The USD/JPY is rising, and the US core CPI exceeded market expectations, leading to a stronger dollar.【September 14, 2023】

September 14, 2023

Markets Analysis

目次

Fundamental Analysis

- The US core CPI has increased from the previous month, indicating that inflation acceleration hasn’t stopped.

- There is a possibility of an additional rate hike in the US, and the currency market is reacting with a stronger dollar.

- The USD/JPY rose to the late 147 JPY, but an upper shadow appeared, suggesting that there might be resistance at higher levels.

USDJPY Technical Analysis

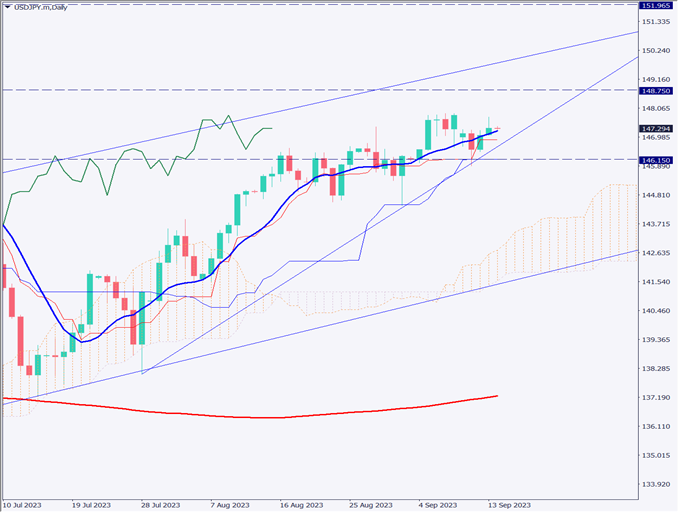

Analyzing the daily chart of the USD/JPY exchange rate. Currently, it is barely above the 10-day moving average, but the upper side feels heavy. It is supported by the trend line within the ascending channel, the conversion and base lines of the Ichimoku Cloud, and the moving average, maintaining a gradual upward trend.

There are no clear factors for a decline, but as of writing, there seems to be a slight trend toward a weaker dollar. It’s essential to keep an eye on short-term movements and the continuity of the medium to long-term upward trend.

Day Trading Strategy (Hourly)

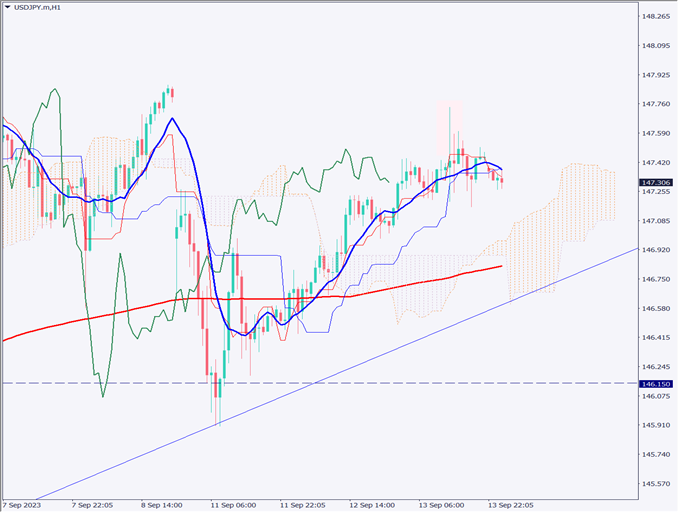

Analyzing the 1-hour chart of the USD/JPY exchange rate. After the US CPI announcement, it temporarily rose to 147.70 JPY, but then three upper shadows formed, suggesting selling pressure. Currently, it’s below the 10-day moving average, indicating a short-term trend towards a weaker dollar. If this continues, there’s a possibility it might drop to the Ichimoku Cloud area.

When it reaches the 240-moving average, a rebound is expected. Therefore, buying on dips around the early 147 JPY is a considered strategy. The specific entry point envisioned is 147.050 JPY, with a stop at 146.85 JPY.

Support and Resistance Lines

The resistance line to be considered in the future is as follows

147.50 JPY – Resistance line

147.00 JPY – Round number/Support line

Market Sentiment

USDJPY Sell: 67% Buy: 33%

Today’s Important Economic Indicators

| Economic Indicators and Events | JST (Japan Standard Time) |

| Australian Employment Statistics | 10:30 |

| ECB Interest Rate Announcement | 21:15 |

| US Retail Sales | 21:30 |

| US Producer Price Index | 21:30 |

*Trading advice in this article is not provided by Milton Markets, but by Shu Fujiyasu Jr., a certified technical analyst.