USDJPY Rises to Mid-144 JPY Range, Possibly Due to Quarter-End Position Adjustments【September 26, 2024】

Fundamental Analysis

US new home sales have decreased, and today, Fed Chair Powell is scheduled to speak.

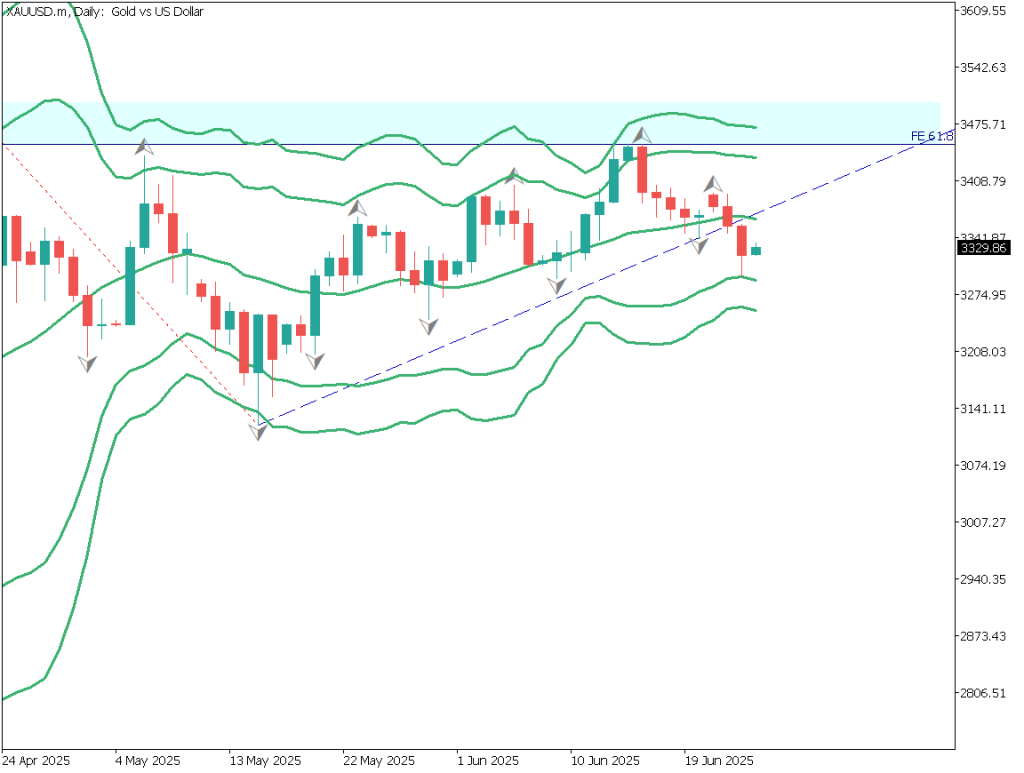

Gold is steadily rising, briefly reaching 2,670 USD.

USDJPY technical analysis

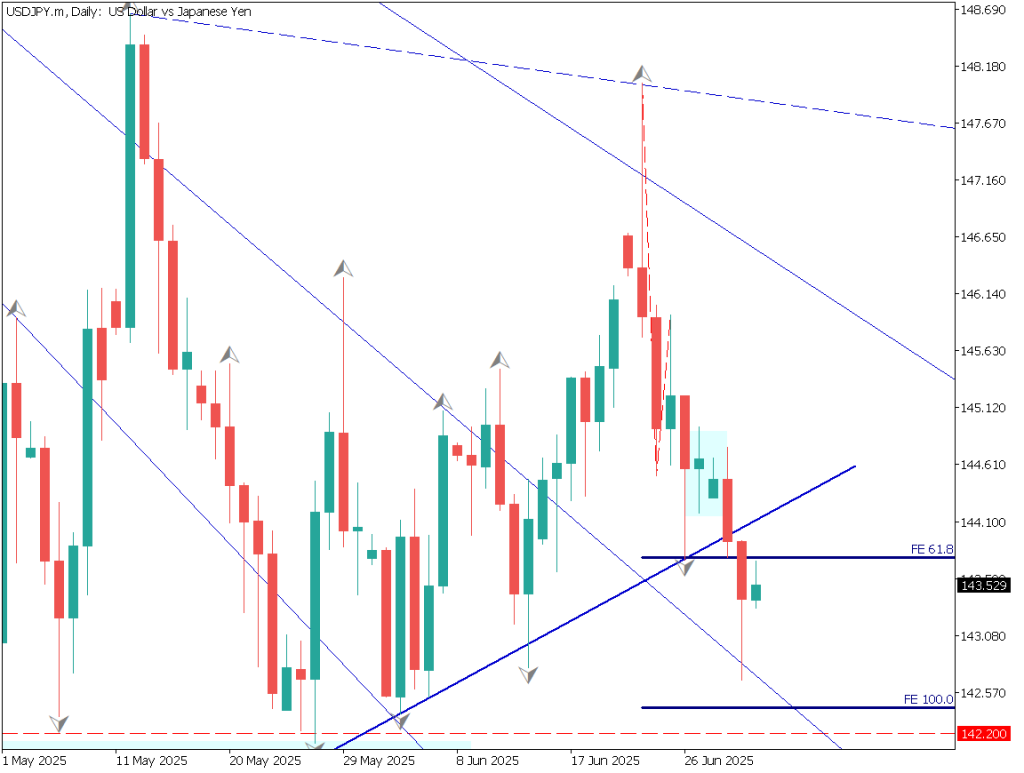

USDJPY rose to the mid-144 JPY range. This is the weakest level for the yen since early September and may be due to quarter-end position adjustments. The 28-day moving average had been acting as resistance, but yesterday’s rise broke through the 28-day MA. The pair is now approaching the 52-day MA.

Additionally, it has surpassed the upper limit of the descending channel, and 144.50 JPY is a very strong resistance area, corresponding to the 50% retracement of the recent upward trend. Therefore, even if it briefly touches the 145 JPY range, selling pressure is expected to increase.

The 52-day MA is currently hovering around 145.18 JPY.

Day trading strategy (1 hour)

Analyzing the USDJPY hourly chart, the 28 MA has crossed above the 52 MA, forming a golden cross. The conversion line seems to be acting as support for now. However, the upside is quite heavy. If it falls below the conversion line, it could drop to the low 144 JPY range.

Moreover, with few bullish factors, it’s a tough market.

The day trading strategy is to open new sell positions when the pair reaches the 145 JPY range, aiming for a close in the low 144 JPY range. It’s a defensive trading stance, but due to the unpredictable nature of the USDJPY market at the quarter’s end, the strategy is to trade only if possible while maintaining a defensive approach.

Support/Resistance lines

Key support and resistance levels to consider moving forward are as follows:

145.18 JPY: 52-day moving average

144 JPY: 28-day moving average

Market Sentiment

USDJPY: Sell 56%, Buy 44%

Today’s important economic indicators

Economic indicators and eventsJapan timeBOJ Monetary Policy Meeting Minutes8:50US GDP21:30US Initial Jobless Claims21:30Fed Chair Powell Speech22:20US Treasury Secretary Yellen Speech0:15 (next day)

*Trading advice in this article is not provided by Milton Markets, but by Shu Fujiyasu Jr., a certified technical analyst.

Risk Disclaimer

This analysis is for educational purposes only and does not constitute investment advice. Trading forex and CFDs involves significant risk and may not be suitable for all investors. Past performance is not indicative of future results.

This analysis is for educational purposes only and does not constitute investment advice. Trading forex and CFDs involves significant risk and may not be suitable for all investors. Past performance is not indicative of future results.