Exchange Rates Decline in Volatility; U.S. Secretary of State Meets with President Xi【June 20, 2023】

June 20, 2023

Markets Analysis

目次

Fundamental Analysis

- U.S. Secretary of State Blinken visits China, a stepping stone to a U.S.-China summit by the end of the year

- Improvement in U.S.-China relations; any economic agreement between the U.S. and China would be bullish for the Australian dollar.

- Minutes of the Bank of Australia’s monetary policy meeting to be released; focus on comments on future interest rate hikes

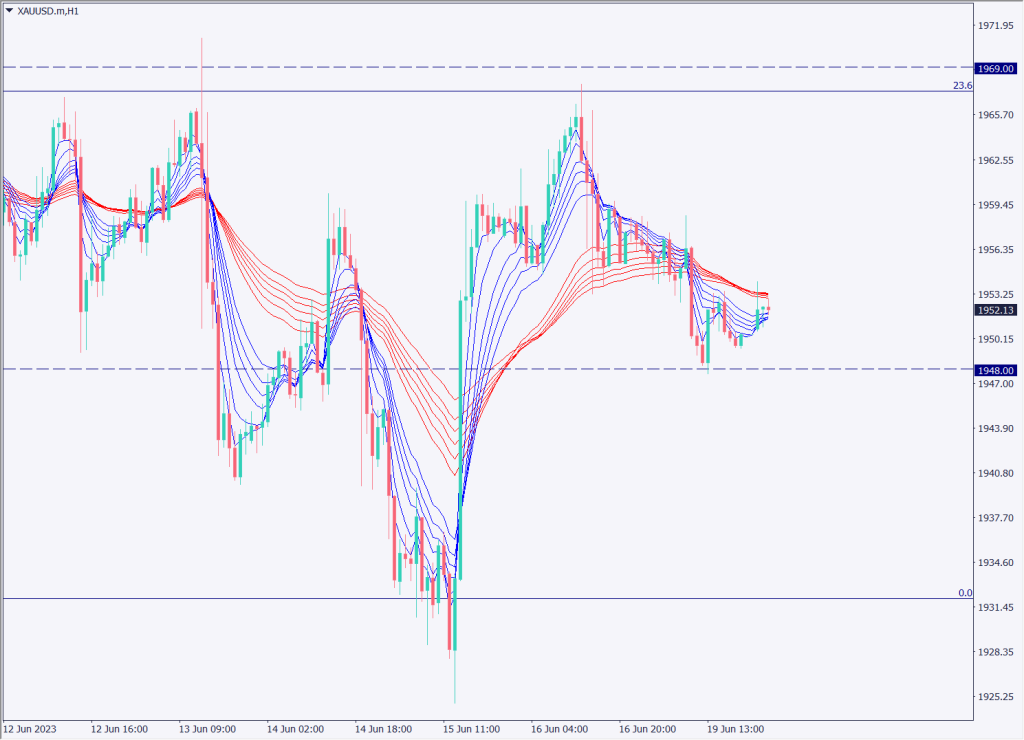

XAUUSD Technical Analysis

Gold has been range-bound, staying within a very narrow range. The latest low is $1924, which is considered to be one milestone. Analyzing the daily chart, it can be considered as an adjustment period of the downtrend. Also, considering that the highs are gradually devaluing and the RSI value is also declining, the price is slightly on the downside.

Considering the inverted N-shape, the final target price for the downtrend is around $1,830; once the price breaks below $1,824, we will switch to a lower line of sight and see how far the trend continues. However, the overall market is trending lower against the dollar, so we do not want to chase lower prices too deeply. Short-term rotation trading policy

Day Trade Policy

The day trade policy is to look for a rebound at $1929, with a stop loss if it breaks below $1924.

If it breaks below $1924, it will enter a blank price zone with no support band, and the decline may accelerate all the way to $1900.

Support and Resistance Lines

The resistance line to be considered in the future is as follows

1967 USD – Fibonacci level of 23.6%

1924 USD – the lowest recent price

Market Sentiment

XAUUSD Sell: 43% Buy: 57%

Today’s Important Economic Indicators

| Economic Indicators and Events | JST (Japan Standard Time) |

| Howe Financial Policy Decision Meeting Keynote | 10:30 |

| Number of meters of building permits | 21:30 |

*Trading advice in this article is not provided by Milton Markets, but by Shu Fujiyasu Jr., a certified technical analyst.