USDJPY Faces Strong Resistance at 145, Trading Within the Ichimoku Cloud【May 29, 2025】

May 29, 2025

Markets Analysis

目次

Fundamental Analysis

- The U.S. Court of International Trade has ruled that the Trump administration’s tariff measures are illegal and ordered an injunction.

- This decision boosted risk appetite, leading to higher U.S. stock prices and strengthening upward momentum in USDJPY.

EURUSD Technical Analysis

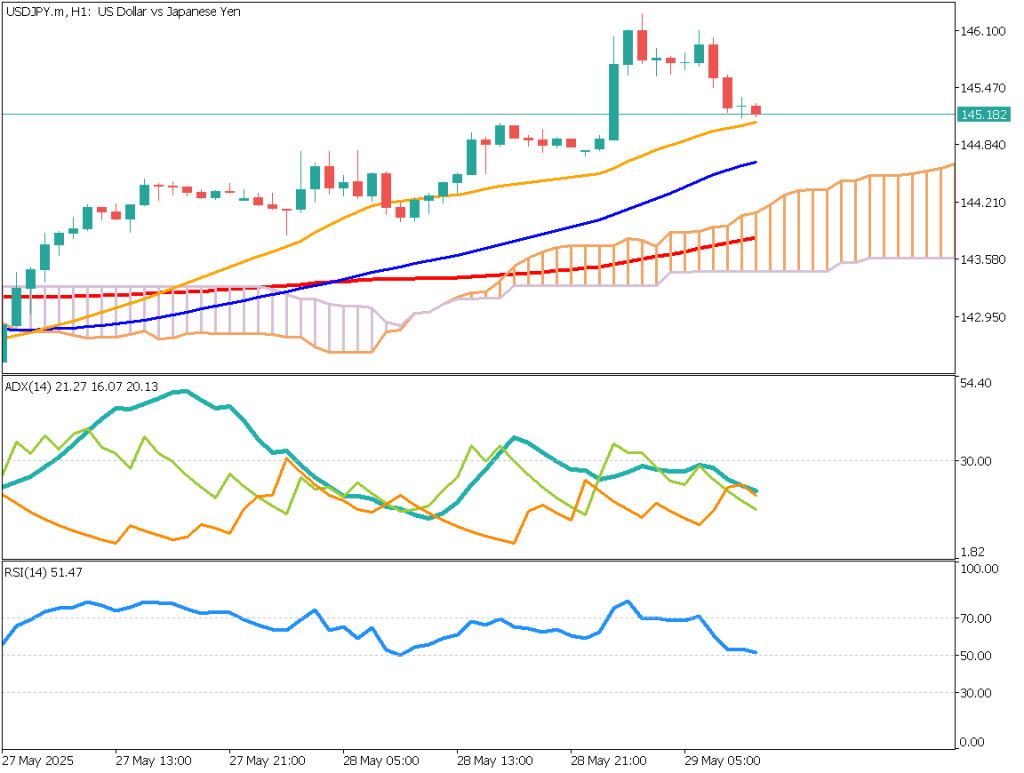

USDJPY climbed to the 145 level and temporarily broke above the Ichimoku cloud during Tokyo hours, reaching the lower 146 range. The upward move is primarily attributed to the court ruling against Trump-era tariff policies.

With risk appetite returning, U.S. stocks surged, and USDJPY followed suit with stronger bullish momentum. While the moving averages remain tilted downward, the formation of a golden cross between the 52-day and 26-day moving averages is noteworthy. Whether the pair can break above the 90-day MA will be a key focus going forward.

ADX shows an upward move with a rising +DI, suggesting growing bullish momentum. The RSI has recovered to 53, indicating a bullish trend.

Day Trading Strategy (1-Hour Chart)

On the hourly chart, USDJPY is showing a mild uptrend, moving along the 26-period moving average. RSI has pulled back to around 50, indicating potential for dip-buying. However, all ADX lines are trending downward, signaling a lack of clear trend direction. U.S. GDP figures are scheduled for release later today, which could impact momentum.

The focus will be whether the price bounces off the 26-period MA or drops toward the 52-period MA.

Intraday Trading Strategy (NY Session)

We suggest a dip-buying approach in the New York session.

🔹Entry: Buy near 144.00

🔹Take Profit: 145.50

🔹Stop Loss: Below 144.00

Support and Resistance Levels

Support and resistance levels to watch going forward:

- 145.60 – Upper boundary of the Ichimoku cloud

Market Sentiment

USDJPY

- Short positions: 43% Long positions: 57%

Today’s Key Economic Events

| Event | Time (JST) |

| U.S. Real GDP (QoQ) | 21:30 |

| U.S. Initial Jobless Claims | 21:30 |

| U.S. Crude Oil Inventories | 01:00 (next day) |

*Trading advice in this article is not provided by Milton Markets, but by Shu Fujiyasu Jr., a certified technical analyst.