EURUSD falls, EU zone inflation expectations slow【July 6, 2023】

July 06, 2023

Markets Analysis

目次

Fundamental Analysis

- U.S. stock indexes fall; trading volume may decline due to profit-taking and a wait-and-see market

- Eurozone Inflation Expectations Decline, May Affect Interest Rate Policy from August

- U.S. FOMC Meeting Summary Released, Unanimous Result Shows No Rate Hike Halt

- Chinese Economic Indicators Weak, Australian Dollar Sold

EURUSD Technical Analysis

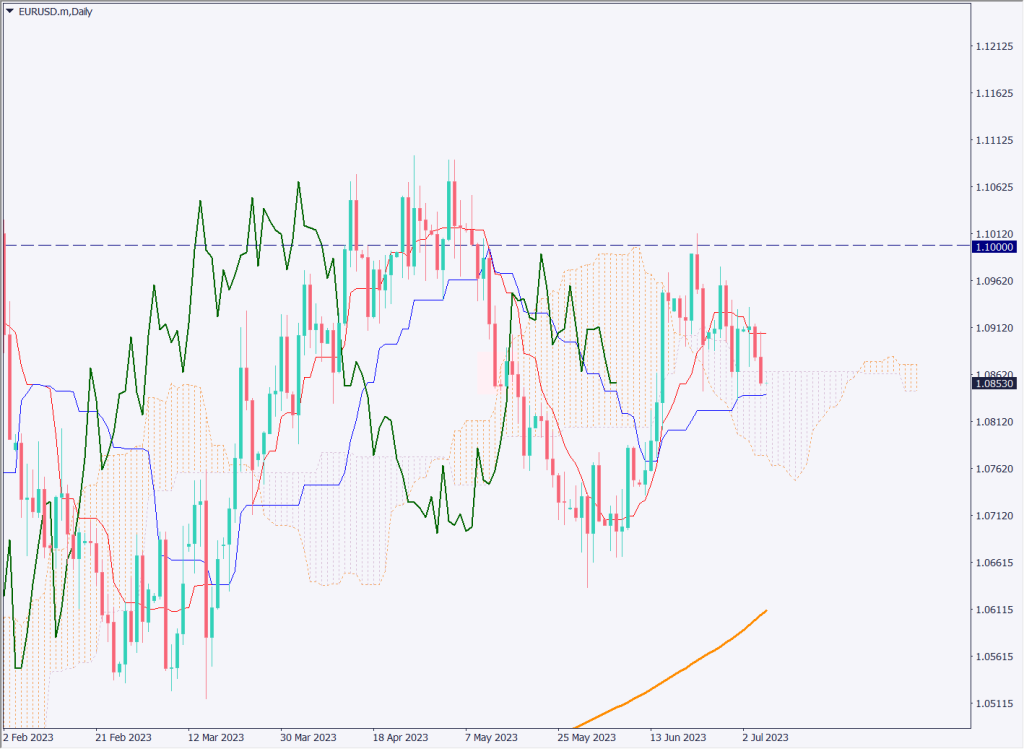

Analyzing the daily chart of the EURUSD, the pair has fallen back from USD 1.10 and is now in a downtrend. The price has entered the Ichimoku Chart cloud and is somewhat firm on the downside. There is a good possibility of a rebound at the upper cloud line. Slowing inflation in the EU zone has raised expectations of a halt in interest rate hikes after August, and the dollar’s appreciation after the release of the U.S. FOMC meeting summary was a factor in yesterday’s decline.

Day Trade Strategy (Hourly)

The day-trade policy is to sell back. The overall currency market is tilted in the direction of buying the dollar, and we consider holding positions in the direction of buying the dollar. The short-term moving average is below the long-term moving average, and the slope is also in a downward direction. We would consider selling back to the short term moving average when the price returns to the short term moving average.

Support and Resistance Lines

The resistance line to be considered in the future is as follows

1.087 USD – Pivot point

1.0824 USD – Major support zone

Market Sentiment

EURUSD Sell: 39% Buy: 61%

Today’s Important Economic Indicators

| Economic Indicators and Events | JST (Japan Standard Time) |

| U.S. ISM Non-Manufacturing Index | 23:00 |

*Trading advice in this article is not provided by Milton Markets, but by Shu Fujiyasu Jr., a certified technical analyst.