U.S. CPI falls short of expectations, USDJPY surges, signs of a repeat of the streak to 150 JPY.【August 11, 2023】

August 11, 2023

Markets Analysis

目次

Fundamental Analysis

- U.S. CPI falls short of market expectations at 3.2%, setting back expectations of a rate hike at the September FOMC meeting

- The dollar is buying, and the USD/JPY exchange rate is approaching 145 JPY.

- The JPY has a record of 9 consecutive days of rally to 150 JPY at the same level as last year, so be wary.

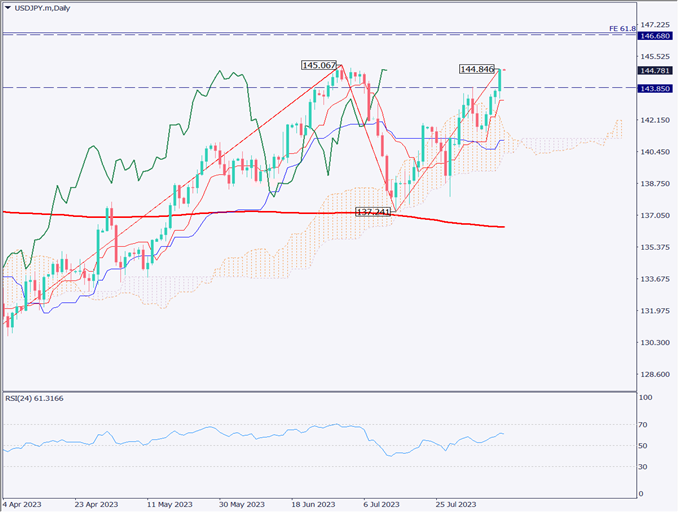

USDJPY Technical Analysis

The dollar is approaching the 145-JPY level. Backing factors are the weaker-than-market-expected U.S. Consumer Price Index (CPI) result and the receding speculation of an interest rate hike in September. Expectations for a soft landing of the U.S. economy have strengthened and risk appetite has accelerated dollar buying.

Yesterday, the pair clearly broke above 143.89 JPY. According to the Dow Theory, an uptrend is indicated. The lagging line on the Ichimoku Kinko Chart is also above the candlestick, and the position of the reference line and cloud is also positive for the three roles, indicating an uptrend signal. Although there is a sense of caution about high prices, the RSI is at 61, suggesting that there is room for upside.

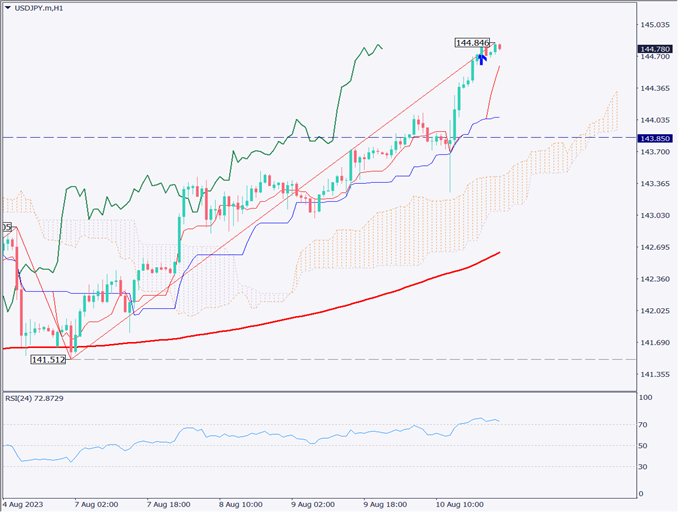

Day Trading Strategy (Hourly)

Currently, the RSI figure for the USDJPY has reached 72, and this level generally indicates “overbought”. Furthermore, 145.07 JPY has been acting as a strong resistance line in the chart so far. These two factors make us strongly feel that a temporary selloff is possible in the short term.

Our strategy is to aim for a push back when the market has sufficiently pulled back. Specifically, we plan to make a new buy entry at a time when the RSI shows signs of rising again after falling back below 70.

Entry: Target the first half of 144 JPY, especially around 144.10 JPY.

Settlement: Consider taking profits near strong resistance at 145 JPY.

Stop: Set a stop at 143.85 JPY and prepare for an unfavorable development.

Support and Resistance Lines

The resistance line to be considered in the future is as follows

143.97 JPY – Support zone

144.10 JPY – Strong support band

Market Sentiment

USDJPY Sell: 72% Buy: 28%

Today’s Important Economic Indicators

| Economic Indicators and Events | JST (Japan Standard Time) |

| UK GDP | 15:00 |

| U.S. Producer Price Index | 21:30 |

| University of Michigan Consumer Confidence Index | 23:00 |

*Trading advice in this article is not provided by Milton Markets, but by Shu Fujiyasu Jr., a certified technical analyst.