Upside pressure builds on the USDJPY, with long-term interest rates at their highest level since 2014【August 1, 2023】

August 01, 2023

Markets Analysis

目次

Fundamental Analysis

- Long-term interest rates in the bond market exceeded 0.6%, the highest level since 2014

- BOJ Conducts Temporary JGB Buying Operations to Keep Interest Rates Under Control

- JPY all around weak and USDJPY and crosses rise as BOJ takes steps to curb interest rates

USDJPY Technical Analysis

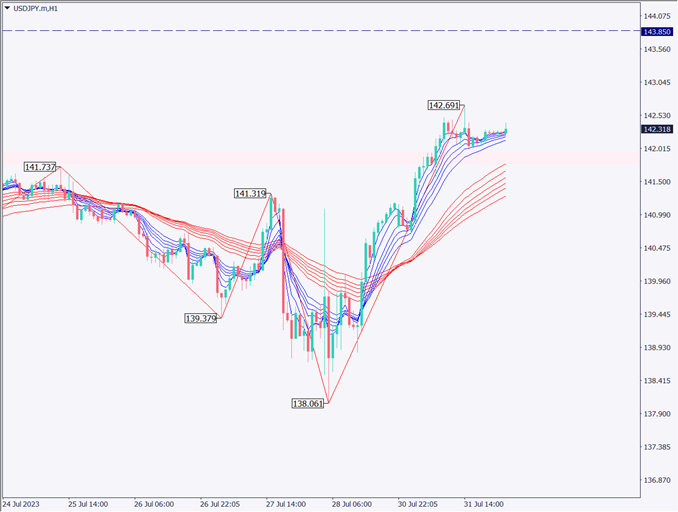

Analysis of the daily USDJPY chart shows that the pair has broken above the recent high of 141.95 JPY and the 24-day moving average has also broken above. A very strong uptrend is developing. Considering currency strength and weakness, the JPY has weakened across the board, and the dollar continues to be under upward pressure.

A clear break above the most recent highs has created an uptrend according to the Dow Theory. There are few major resistance lines, and technically, the pair could rise toward 145 JPY on a daily basis.

Day Trading Strategy (Hourly)

As a day trading strategy, we would like to stock up on buying.

Although 142.50 JPY is a slightly stronger resistance line, a break above 142.68 JPY, the recent high for the hourly session, would likely involve stops and a surge to the 143 JPY level is possible.

The longer-term line of the GMMA (red line) shows that the interval is widening, a form that suggests a strong uptrend. The upside forecast for this week is around ¥143.91, and a rise is likely. One reason to buy the JPY is rising long-term interest rates, but the BOJ is trying to keep rates down by ordering a temporary JGB purchase operation.

Considering the above, the current trend appears to be a good one for buying. However, we need to be careful of sudden plunges and news.

Support and Resistance Lines

The resistance line to be considered in the future is as follows

143.85 JPY – major resistance zone

141.90 JPY – recent support zone

Market Sentiment

USDJPY Sell: 67% Buy: 33%

Today’s Important Economic Indicators

| Economic Indicators and Events | JST (Japan Standard Time) |

| Japan Unemployment Rate | 8:30 |

| Australian Policy Rate Announcement | 13:30 |

| U.S. ISM Purchasing Managers’ Index | 23:00 |

*Trading advice in this article is not provided by Milton Markets, but by Shu Fujiyasu Jr., a certified technical analyst.