Gold Declines Amid Rising U.S. Interest Rates, Increasing Selling Pressure【October 9, 2024】

Fundamental Analysis

Gold has fallen for five consecutive days, pressured by rising U.S. 10-year Treasury yields.

The stock market’s fear index has risen to around 21, with stock prices fluctuating.

Unrest in the Middle East continues, leading to some demand for gold as a safe-haven asset.

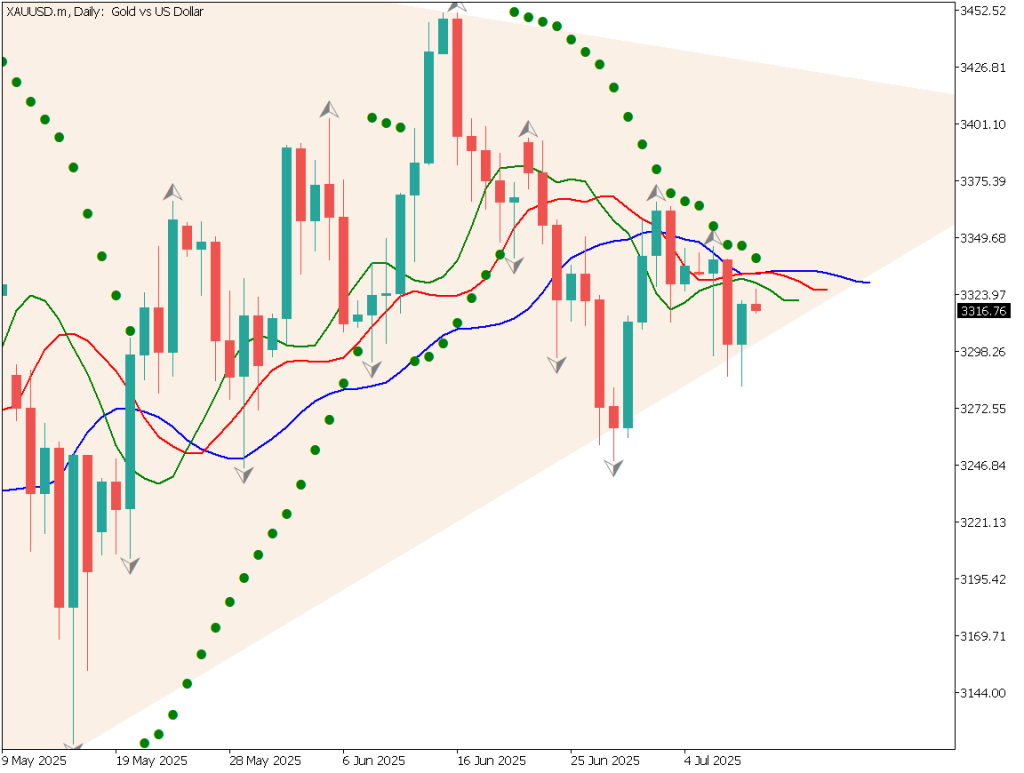

XAUUSD technical analysis

Analyzing the daily chart for gold: gold has fallen below its recent low of 2625 USD and also below the conversion line. Funds are flowing into the U.S. dollar as U.S. 10-year Treasury yields rise, reaching levels not seen since August, creating significant selling pressure on gold.

However, the overall bullish trend is expected to remain unchanged. A small rate cut may be possible, but as long as the U.S. Federal Reserve maintains its rate-cutting stance, I intend to adopt a buy-the-dip strategy for gold. I would consider buying if it dips below the 2600 USD level, which is near the baseline of the Ichimoku Kinko Hyo indicator.

Day trading strategy (1 hour)

Analyzing the 1-hour chart for gold: the market has broken out of a range to the downside, establishing a bearish trend. While this view differs from the daily chart, from a short-term perspective on the 1-hour chart, the strategy is to sell. There is a possibility that gold will test the 2600 USD level. Currently, the conversion line is acting as resistance, and I will watch to see if there is a rebound.

The day trading strategy is to sell.Enter a sell position at 2625 USD, with a stop if the price exceeds 2628 USD.Take profit around the 2600 USD level.

Support/Resistance lines

Key support and resistance levels to consider are as follows:

2625 USD: Daily resistance line

2613 USD: Monthly support line

Market Sentiment

XAUUSD: Sell 49% / Buy 51%

Today’s important economic indicators

Economic indicators and eventsJapan timeNew Zealand Policy Rate Announcement(Forecast: 0.50% rate cut)10:00FOMC Member Speech21:00U.S. Crude Oil Inventory23:30FOMC Meeting Minutes03:00 (Next Day)

*Trading advice in this article is not provided by Milton Markets, but by Shu Fujiyasu Jr., a certified technical analyst.

Risk Disclaimer

This analysis is for educational purposes only and does not constitute investment advice. Trading forex and CFDs involves significant risk and may not be suitable for all investors. Past performance is not indicative of future results.

This analysis is for educational purposes only and does not constitute investment advice. Trading forex and CFDs involves significant risk and may not be suitable for all investors. Past performance is not indicative of future results.