USDJPY temporarily above 145 yen; profit-taking selling strengthens downtrend【July 3, 2023】

July 03, 2023

Markets Analysis

目次

Fundamental Analysis

- U.S. stock indexes rise, profit-taking selling continues, but there is a strong appetite for push-backs

- USD/JPY briefly above JPY 145, but falls to low JPY 144 due to profit-taking

- Nasdaq market rises to a record in the first half of the year, boosted by the Ai boom

- U.S. Personal Consumption Expenditure Index slowed, easing expectations of a rate hike slightly

USDJPY Technical Analysis

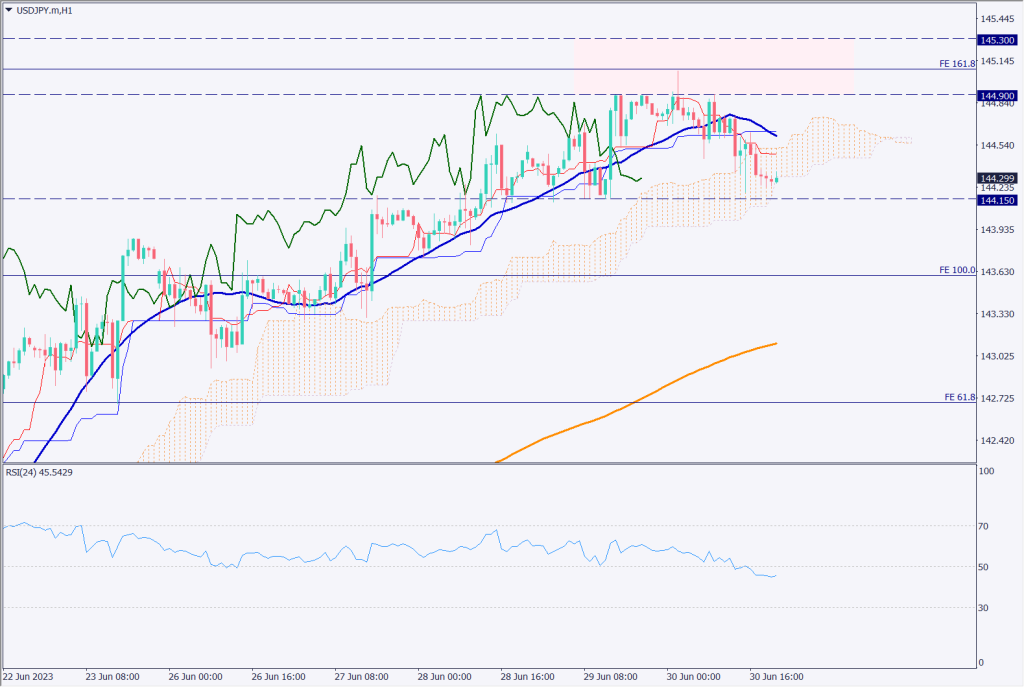

USDJPY briefly rose above 145.00 JPY to 145.07 JPY. This is the price corresponding to 161.8% of the Fibonacci Expansion, a level generally considered to be near the end of the trend. After reaching 161.8%, profit-taking selling became stronger, and the price is currently hovering around JPY 144.25.

The upside is considerably heavy as this is a level where the risk of currency intervention is easily recognized. It is believed that there will be currency intervention at some point, and we expect that it will be difficult for the pair to break through JPY 145 unless the currency intervention risk eases.

Day Trade Strategy (Hourly)

Day trading policy is to buy at the push. We would like to attract enough to set up new purchases. Specifically, we assume the area around JPY 143.85. The dollar is strengthening, and considering fundamentals, there is little material to buy the yen. The only thing that is buying the yen is the risk of currency intervention. Considering technical and fundamental factors, we believe that a buy strategy is the way to go.

The pair is supported by the lower boundary of clouds on the Ichimoku Kinko Chart, but a break below the clouds would probably start a short-term downtrend.

Support and Resistance Lines

The resistance line to be considered in the future is as follows

144.90 JPY – Major resistance

144.15 JPY – Major support zone

Market Sentiment

USDJPY Sell: 67% Buy: 33%

Today’s Important Economic Indicators

| Economic Indicators and Events | JST (Japan Standard Time) |

| BOJ Short-term Economic Survey of Japan | 8:50 |

| ISM Manufacturing Purchasing Managers’ Index | 23:00 |

*Trading advice in this article is not provided by Milton Markets, but by Shu Fujiyasu Jr., a certified technical analyst.