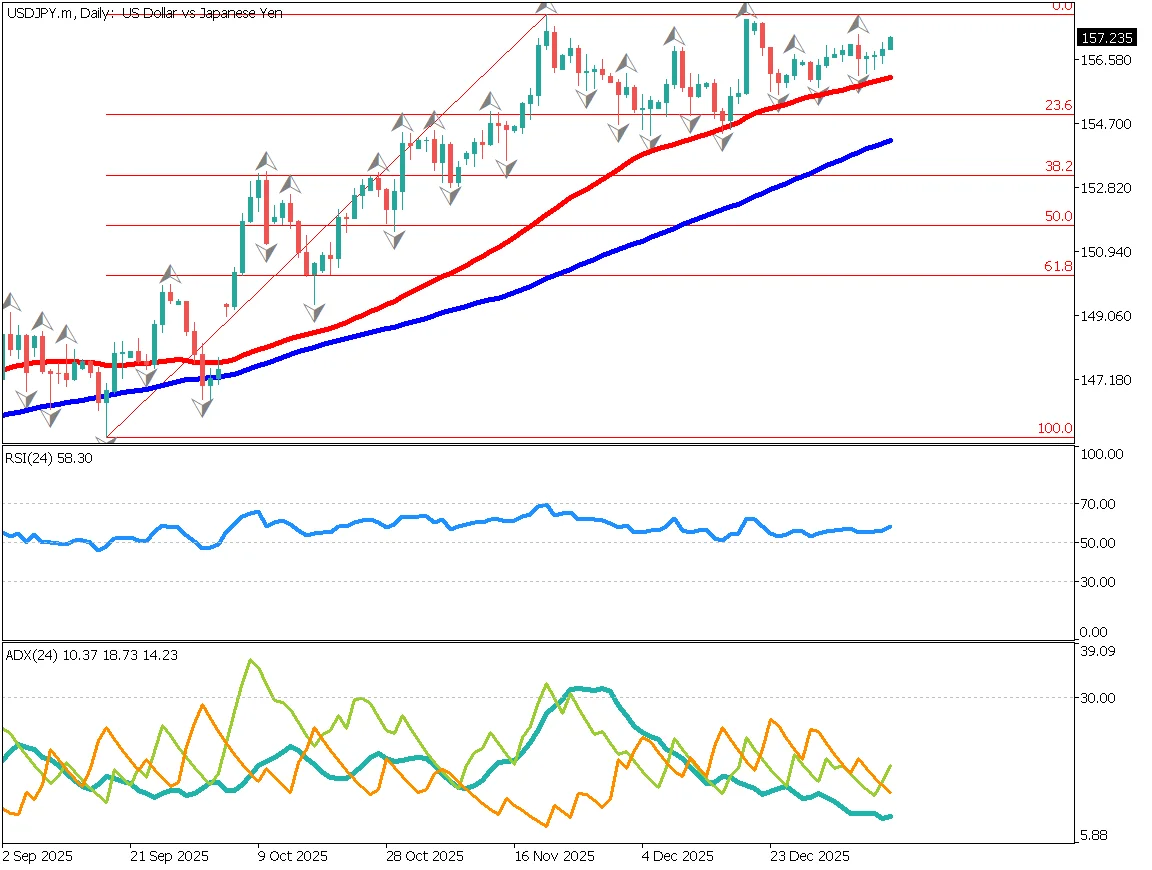

52-day moving average acts as support

USD/JPY is showing a slight upward bias. In a market lacking clear catalysts, the pair is gradually testing higher levels. The 52-day moving average is functioning as a support line. Attention is focused on whether the pair will attempt to test the 158 level.

Today, the U.S. employment report is scheduled for release. This is the first employment report of 2026 and is expected to directly reflect the impact of the U.S. government shutdown. It will be an important indicator for the market to assess how much impact there has been and whether the U.S. economy is slowing. Price movements in January are often seen as a reference for forecasting trends for the rest of the year.

The key point is whether USD/JPY will break above the current range or fall below the 52-day moving average, as this will help determine the next direction.

