Eurodollar Declines as Prolonged Middle Eastern Tensions Drive Safe-Haven Asset Purchases【October 19, 2023】

October 19, 2023

Markets Analysis

目次

Fundamental Analysis

- Tensions in the Middle East intensify with hospital attacks in the Gaza Strip; Islamic countries blame Israel.

- Assets flock to gold, with funds concentrating on safe havens.

- Eurodollar drops while the Swiss Franc, a European currency, sees buying activity.

EURUSD Technical Analysis

Analysing the daily chart for the Eurodollar. The baseline of the Ichimoku Cloud acts as a resistance line, and the Eurodollar is showing signs of a pullback. The complexities of US diplomacy combined with escalating Middle Eastern tensions stoke market anxieties. Safe currencies like the Swiss Franc and the USD are seeing an uptick in buying, and gold is surging. This mirrors an investor risk-off attitude.

Conversely, the consumer price index within the EU area is evolving as per market expectations, bolstering support for the USD under an inflation-controlled environment. A key point to watch will be whether it breaks below the 1.050 USD round number.

Day Trading Strategy (Hourly)

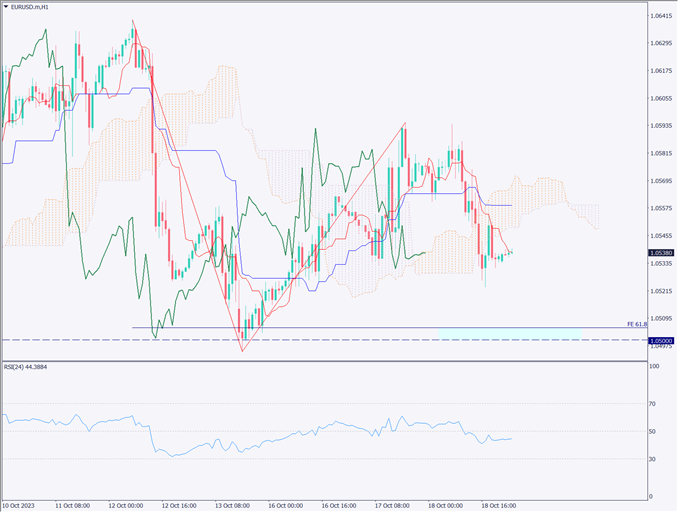

Reviewing the 1-hour chart for the Eurodollar. Currently, it’s in a trendless market, but the conversion line of the Ichimoku Cloud is serving as a resistance line. With the RSI at 43 and below 50, it suggests a bearish undertone.

The Fibonacci 61.8% coincides near the 1.050 USD mark, making the 1.05 USD line a focal point. If a clear breach below 1.05 USD is confirmed, we can expect a decline towards approximately 1.045 USD.

Day trading strategy would be to sell on a clear break below 1.05 USD. The target entry after breaching 1.05 USD would be to liquidate at 1.0465 USD, with a stop at 1.055 USD.

Support and Resistance Lines

The resistance line to be considered in the future is as follows

1.050 USD – Round number.

Market Sentiment

EURUSD Sell: 23% Buy: 77%

Today’s Important Economic Indicators

| Economic Indicators and Events | JST (Japan Standard Time) |

| Australian Employment Statistics | 9:30 |

| US Philadelphia Fed Manufacturing Index | 21:30 |

| Speech by Powell, Chair of the Federal Reserve | 1:00 (following day) |

*Trading advice in this article is not provided by Milton Markets, but by Shu Fujiyasu Jr., a certified technical analyst.