Gold Targets USD 2,000 as Capital Outflows to Safe-Haven Assets Accelerate【October 23, 2023】

October 23, 2023

Markets Analysis

目次

Fundamental Analysis

- Gold momentarily approaches USD 2,000 with no clear end to the Middle East conflict in sight.

- The possibility of the US getting embroiled in the Middle East conflict increases the demand for safe-haven assets.

- As the week commences, the market shows a drop with an opening gap; caution is advised during this adjustment period.

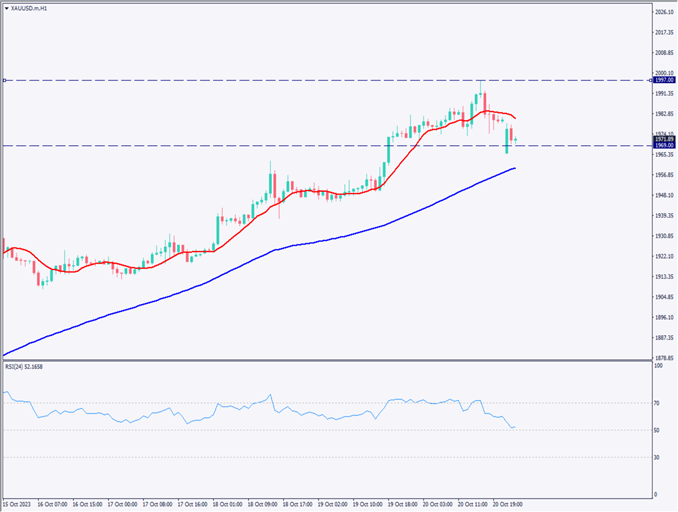

XAUUSD Technical Analysis

Analyzing the daily gold chart, the 10-day moving average is surpassing the 240-day moving average, indicating the formation of a golden cross. With the price reaching close to the target of USD 2,000, there’s a sense of market cooling down.

The market has experienced a strong rally, making it ripe for a potential correction. For the price to continue its ascent beyond the USD 2,000 mark, fresh catalysts are necessary. Observing the 4-hour RSI, there’s a chance it might dip below 70, signaling the need for caution against a possible medium-term adjustment.

Day Trading Strategy (Hourly)

Analyzing the 1-hour chart, the 72-day moving average seems to be serving as a potential support line. The 24-day moving average has been breached, suggesting a possible intensification in the corrective movement. The RSI stands at 52, with the focal point being whether it will bounce at 50 or break below it.

Predicting the trajectory of the Middle East situation is challenging, but an immediate resolution seems unlikely. Fundamentally, it seems natural for gold prices to ascend.

After the sell-offs during corrections, there’s a high likelihood of dip-buying. For day trading, the strategy would be to buy on these dips. Specifically, consider entering around USD 1,960 and targeting exits around USD 1,977. For medium to long-term perspectives, holding up to USD 2,000 is feasible. A stop would ideally be executed once the 72-day moving average is breached.

Support and Resistance Lines

The resistance line to be considered in the future is as follows

USD 2,000 – A round number.

USD 1,969 – A major support line.

Market Sentiment

XAUUSD Sell: 67% Buy: 33%

Today’s Important Economic Indicators

| Economic Indicators and Events | JST (Japan Standard Time) |

| EU Consumer Confidence Index | 23:00 |

*Trading advice in this article is not provided by Milton Markets, but by Shu Fujiyasu Jr., a certified technical analyst.