USDJPY Remains in the 161 JPY Range, Focus on US Employment Statistics【July 5, 2024】

Fundamental Analysis

UK General Election: Labour Party Wins Decisively, First Regime Change in 14 Years

US Employment Statistics: Decline in Employment Numbers & Increase in Unemployment Rate Expected

Rising Expectations for US Rate Cut, Majority Predict September

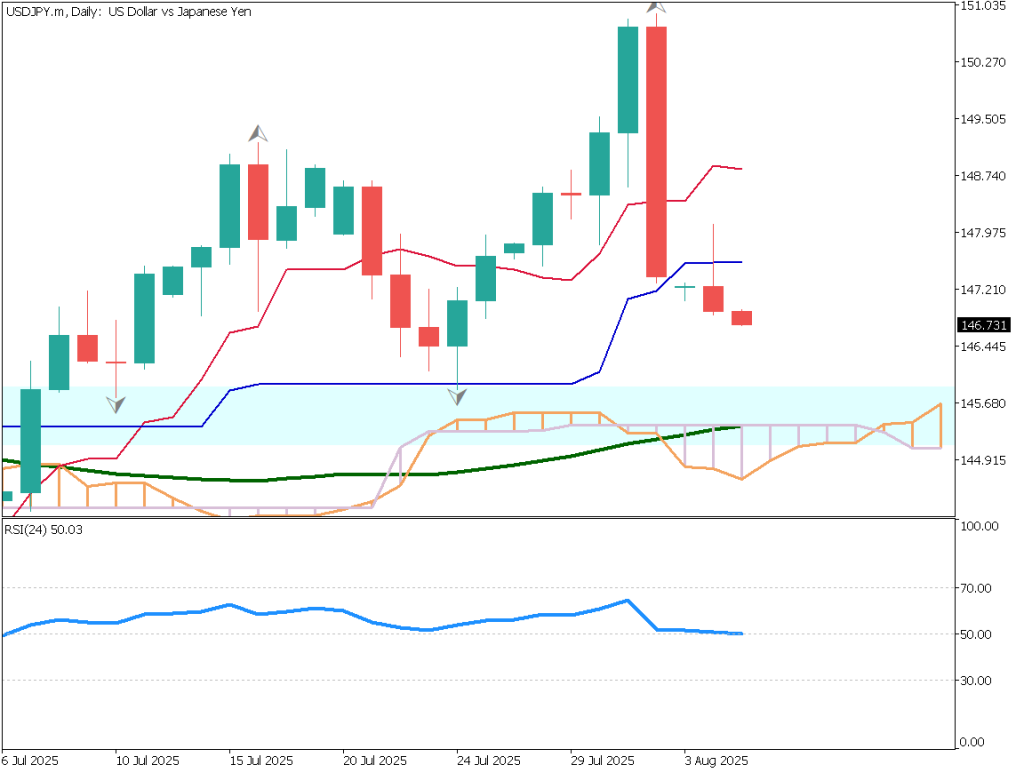

USDJPY technical analysis

Analyzing the USDJPY daily chart. USDJPY remains in the lower 161 JPY range, with the Ichimoku Kinko Hyo’s conversion line functioning as a support line. With today’s US employment statistics, significant volatility is expected.

In the UK, the general election saw the Labour Party winning decisively. While this has no direct impact on USDJPY, the Pound is becoming more attractive. Although it temporarily fell to 160.70 JPY, it didn’t last long. The daily conversion line is hovering around 160.70 JPY.

