USD/JPY Rises to Mid 151 JPY, Fed Chair Powell Maintains Hawkish Stance【November 13, 2023】

November 13, 2023

Markets Analysis

目次

Fundamental Analysis

- Fed Chair Powell’s hawkish comments drive the dollar higher, pushing USD/JPY up

- Oil prices rebound to 75 USD, halting the downward trend

- Gold prices plummet, moving around 1930 USD in response to rising U.S. interest

USDJPY Technical Analysis

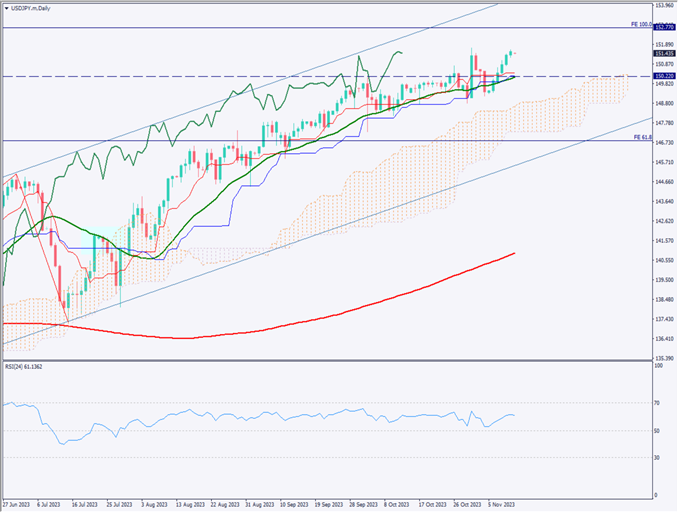

Analyzing the daily chart of the USD/JPY pair. As a result of Fed Chair Powell’s hawkish remarks and the Bank of Japan’s continued monetary easing policy, the interest rate differential has widened, and the dollar has reached new highs against the yen. A five-day consecutive rise is observed, with the 2022 high of 151.94 JPY now in sight.

The weekly chart indicates a breakout from a range-bound market, suggesting the continuation of an upward trend. The target, derived using the upper limit of the rising channel and Fibonacci expansion, is set at 152.77 JPY. Attention should be paid to the continuing trend of a stronger dollar and a weaker yen, especially if the price exceeds 151.94 JPY.

Day Trading Strategy (1-Hour Chart)

Analyzing the 1-hour chart of the USD/JPY pair. The upward trend is gently continuing, with a temporary drop below the Ichimoku conversion line in morning trading, but the baseline has acted as a support line and the price has reversed upwards.

The focus now is on whether the price will exceed 151.60 JPY; surpassing this level could lead to a new high beyond 151.94 JPY. Despite the constant risk of currency intervention, a strategy of buying on dips is considered appropriate.

The specific entry point is set at 151.40 JPY, with a target price of 151.65 JPY and a stop loss at 151.25 JPY.

Support and Resistance Lines

The resistance line to be considered in the future is as follows

152.77 JPY – Fibonacci level

Market Sentiment

USDJPY Sell: 82% Buy: 18%

Today’s Important Economic Indicators

| Economic Indicators and Events | JST (Japan Standard Time) |

| EU Economic Outlook | 19:00 |

| OPEC Monthly Report | 21:00 |

*Trading advice in this article is not provided by Milton Markets, but by Shu Fujiyasu Jr., a certified technical analyst.