USDJPY rises steadily; BOJ policy turns more gradual than expected【August 2, 2023】

August 02, 2023

Markets Analysis

目次

Fundamental Analysis

- USDJPY temporarily rises to 143.55 JPY, but profit-taking moves, highest in the past 3 weeks

- U.S. economic indicators fell short of market expectations across the board; U.S. stock prices declined

- Bank of Australia decides to keep policy rates unchanged, putting heavy selling pressure on AUD

USDJPY Technical Analysis

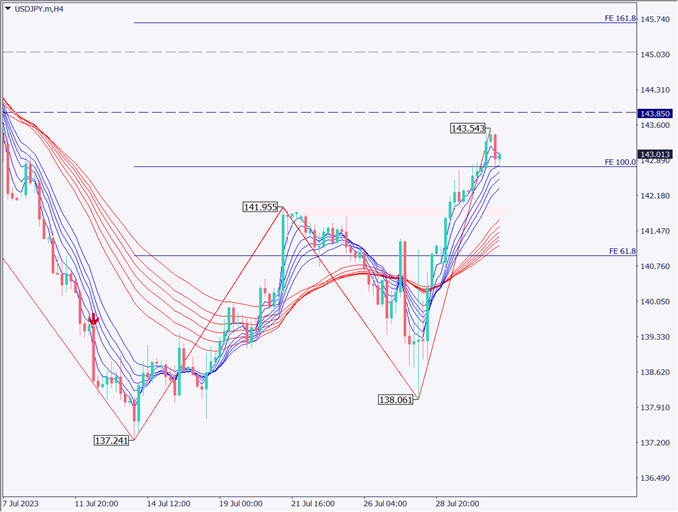

Analyzing the daily chart of the USD/JPY, the pair has been rising steadily after breaking above the high of JPY 141.95. Yesterday, the pair fell back due to profit-taking, but the Fibonacci level is now in mind. Since the price is rebounding at 100%, we judge that there is a strong appetite for pushback. The daily unit upside target is 145.70 JPY, and there are no major resistance lines there.

The GMMAs are spaced apart and the uptrend is continuing; August is also called a “dead summer market,” and trading volume tends to decline. Therefore, we do not want to follow the market deeply. We intend to maintain an uptrend but take profit-taking in small increments.

Day Trading Strategy (Hourly)

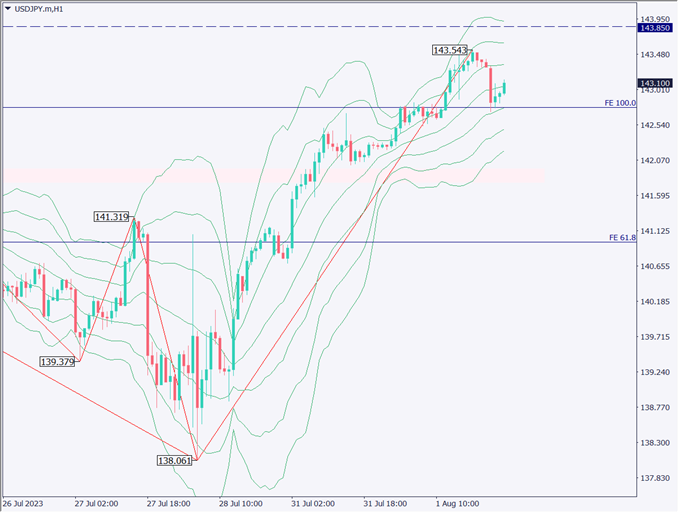

The day trading strategy is to buy on the push side. We can confirm that the 100% Fibonacci is strongly in place. The pair fell back from 143.50 JPY in the morning, but has rebounded at the 142.76 JPY level, which corresponds to 100%. Sell positions are increasing, and a break above 143.55 JPY could trigger a sharp rally by hooking the stop loss. The upside target is assumed to be JPY 143.85.

With the U.S. ADP employment data today and the U.S. government employment data on Friday, we should pay close attention to movements after the London time.

Support and Resistance Lines

The resistance line to be considered in the future is as follows

143.85 JPY – Major resistance level

142.78 JPY – 100% Fibonacci level

Market Sentiment

USDJPY Sell: 72% Buy: 28%

Today’s Important Economic Indicators

| Economic Indicators and Events | JST (Japan Standard Time) |

| U.S. ADP Employment Statistics | 21:15 |

*Trading advice in this article is not provided by Milton Markets, but by Shu Fujiyasu Jr., a certified technical analyst.