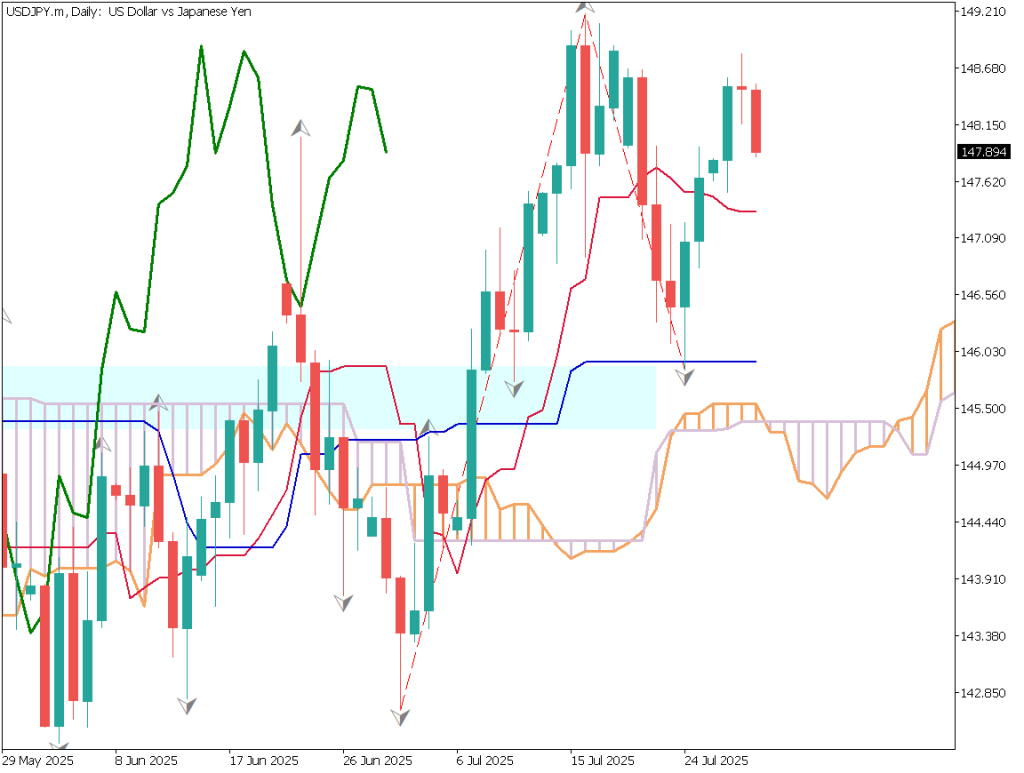

Day trading strategy (1 hour)

Analyzing the USDJPY 1-hour chart. The 72, 52, and 28 moving averages are forming a perfect bearish order. Additionally, the RSI has rebounded at 50, indicating a corrective movement. It seems advisable to avoid buying on dips in the 161 JPY range today.

It’s still unclear whether the range-bound market will continue or if it will shift to a downtrend. This depends on the employment statistics.

The day trade policy is to sell. Aim for a drop to 160.40 JPY. Set the stop at 161.40 JPY. Close positions before the US employment statistics are released.

Support/Resistance lines

The following support and resistance lines should be considered going forward:

161.17 JPY – Fibonacci

Market Sentiment

USDJPY Sell: 68% Buy: 32%

Featured Currency Pair of the Week (NZDJPY)

New Zealand Dollar has been in a range, with a slight pullback yesterday. This is influenced by USDJPY entering a correction phase from an upward trend. The high was 98.76 JPY. There is relatively strong resistance at the 99 JPY range. It may pull back once and then resume its upward trend.

It is expected that USDJPY will fluctuate significantly with the US employment statistics. Cross-yen pairs will have larger fluctuations, so caution is necessary.

Today’s important economic indicators

Economic indicators and eventsJapan timeUS Employment Statistics21:30Canada Employment Statistics21:30

*Trading advice in this article is not provided by Milton Markets, but by Shu Fujiyasu Jr., a certified technical analyst.

Risk Disclaimer

This analysis is for educational purposes only and does not constitute investment advice. Trading forex and CFDs involves significant risk and may not be suitable for all investors. Past performance is not indicative of future results.

This analysis is for educational purposes only and does not constitute investment advice. Trading forex and CFDs involves significant risk and may not be suitable for all investors. Past performance is not indicative of future results.