USDJPY continues to rise for 3 days, waiting for U.S. CPI release, but all-around depreciation of the JPY【August 8, 2023】

August 08, 2023

Markets Analysis

目次

Fundamental Analysis

- U.S. stock indexes are sharply higher, a temporary rebound from the daily declines?

- The yen continues to weaken across the board, and the dollar-yen rises even in a dollar sell-off market.

- Focus is on whether USDJPY will surpass the recent high of 143.85 JPY

USDJPY Technical Analysis

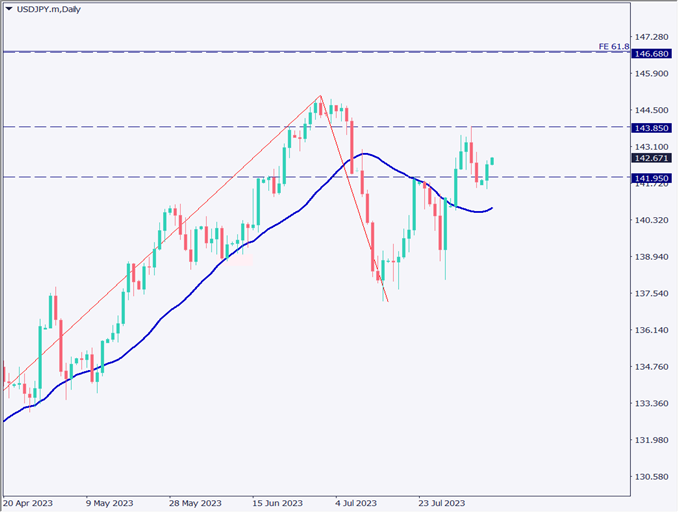

Analyze the daily USD/JPY chart. The dollar-yen was held back by resistance at 143.85 JPY and dropped back to 141.95 JPY. There, it was pushed back to 141.95 JPY, and is now attempting to try to move higher again. A break above 143.85 JPY would trigger another uptrend based on the Dow Theory, which is attracting attention.

The wait-and-see mood is now growing stronger as the pair awaits the release of the U.S. CPI on May 10, and a break above 143.85 JPY would put the high of 145.07 JPY and 146.68 JPY on the horizon.

Day Trading Strategy (Hourly)

Analyzing the 1-hour time frame of the USDJPY. The USDJPY had been in a predominantly downtrend, but yesterday it showed a reversal, confirming that it has shifted from a downtrend to an uptrend. The RSI is also at 57, and the RSI graph is also on an upward trend, which also indicates that the market is in favor of buying.

Market sentiment is also showing a buildup of sell positions, so we can expect an uptick with stop-losses involved.

The trade strategy is to buy at the 24 moving averages. Close at 143.30 JPY. The stop loss will be executed when the price breaks below the downtrend line or the 24-moving average.

Support and Resistance Lines

The resistance line to be considered in the future is as follows

143.30 JPY – Major resistance line

142.17 JPY – Pivot point

141.95 JPY – Major support zone

Market Sentiment

USDJPY Sell: 62% Buy: 38%

Today’s Important Economic Indicators

| Economic Indicators and Events | JST (Japan Standard Time) |

| German Consumer Price Index | 15:00 |

*Trading advice in this article is not provided by Milton Markets, but by Shu Fujiyasu Jr., a certified technical analyst.