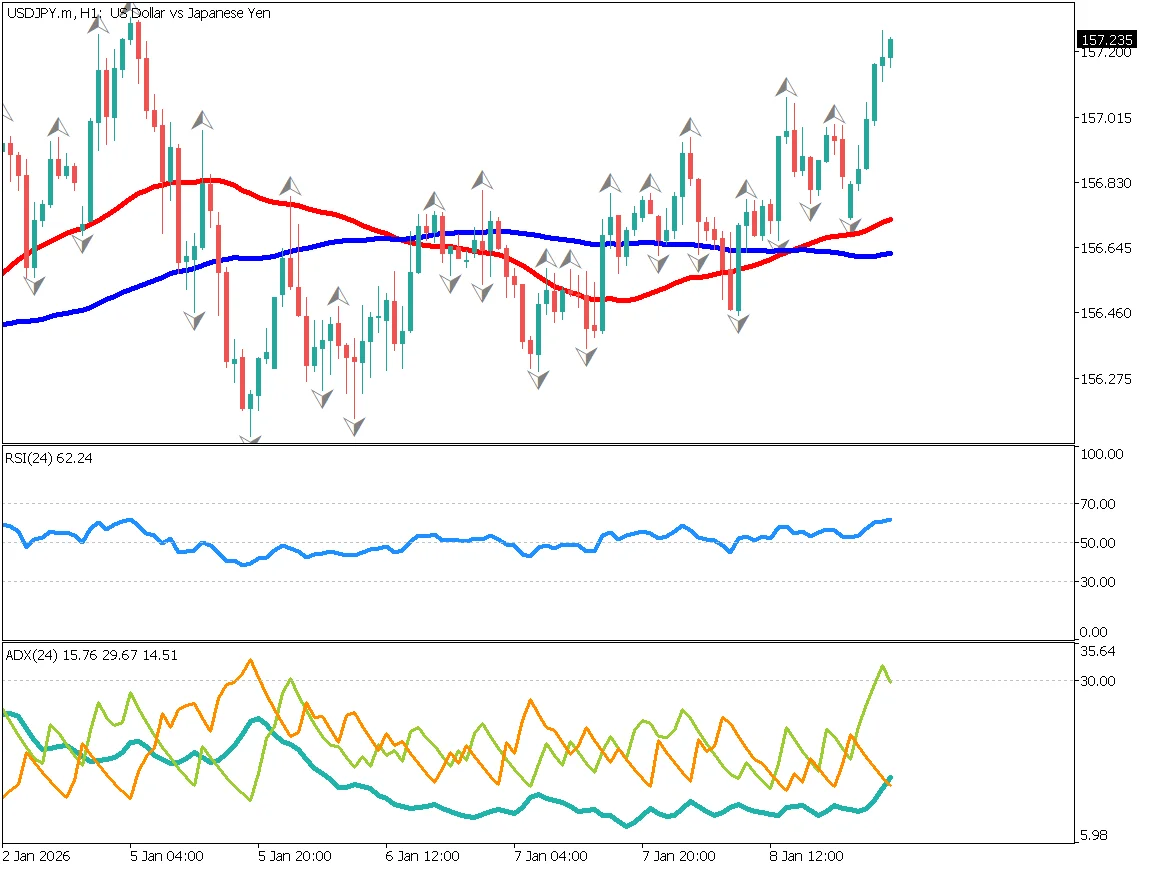

Uptrend on the hourly chart, but…

On the daily timeframe, the 52-day moving average is turning upward, while the 90-day moving average remains flat. The RSI is above 50, at around 62, indicating stable upward momentum. The ADX is also rising, suggesting that the trend is gradually strengthening.

Everything depends on today's U.S. employment report. If the data suggests that the U.S. economy remains solid and provides reassurance to the market, USD/JPY may aim for new highs. The opposite scenario is also possible if the data disappoints.

The market is closely watching the outcome of the U.S. employment report.

Today's Key Economic Event

| Event | Time |

|---|---|

| U.S. Employment Report | 22:30 |

Ready to trade?

Open live accountThis material is for informational purposes only and does not constitute investment advice. Trading leveraged products involves significant risk of loss. Past performance is not indicative of future results.

![[Special Edition] When Will the Bank of Japan's Next Rate Hike Come?](/_next/image/?url=%2Fimages%2Fmarket-analysis%2F20251031USDJPYDAY.webp&w=3840&q=75&dpl=dpl_7FDQsQkqrpcAqSED6PhxxDEbMMbP)