EURUSD falls; Eurozone economic outlook due to be released【August 23, 2023】

August 23, 2023

Markets Analysis

目次

Fundamental Analysis

- Major U.S. stock indexes fall; wait-and-see mood prevails ahead of events

- Focus on earnings results of NVIDIA, the driving force behind the AI stock boom

- China’s announcement of economic stimulus could cause major changes in the currency markets

EURUSD Technical Analysis

Analysis of the daily chart of the Eurodollar shows that the dollar is buying more and the euro is weakening as a result. The economic outlook for the Eurozone is scheduled to be released today, and depending on the outcome, the market may move higher.

On the technical front, a rebound at the 72 moving average was confirmed, but after hitting the day’s highs, selling pressure has increased and the price has fallen below the price milestone. With this move, a decline to the 240 moving average is in view.

Day Trading Strategy (Hourly)

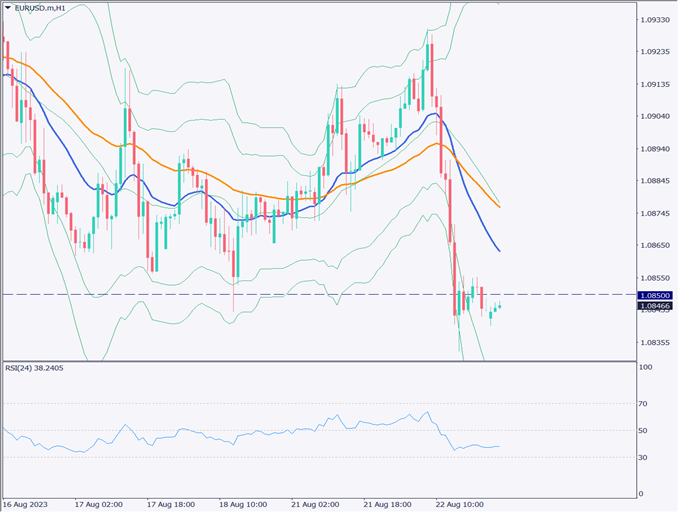

Analysis of the hourly chart of the Eurodollar shows a rebound due to profit-taking after yesterday’s sharp drop to the -3σ of the Bollinger band. The $1.085 level is functioning as an important milestone, and a return move may occur around this price.

A return move strategy would be a good strategy as the price is expected to return to the 10 moving average, which indicates a short-term trend. The entry price is set at $1.086 (10 moving average) and the target for settlement is $1.0815 (-2σ). Meanwhile, the stop loss should be set at $1.088 (the middle line of the Bollinger band).

Support and Resistance Lines

The resistance line to be considered in the future is as follows

1.085 USD – Major milestone price

Market Sentiment

EURUSD Sell: 20% Buy: 80%

Today’s Important Economic Indicators

| Economic Indicators and Events | JST (Japan Standard Time) |

| NZ Retail Sales | 7:45 |

| Japan Manufacturing Purchasing Managers’ Index | 9:30 |

| EU Economic Outlook | 19:00 |

| U.S. Building Permits | 21:00 |

| Canada Retail Sales | 21:30 |

*Trading advice in this article is not provided by Milton Markets, but by Shu Fujiyasu Jr., a certified technical analyst.