USDJPY falls to 138 JPY level, US inflation rate declines, interest rate hike speculation recedes【July 13, 2023】

July 13, 2023

Markets Analysis

目次

Fundamental Analysis

- U.S. CPI falls to 3%, lowest in 2 years

- Dollar Selling Increases as Additional US Interest Rate Hike Speculation Declines

- Volatility increases for straight dollar currency pairs

- EURUSD surges above the USD 1.110 milestone

- Gold Recovers USD 1,950 Level for First Time Since Mid-June

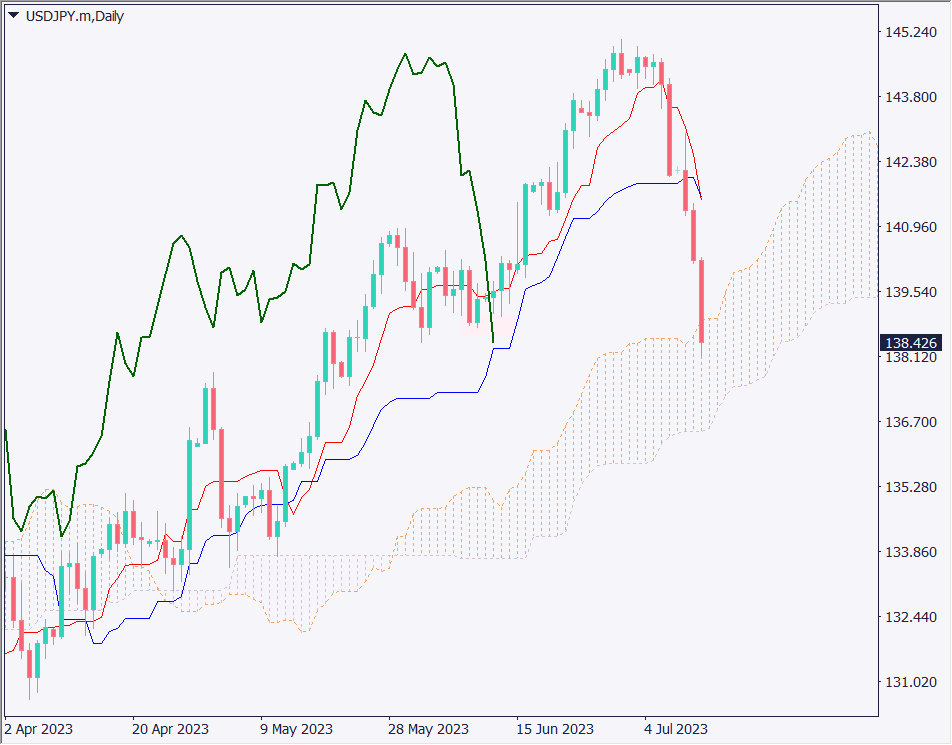

USDJPY Technical Analysis

The USDJPY is gaining momentum in its decline. Especially during overseas hours, the yen is buying heavily. In the background, the U.S. CPI is at its lowest level in two years, accelerating dollar selling, and overseas yen buyers are expecting a change in policy at the BOJ meeting on July 28.

The pair had formed a range at the first half of 139 yen, but fell sharply after the release of the U.S. CPI. It plunged to 138.70 yen and rebounded for a moment, but the sell-off was stronger on the return to the lower 138 yen, involving a stop loss.

Daily Chart Analysis

Analyze the daily chart of the dollar-yen. The pair has broken through the upper cloud level of the Ichimoku Kinko Chart and is entering the cloud. Technically, this is a level where the decline will be pausing. The cloud is very thick and once it enters the cloud, it is assumed that it will take some time to break below. We expect the pair is likely to form a range and struggle between 136.50 yen and the first half of 137 yen. If it breaks below the cloud, the decline will intensify and the lower 130 yen will be in view.

Day Trading Strategy (Hourly)

Day trading policy is to return to the market. Since the dollar is selling off strongly, we will take a sell policy. We would like to pull back enough to sell. Specifically, we will consider selling near JPY 139.15.

Or, push to buy at around JPY 137.85. There is a thick support zone at JPY 137.85 – 137.90, so we expect the pair to rebound somewhat. The hourly RSI is below 30, but the timing when the RSI exceeds 30 again will be an opportunity to buy on the pushback.

Support and Resistance Lines

The resistance line to be considered in the future is as follows

139.16 JPY – Major resistance level

137.90 JPY – Major support zone.

137.12 JPY – Major support zone

Market Sentiment

USDJPY Sell: 64.6% Buy: 35.4%

Today’s Important Economic Indicators

| Economic Indicators and Events | JST (Japan Standard Time) |

| British GDP | 15:00 |

| EU Financial Rendezvous | 19:00 |

| Number of Unemployment Insurance Applications | 21:30 |

| U.S. Producer Price Index (PPI) | 21:30 |

*Trading advice in this article is not provided by Milton Markets, but by Shu Fujiyasu Jr., a certified technical analyst.